The Great Unpegging

and the shorters who made billions betting against crypto’s Enron

“Cool, I’m in. Would prefer to ask whatever your net worth is and bet 90% But maybe this is what that is already”, snidely states Do Kwon, the Founder of Terra Luna, on the 13th of March to an anonymous account asking to make a 1 million dollar bet against Luna.

Luna is a cryptocurrency launched in 2019 and created by Korean entrepreneur and 29-year-old Do Kwon. The Luna token was launched alongside the Terra token, which aimed to be a stable coin.

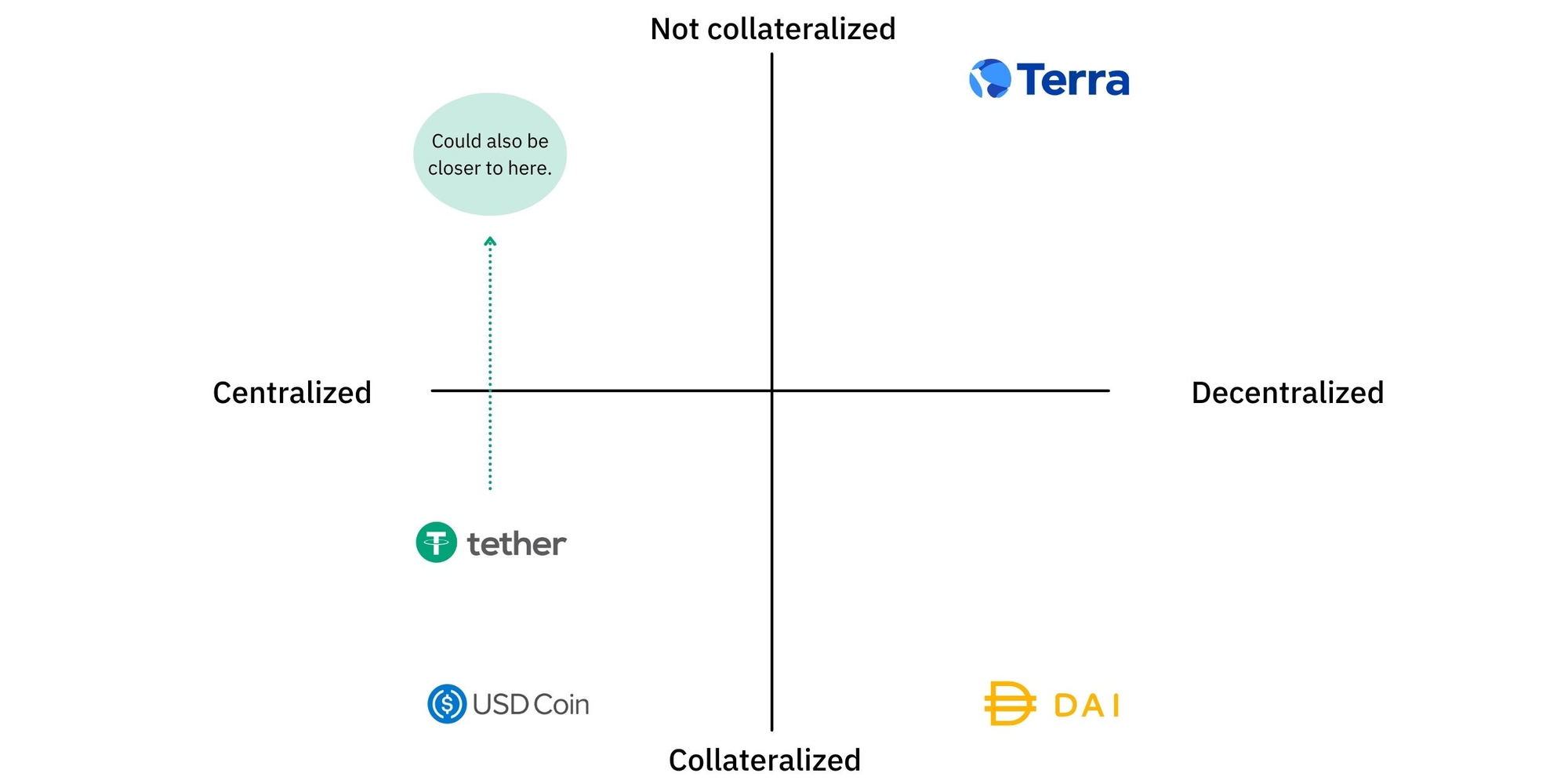

Unlikely cryptocurrencies which rapidly change in value, stablecoins aim to maintain a peg, in this case, 1 UST (United States Terra) is equal to $1 United States Dollar. There are many stablecoins in the world, and their main use case is to either be lent out to gain interest or to safe-guard your money away from prying governments or banks.

The major stablecoins Tether ($USDT) and USD Coin ($USDC) keep their value by a collateralised peg. Every time you buy 1 USDC, you pay for it with $1, and that $1 is stored in a bank account. At any point, you can redeem 1 USDC for $1.

Cryptocurrencies are supposed to be decentralised, so relying on a central government to maintain your peg seemed silly. Not to mention some questioned if these coins did hold the money in a bank account. Some stablecoins such as Tether are even said to be a “giant Ponzi scheme scam”

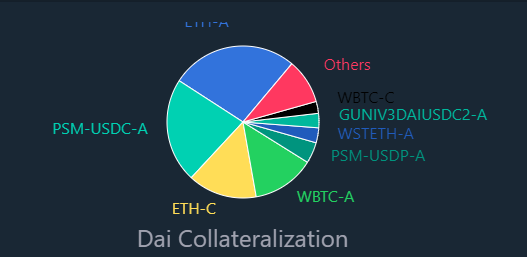

Eventually, people created collateralised coins which rely on decentralised assets. One such example is $DAI. DAI is collateralised by a bucket of other cryptocurrency assets (mostly Ethereum, Bitcoin, and USDC):

There’s a multitude of ways it maintains its pegs, all through algorithms. This is why DAI is called an Algorithmic Stablecoin. One way to picture it is:

DAI goes below $1 Let’s say DAI goes to $0.99. An organisation buys $1 billion worth of DAI. This reduces supply, and the demand stays roughly the same. Therefore the price has to go up to meet demand, which means it rises to $1. The company can then sell its DAI for their $0.01 profit, which results in $10 million.

DAI goes above $1 Let’s say DAI goes to $1.01. An organisation that holds a lot of $DAI sells $1 billion worth of DAI. Demand stays the same, but supply increases. The price goes back to $1, and the company profits $10 million.

There’s a couple more mechanisms involved, but this is the core of it. All of this is done using algorithms and is called algorithmic arbitrage (normally these fluctuations only last a few seconds).

Now, what if those other assets die out? What if one of them gets hacked? Relying on other assets to peg your coin to is silly. Normally we peg it to trust in the system (fiat currencies. the £1 in your pocket is worth £1 because you trust it is, and the person you’re trading with trusts it is).

This is where Terra comes in.

Terra was supposed to be the first decentralized non-collateralized stable coin. The idea was revolutionary. No longer do you need to trust fiat currencies or use collateralization of other cryptocurrencies to have a stablecoin. It was so revolutionary the value of Terra Luna was $59 billion at its peak, which was close to Enron’s $70 billion value. Unlike Enron, however, Terra Luna gained around $20 billion value a year compared to Enron’s measly $5 billion

You may ask “how do you maintain a $1 peg with no collateralization?” which is a great question everyone should have asked about a month ago before it all fell. Terra relied on its sister coin, Luna, to maintain its peg.

Every time 1 UST is created, the equivalent of $1 of Luna is burned. The demand for Luna stays the same, but the supply reduces. This increases the price of Luna.

After that, the same arbitrage principles apply:

Price of $UST is $1.01 Any Luna holder can swap $1 of Luna for UST, and sell each UST at $1.01 making a profit. This increases supply, the demand stays the same so it goes back to $1.

Price of $UST is $0.99 Any $UST holder can swap their money for $1 of Luna making a profit. This reduces the supply of $UST and the demand stays the same, so it goes back to $1.

Terra is not collateralised by its sister token Luna, which is a step up from DAI which is collateralised by (hopefully) unrelated assets.

So long as the price of Luna never collapses below $1, this stablecoin will always hold.

Terra Luna’s Growth in South Korea

Unlike most cryptocurrencies, Terra had a real-world use case. Its first use-case is a savings product called Anchor.

Anchor’s Ponzinomics

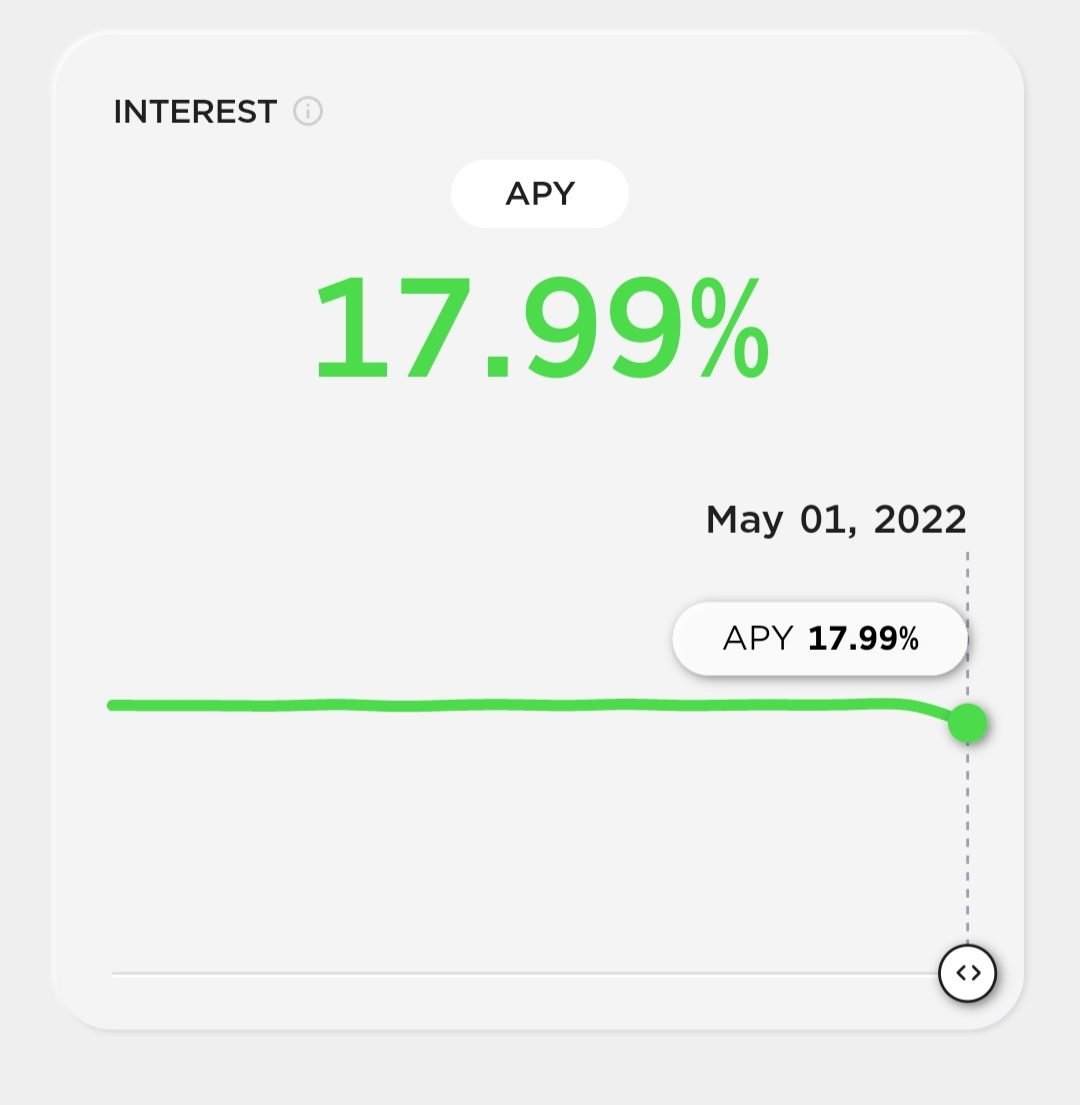

The Anchor protocol is an application on Terra Luna promising a 20% yearly return on stablecoins. So for every £100 you put into it, you should have no risk involved and be able to make £20 a year. This is 10% higher than what Bernie Madoff’s promised.

Unlike the Madoff Ponzi, however, Anchor has always admitted to these returns being unsustainable and is honest about where they came from. Essentially Anchor’s reserves were funded by venture capitalists, or Do Kwon himself. And they used these reserves to pay out large interest rates.

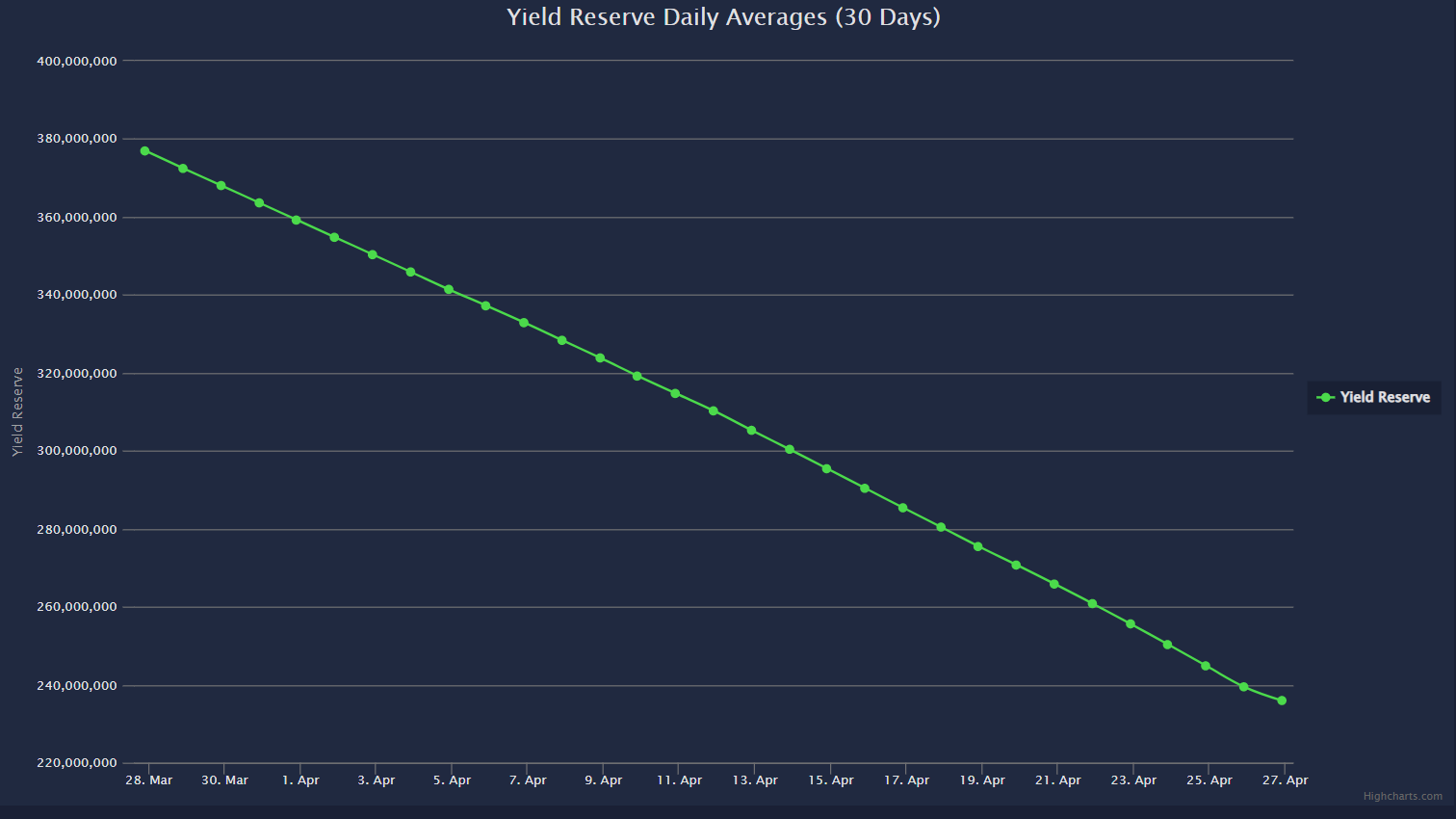

They did this to gain users, and eventually, they would turn off the large rates and go back to a normal level. By April it was obvious that they were going to run out sooner, rather than later.

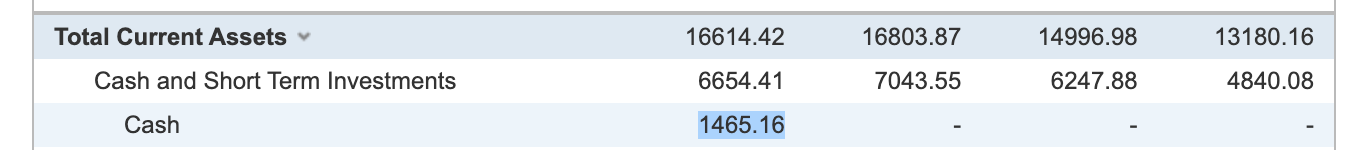

Anchor has a daily income of $2.1 million, but a daily expense of $7.1 million in interest. Anchor is only able to cover 30% of what they pay out, and the other 70% comes from the reserves.

Eventually, a proposal reaches quorum, the protocol will continually decrease its interest rate monthly until it finds an infliction point where the reserves start to build back up. Starting at 18% in May.

Chai

Chai is a FinTech which bridges the gap between decentralised finance and traditional finance. Merchants can now accept $UST, and users can now spend it using the Chai debit card. The idea is that users can use Anchor to gain a 20% interest rate, and merchants get much cheaper and faster transactions. It’s a win for all!

The Chai card also accumulates points which can be redeemed with specific merchants.

This has been done in the Western world too, except usually the merchants aren’t the ones accepting crypto. It is converted from Crypto to Fiat at the point of sale for the merchants sake. In South Korea, over 2200 merchants used Chai — including Nike and Philip Morris.

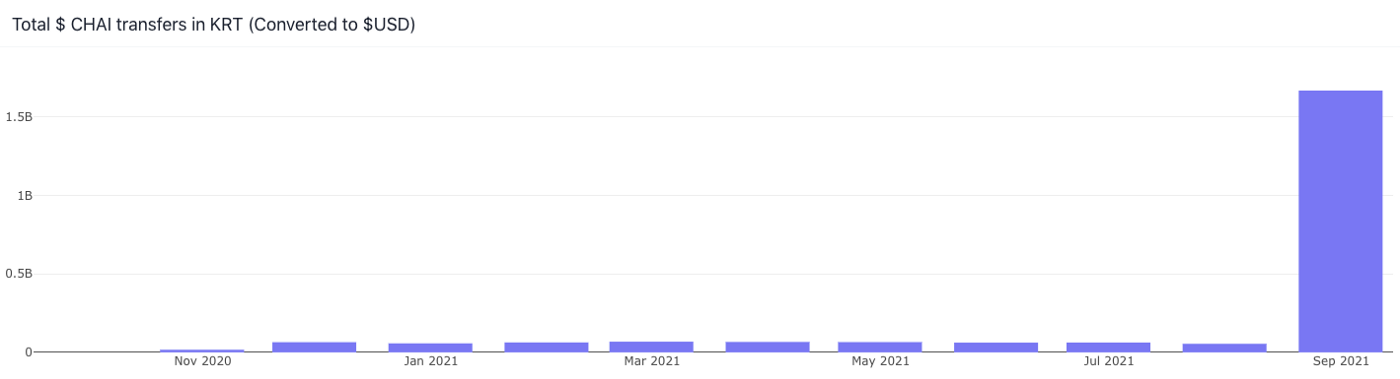

Chai’s usage has been growing exponentially, and they have even raised a Series B at $60 million.

The point I’m trying to make is unlike other cryptocurrencies, Luna had a real-world use case in Korea and startups were even created in the Luna ecosystem. When it collapsed, all those people working for startups will likely lose their jobs or are now ruined.

The fall of Terra Luna

As the bet against Luna heated up, Do Kwon got cockier and cockier. Calling those who would bet against him poor.

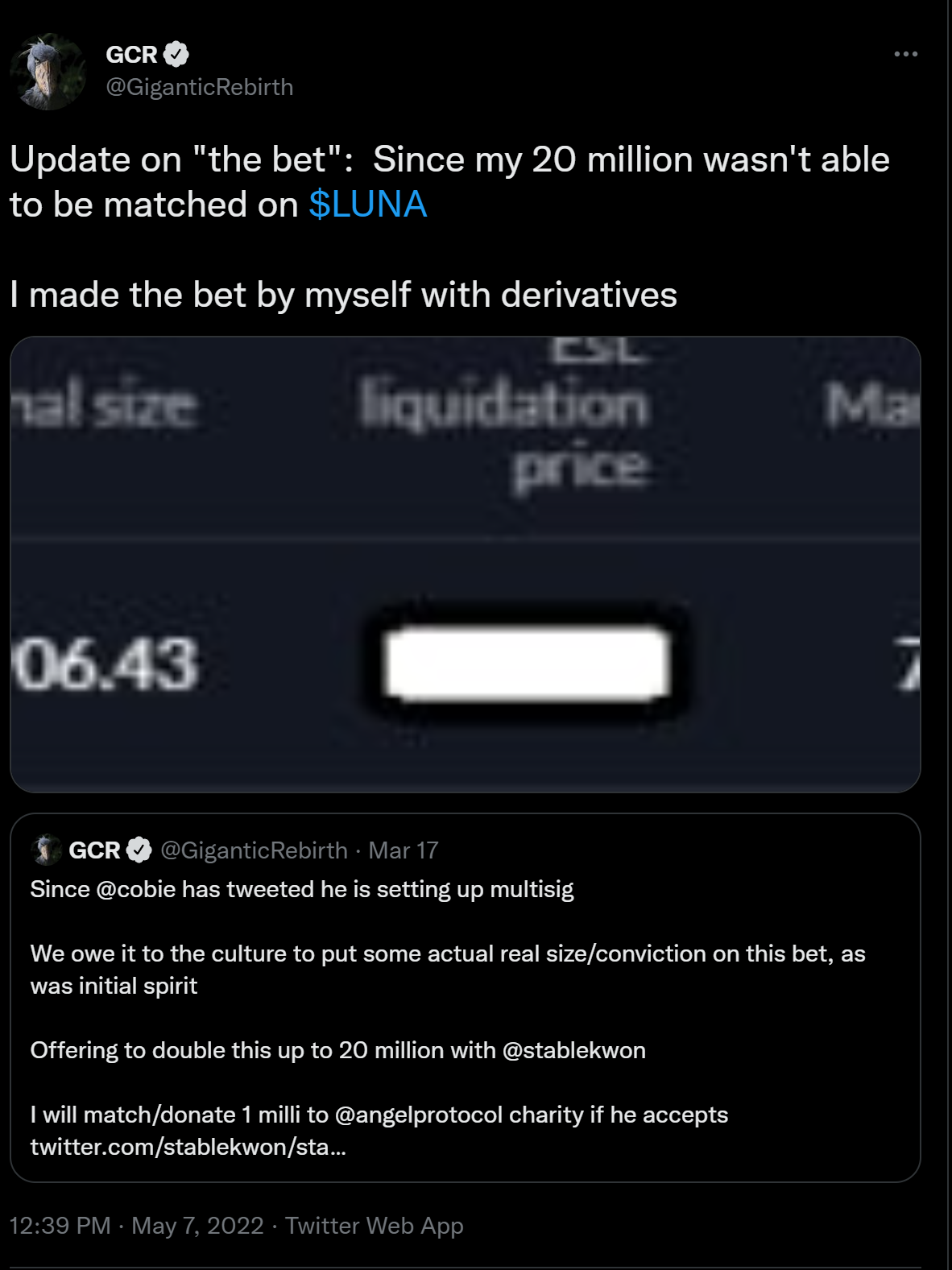

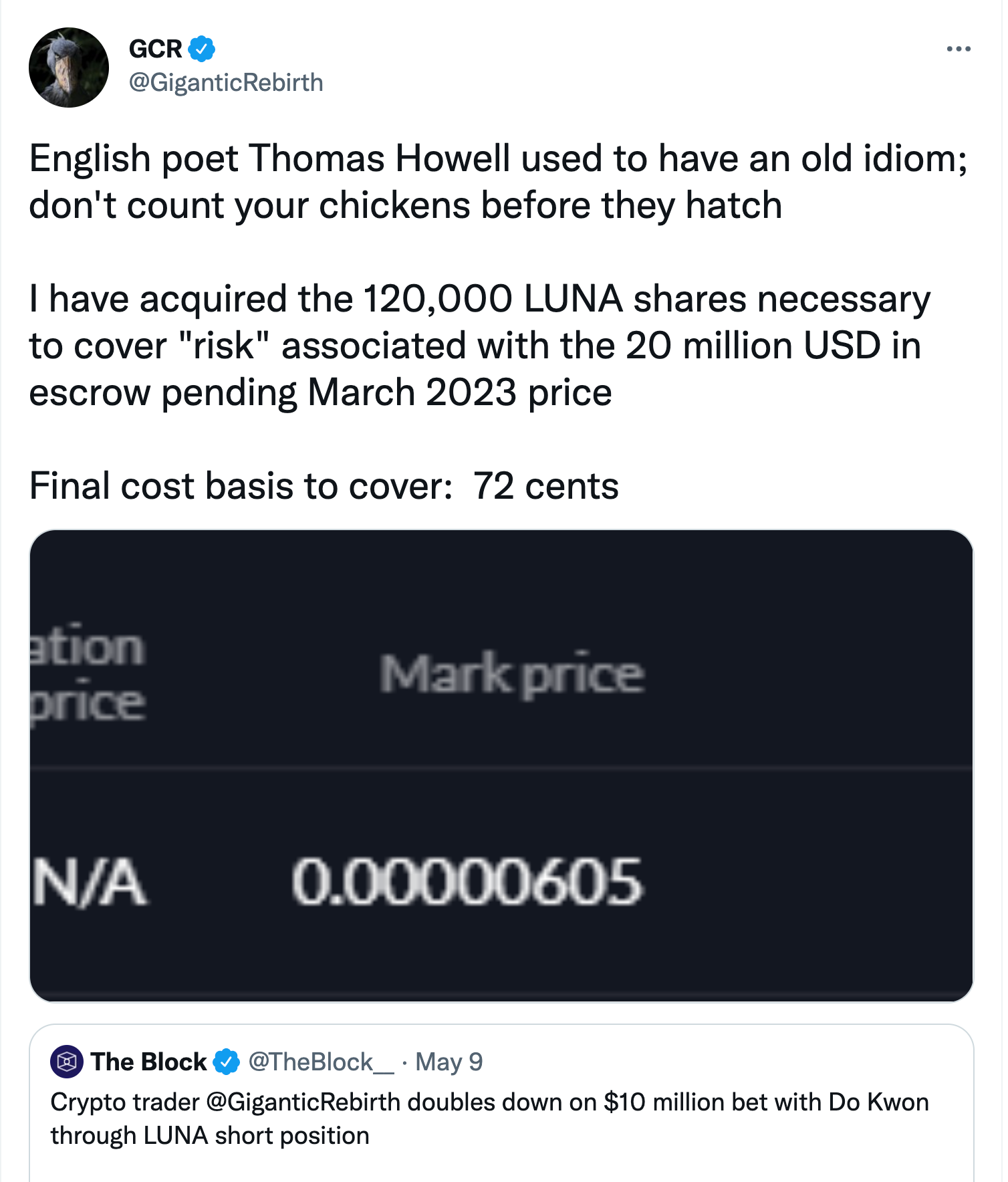

The bet size currently stood at $1 million each, that was until retired trader GiganticRebirth steps into the ring and bets $10 million that Luna will fail.

Surprisingly, Do Kwon matches. The total bet is $11 million for Luna to fail or win. Eventually the bet becomes too large, and GiganticRebirth shorts Luna with $10 million in derivatives (after Do Kwon refused to match).

The bet is on. People are shorting Luna left and right, but it doesn’t falter for long.

On the 8th of May, UST depegs slightly down to $0.98. Stablecoins tend to depeg occasionally because their market worth is only what people will pay for it. Let’s say I desperately need to get some coins, I can sell you a $10 bill for $5 of coins. Even though $10 is worth $10, you can sell it for less or more in the markets. The same is true for stablecoins.

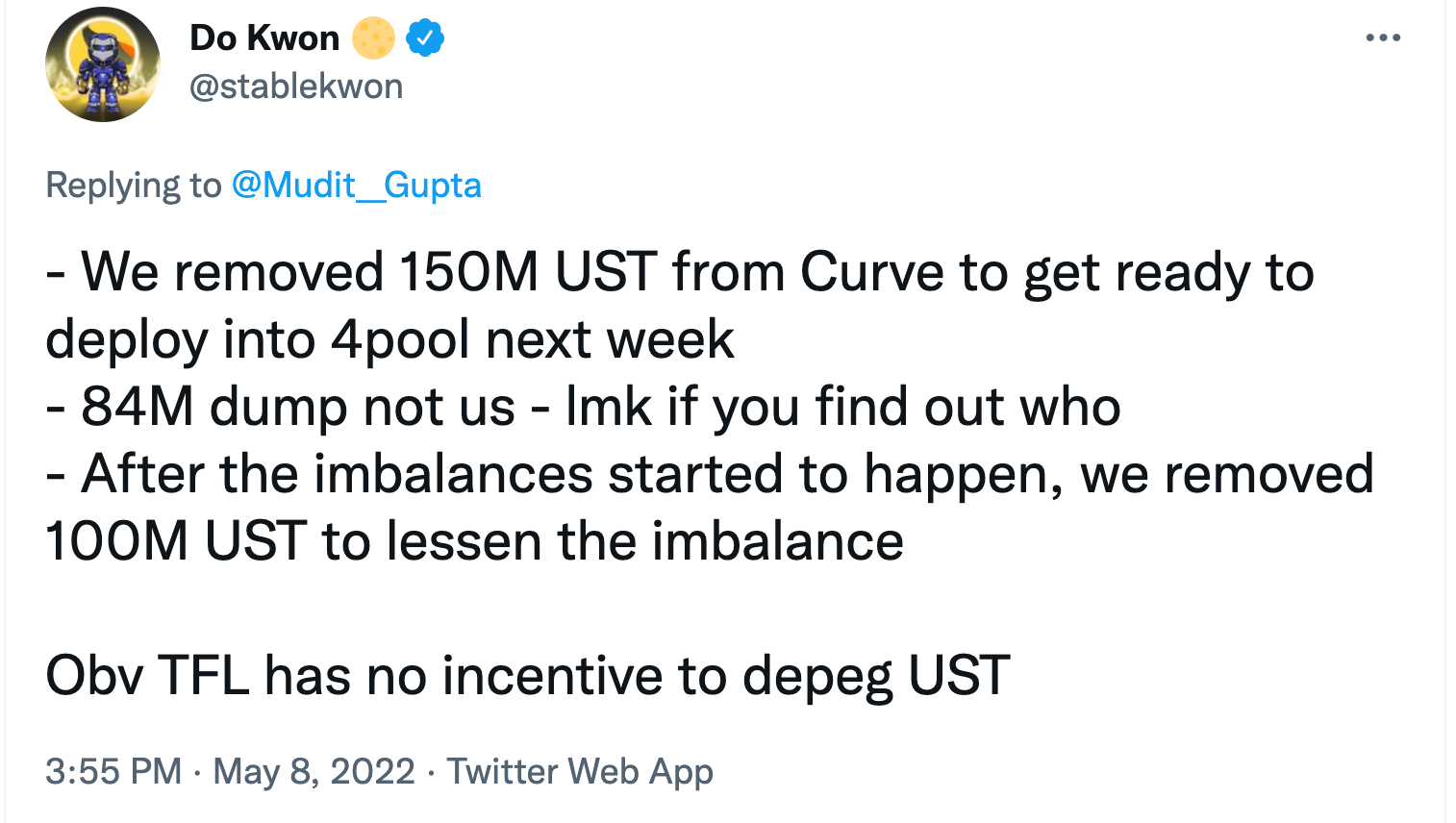

Do Kwon responds by calling people worried about the depegging poor, and Terra temporarily regains its peg. In the comments when someone compares Terra Luna with Bitconnect (a famous crypto Ponzi-scheme) Do Kwon makes fun of them.

However, if Do Kwon had known what had been happening in the shadows, perhaps he wouldn’t have been such a dick. For you see, a dragon with more wealth than Smaug had been setting the stage to destroy Terra Luna for months, and it was finally ready to devour its prey and steal his wealth in a Soros style attack.

And for readers that enjoy karma, the next very day after that tweet the dragon attacks — destroying Terra Luna.

What Shorters Do In the Shadows

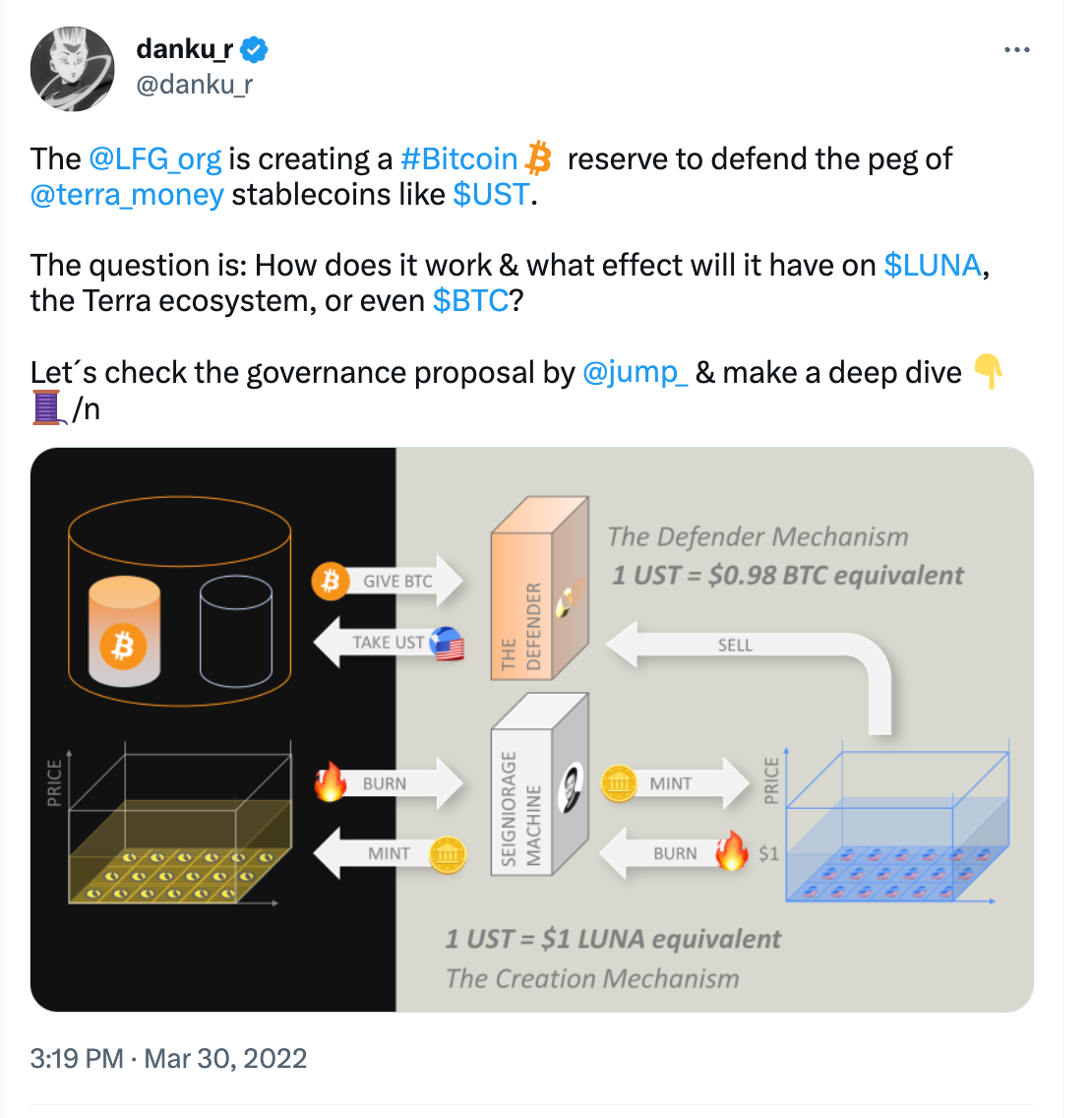

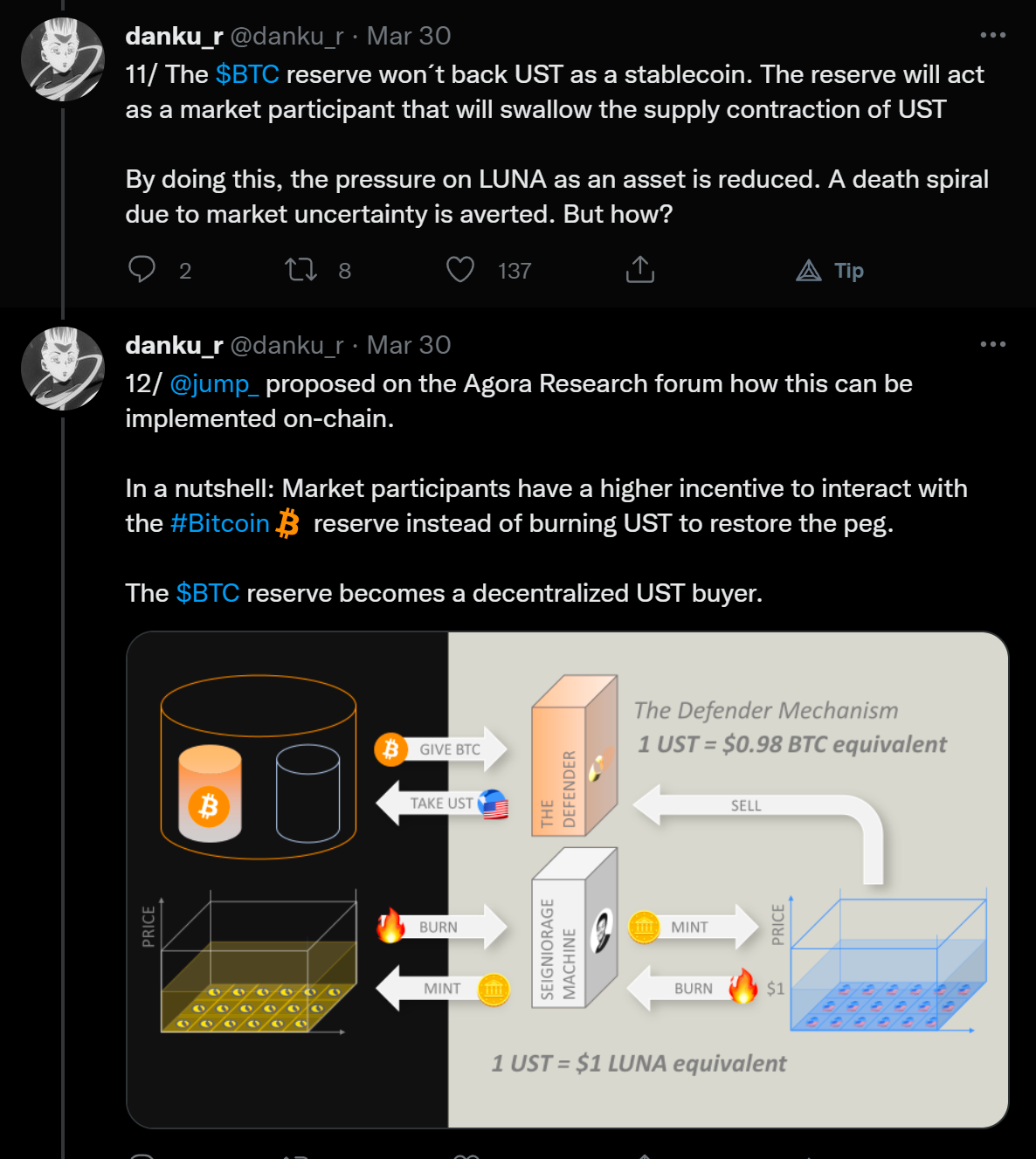

On 22/3/2022 the Luna Foundation Guard, which is the nonprofit organisation that helps secure and build Terra Luna, started accumulating Bitcoin and by the 26th of March held a $1 billion+ Bitcoin Position.

This is to defend against the death spiral. If UST decreases in value, Luna might fall in price. If the market loses trust in Luna, it might lose trust in UST & sell. The cycle goes around and around until both are worthless.

To defend against the death spiral, they reduce the pressure on Luna by using a Bitcoin reserve. This doesn’t eliminate the problem, but should help.

This happens in traditional markets too. Sometimes reserves are kept in gold or oil to make sure that if the fiat currency hyper-inflates or otherwise the banks can protect their customers. However, unlike traditional markets who use uncorrelated assets, the Luna Foundation Guard decided to use a highly correlated asset.

Here orange is Bitcoin/USD, and Blue is Luna/USD. When Bitcoin goes up, Luna shortly follows and often in larger jumps, because it was worth 0.02% of Bitcoin’s value before the crash. You don’t need to be a market expert to say they are correlated. If Bitcoin goes down, so will Luna — meaning the reserves aren’t all they’re set up to be.

Pundits spoke out and stated that Bitcoin as a backing for a coin would not make sense, and neither does announcing a $1 billion purchasing before it happens. Most smart investors do not do this, as they will get front-run to the high heavens and over-pay massively.

For a laugh, many cryptocurrency enthusiasts (even Ben Cowen, 800k YouTube subscribers, self-proclaimed Bitcoin Quant) fought against the backing being stupid by trying to offend the person at hand (calling them old, poor, etc) or stating that “Luna will go to the moon” instead of evaluating the information at hand.

For comparison against what a traditional finance company would do, here is Luna/USD (blue) compared to Gold/USD. A lot of people in crypto ignore what traditional finance does thinking it’s “old”, or expect reserves to grow at the same rate as crypto or stocks. Reserves are meant to protect you, not rapidly swing or grow 50% a year. And these traditional finance companies have hundreds of years of experience and to disregard their expertise is stupid.

So long as Bitcoin doesn’t go down at the same time as Luna, and especially if they don’t go down an extreme amount, it’ll be fine….

For our next step in understanding where it all went wrong, we need to talk about a war. A rather curvy war.

The Curve Wars

Incentives exist in decentralised finance to:

- Discourage you from selling your tokens.

- Encouraging you to make your tokens more liquid.

Historically this looks like “you lend out your tokens, I pay you a steady stream of tokens as thanks!” but now we’re seeing market places for liquidity. Lending protocols aggregate various opportunities like this for people to earn a yield on lending out their tokens, providing liquidity.

The aggregation and competition of these markets are varied, but the most popular is Curve. Thus, the competition for the hottest liquidity provider is affectionately known as the Curve Wars.

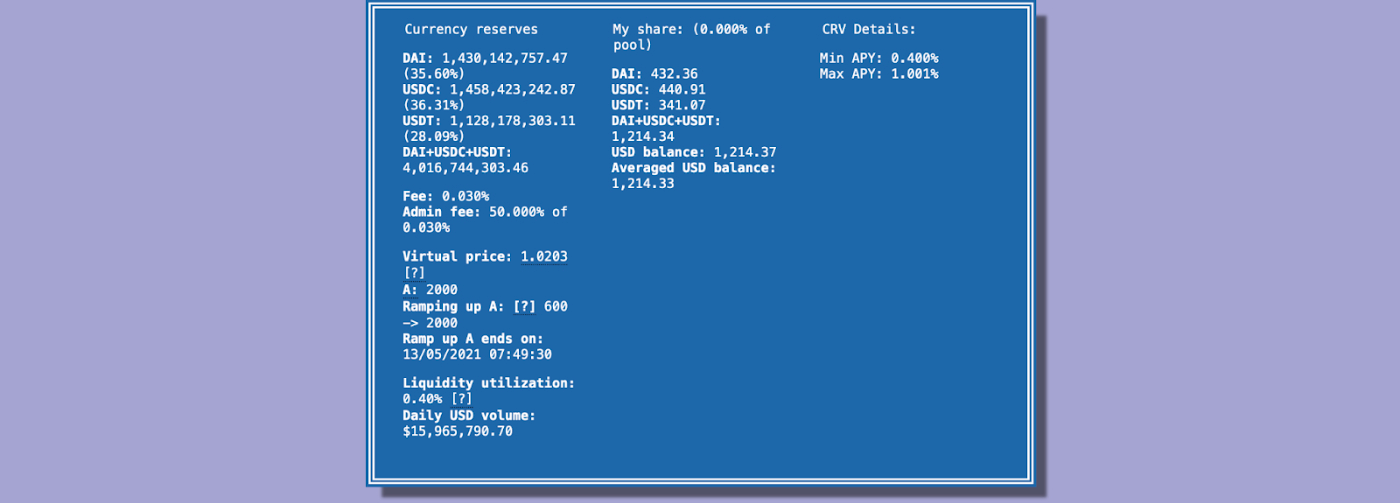

By far the largest stablecoin pool on Curve, a Windows 95 look-a-like app, is the 3pool with $4 billion in total value locked (that’s how much the assets in the pool are worth).

The 3-pool consists of 3 stablecoins, $DAI, $USDC, and $USDT. The more liquidity a pool has, the easier it is for large institutions to swap between stablecoins, meaning if you want your stablecoin to experience institutional adoption you’d want to have a much larger pool — leading to some companies providing their liquidity in these pools.

On the 1st of April Do Kwon introduces the 4-pool:

Notably it removes $DAI and introduces $UST and $FRAX. $FRAX is a competing algorithmic stablecoin, and to be honest I have no idea why it exists or what makes it different — and Googling doesn’t help 🥴 (for what it’s worth, Frax is being talked about so much now it might as well become the very next UST. However, that still doesn’t change the fact that before Luna imploded literally no one had heard of Frax)

If I had to guess, it’s backed by some large institution that will happily funnel billions of their dollars into the pool, like below:

And the reason Do Kwon included it was to get that institutional backing at the start. I get this sense from the statement “between frax.finance, TFL, and redactedcartel we pretty much own all the cvx)”. CVX is a reward token from Convex Finance, built on top of Curve finance which provides access to escrowed voting rights on Curve via the Curve DAO.

In English, Do Kwon has stated that he has (or will) build the largest liquidity pool with large backing and will become the stablecoin king and win the Curve wars.

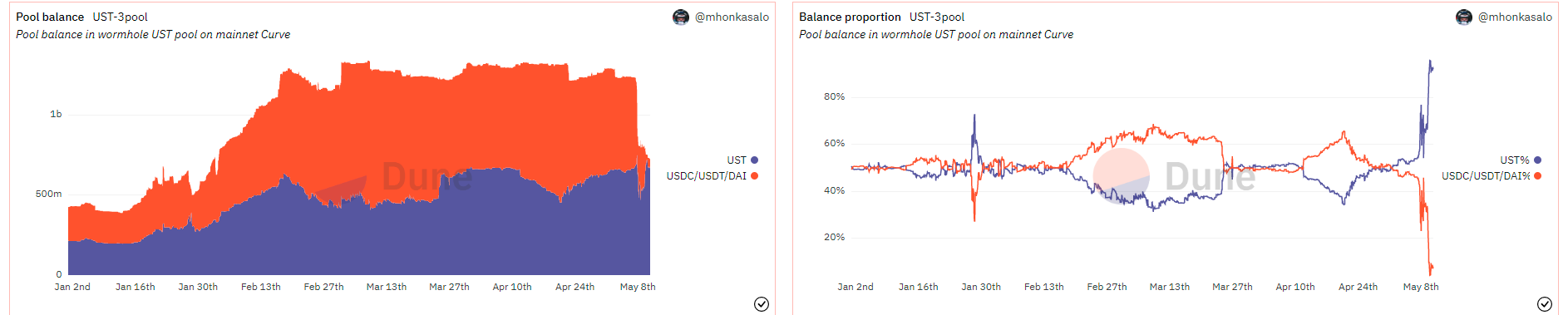

This is important because liquidity for Terra will have to be lower while it’s being funnelled and created into the 4-pool, meaning any attack is capital-efficient.

Before the 4-pool, the 3-pool was the best place to swap into UST. If the Luna crew never created the 4-pool, the attacker at the time would need to take 800 million dollars and run it through the 3-pool to drain it of its liquidity.

When the pool has run out of liquidity, there are no exit doors. Curve is the largest stablecoin pooling provider, meaning essentially if a pool dries up you cannot close your position.

You are stuck with it, and in an emergency, you will have to sell at a major loss to anyone who will buy to recover anything.

Do Kwon was drying the pool up by himself, by moving funds from the 3-pool to the 4-pool. When there is less water in a swimming pool, it is easier to empty it. And once the pool is empty, no one can get out. This makes the attack highly capital efficient for our attacker.

Setting the final trap

This part is speculation, but we are speculating on the information that the attacker had something to gain from destroying Luna and they didn’t just decide to lose 100s of millions of dollars for fun.

The attacker borrows 100k bitcoin to start the position (opening a short) at some point in time. They could also have borrowed Luna, shorting that too. It makes sense for them to borrow Luna, as they are going to destroy it.

The Bitcoin short was then sold into Do Kwon’s buying between the 27th of March and the 11th of April:

It’s a bit of a weird trick. Shorting works by:

- Borrow Bitcoin from someone

- Sell that Bitcoin to create fiat (or similar)

- If Bitcoin goes down, the person you’re borrowing from (likely) wants their Bitcoin back to sell at a loss.

- You buy Bitcoin at a now discounted price, and keep the difference as profit.

- If Bitcoin goes up, you need to supply more money to keep the short position (called a margin call).

The reason that the attacker very likely shorted Bitcoin (instead of Luna) is because, in the words of Twitter:

Luna is a ponzi shitcoin

And because if the $UST peg broke, Luna would start selling Bitcoin which creates downward pressure on it.

To hold a short against Luna, we’d need people who want to take back the borrowed Luna from us. 100k of the attackers Bitcoin was sold to Do Kwon, but it wasn’t all the attacker had. With the amount of profit the attacker was looking at taking, it would be unwise to hold it in an unstable, illiquid Luna format.

It’s possible they also shorted Luna, but no one has found this action on-chain yet. Other smaller fish (betting “only” a few million) did win big by shorting Luna.

The attacker has built:

- a $4.2 billion short position against Luna and Bitcoin

- $1 billion in over-the-counter market options of $UST

The Attack

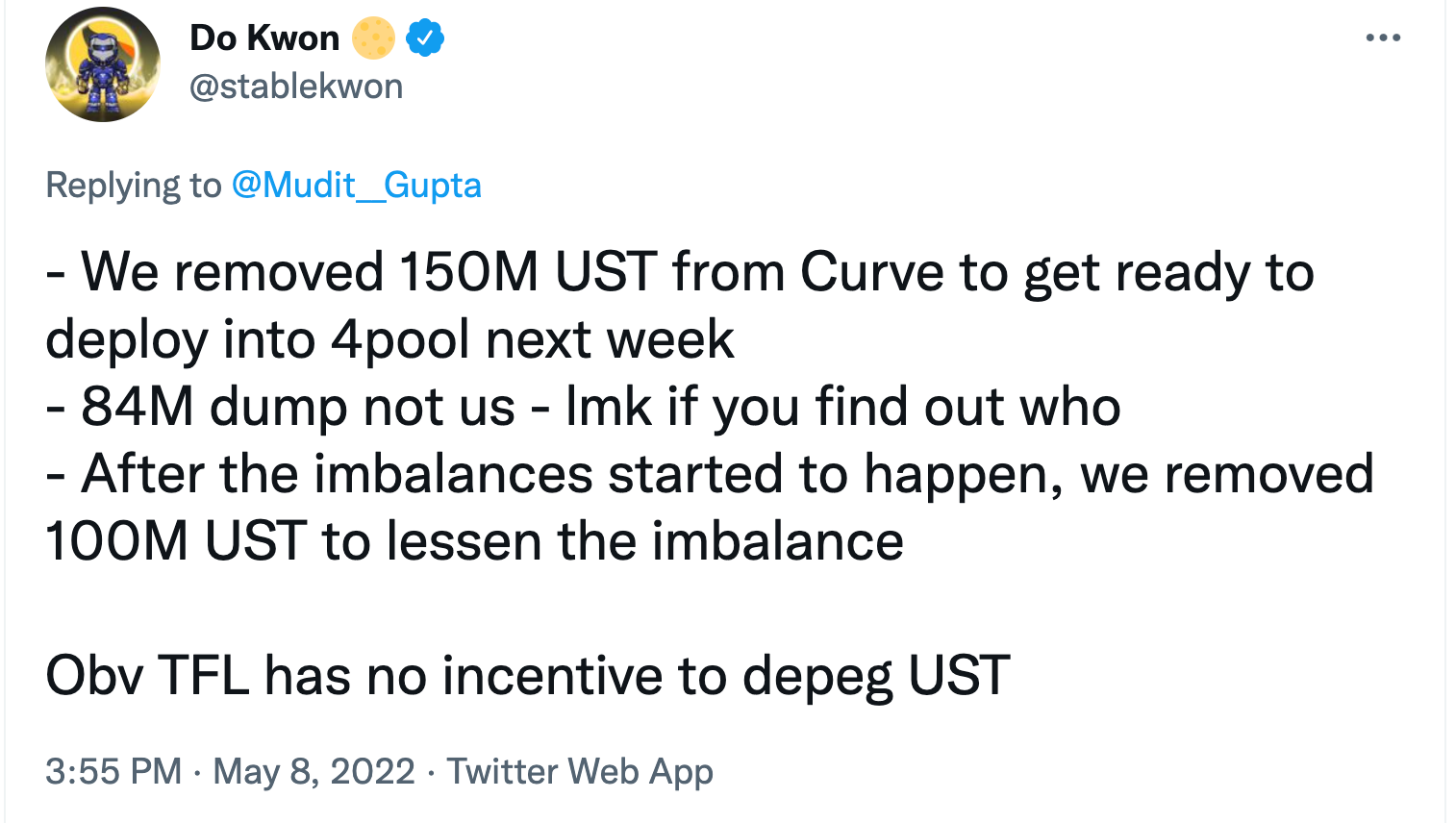

On the same day that Luna removes $150 million from Curve, the attacker strikes.

They use $350 million of UST to drain the pool even further. The Luna Foundation Guard pulls another $100 million, from the image earlier:

This is starting to close the doors. So much liquidity has been lost, about $600 million. Only $200 million remains.

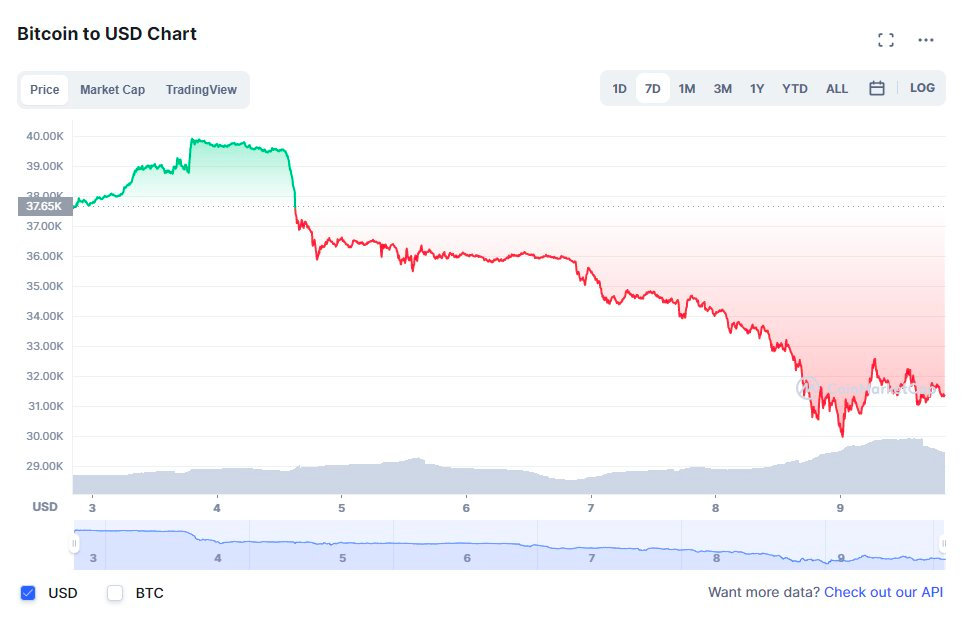

People start to panic. They start selling at a loss to get out before it’s too late, Luna falls to $0.97. Luna starts selling their Bitcoin to defend the peg, as they intended to.

However, the attacker was just getting started.

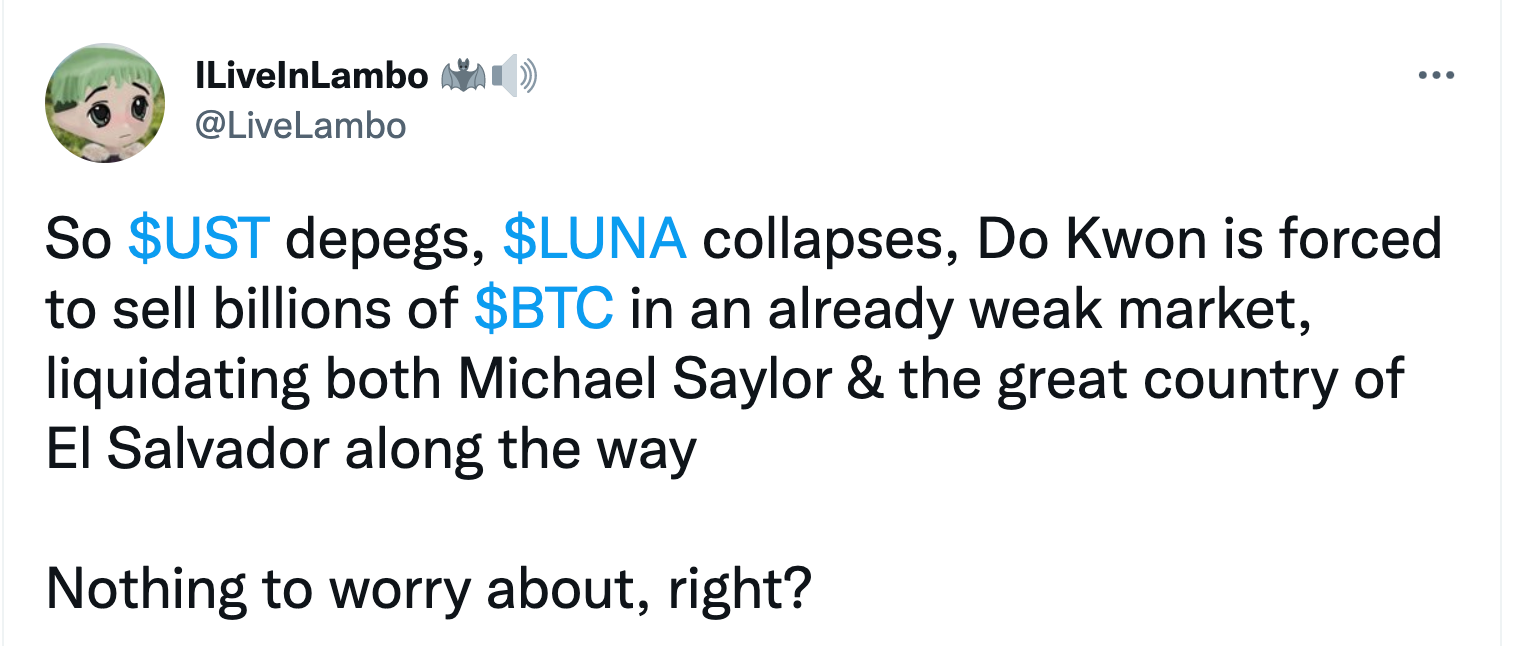

Luna’s mass sale of Bitcoin and the depegging of their stablecoin invites the market to panic even more, dropping 14% in just a few hours. Because Luna bet on a correlated asset they are continually having less & less reserves to repeg UST.

With people running for the exits, and with the Curve pool now empty they are looking for any way out. Some sell for $0.70. Others head to the 2nd largest liquidity provider, Binance.

However, our attacker is smarter than most. They use the rest of their $1 billion $UST position to drain the pools on Binance. Now there is no exit. Our attacker has Luna cornered.

Our attacker is selling so aggressively they are single-handedly depegging themselves on Binance, they are selling at a loss here to depeg $UST even more. This is why speculating they have short positions in both $BTC and $LUNA makes sense, otherwise, they would just be doing this for fun.

The Luna Foundation Guard is selling Bitcoin to defend the peg, the attacker is selling $UST on Binance to destroy all exits. Eventually, the chain gets congested and the CEXs (Binance, Coinbase, Kraken — a centralised exchange where users can buy cryptocurrencies) suspend withdrawals of $UST.

This fuels the bank run even more, sending everything into a spiral. $UST falls to $0.60 and Bitcoin bleeds out, liquidations across the board. Some even suspect that El Salvador was liquidated:

Not all Luna users have gotten the memo at this point, some still believe the project is fine.

If you remember from earlier, the way Luna regains its peg is meant to be:

Any $UST holder can swap their money to $1 of Luna making a profit. This reduces the supply of $UST and the demand stays the same, so it goes back to $1.

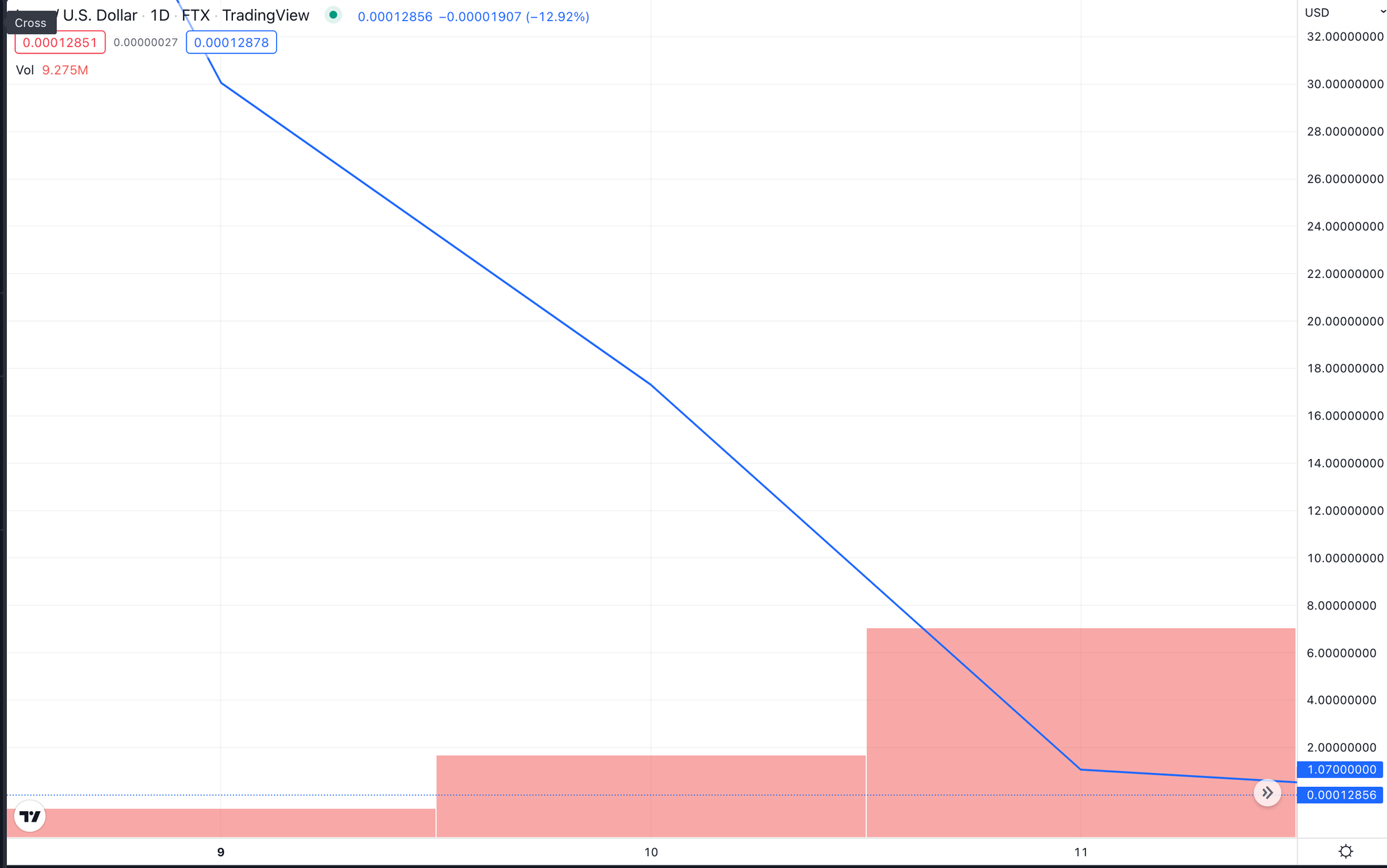

This happens en-mass and suddenly billions of Luna are introduced, the price plummets because the supply far-outstrips the demand and because people lose confidence in the project. Later on, Luna is created at such a rapid rate there is trillions of it.

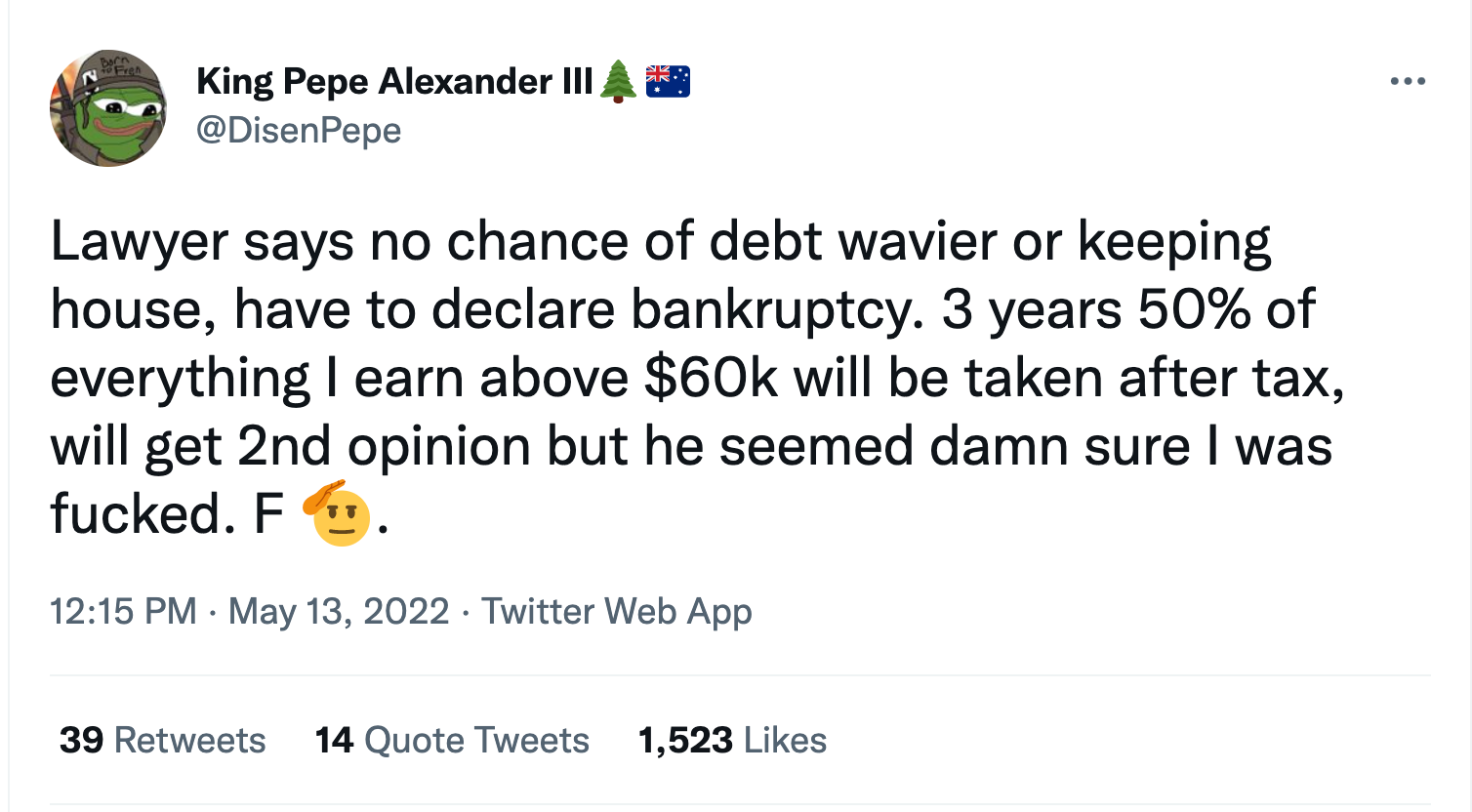

In the end, the entire crypto market took a hit. Luna was destroyed and so was $UST.

If there’s one thing you can learn from this, it’s to never be so confident that your startup will succeed that you’ll call any person with an opposing view “poor” and completely disregard whats happening to your startup.

How much did our dragon make?

If our main player was able to buy back the 100k Bitcoin at $43k, they would have made $942 million on the short.

Because they frantically sold $UST through Binance, they actually lost money from the depegging. About $125 million.

This means our attacker made $815 million, and that’s just what we know of. They could have had other short positions in Luna, a larger short position in Bitcoin or other related cryptocurrencies we don’t know about.

Now, let’s talk about the other shorters.

Who was our dragon?

There are many speculations as to who our dragon was, let’s dig into them a bit. As much as the average Redditor froths at the mouth blaming Citadel for everything wrong with financial markets, it can’t have been them.

existing short positions. This attack cost around $1 billion in UST, and a couple hundred million in Bitcoin shorts.

There is no way any regulator on this planet, yet alone the United States of America, would let Citadel run entirely on fumes while they attempted to destroy a currency and short Bitcoin.

The only way they could get money is by closing a position to capitalise on the profits. This also hasn’t happened. When a company closes a position, yet alone a position worth over $1 billion, the SEC is informed and so are the public.

Blackrock

Again, another one Redditor’s like to perpetrate as the enemy. Blackrock is the richest company in the world by far in terms of total assets under management.

Blackrock’s clients do not care about making 70% profits in a year. Blackrock only needs to make 1% a year to produce $100 billion in profit a year, which is absolutely huge for their clients.

Blackrock does not take risks. Instead, they own almost every single company out there and bet on entire continents.

Blackrock shorting Bitcoin and destroying $UST is completely out of the question. Not only would their clients be pissed, but why would they risk losing billions when they only need 1% to make more money than 99.999% of the US population has?

Who I think it is…

George Soros.

Here’s 4 reasons why:

- This attack is called a Soros attack.

It’s named after what Soros did to the Great British Pound. Dried up the liquidity, shorted everything that would be affected and made billions.

It makes sense that he would notice this type of attack and try again.

- He’s a billionaire.

Soros has so much money he can afford to gamble like this.

- He has so much money he can hire people to perform it for him.

While he may not be technologically inclined, it doesn’t matter. He can easily hire people to perform the attack for him.

And most importantly:

- It’s funny

This attack happened because Terra Luna were arrogant. They refused to listen to the advice of the old guard of finance. “Don’t use correlated assets as reserves”, “keep liquidity high or suffer” etc.

Cryptobros are so incredibly arrogant when it comes to listening to the old guard of finance, even though they have hundreds of years more experience. It would be hilarious if the old guard destroyed Terra Luna.

The Big Short DAO

DAO stands for “decentralised autonomous organisation” The idea being:

- Decentralised - there is no singular over-arching power that controls the organisation.

- Autonomous - Things happen via code and votes, no human is involved.

- Organisation - a company.

In my experience, DAOs are not decentralised nor autonomous. More like dictatorships where citizens can vote on things (but does not mean that thing happens).

If a DAO performs an action without a vote, the users (who often own the DAOs token) lose trust in the DAO and mass-sell their tokens, forcing the DAO to decrease in value meaning the people at the top should be hurt by this.

The decentralisation of a DAO only really applies to a multi-signature wallet. X/Y people need to approve transactions on the wallet. For example, to sell £50 of Luna you might need 3/7 people to approve the transaction. This is important information we’ll need later.

In November 2021 Twitter user GCR created a DAO called RebirthDAO. GCR believed that the markets were extremely euphoric, so they wanted to short the tokens on the way down. The DAO’s purpose was to identify which tokens would crash the hardest.

The DAO succeeded, identifying a set of tokens which fell from grace hard such as Gala’s GALA (-77% from November all-time high), IoTeX’s IOTX (-80%), The Sandbox’s SAND (-64%), Ethereum Name Service’s ENS (-80%), Gitcoin’s GTC (-76%), Livepeer’s LPT (-75%) and Axie Infinity’s AXS (-69%).

To put it succinctly, GCR is the Dr. Burry of the Crypto industry, a giant bear betting against the market. These coins crashing were nice, but GCR was looking for something… bigger. We revisit the start of this article here, as GCR has found their prey:

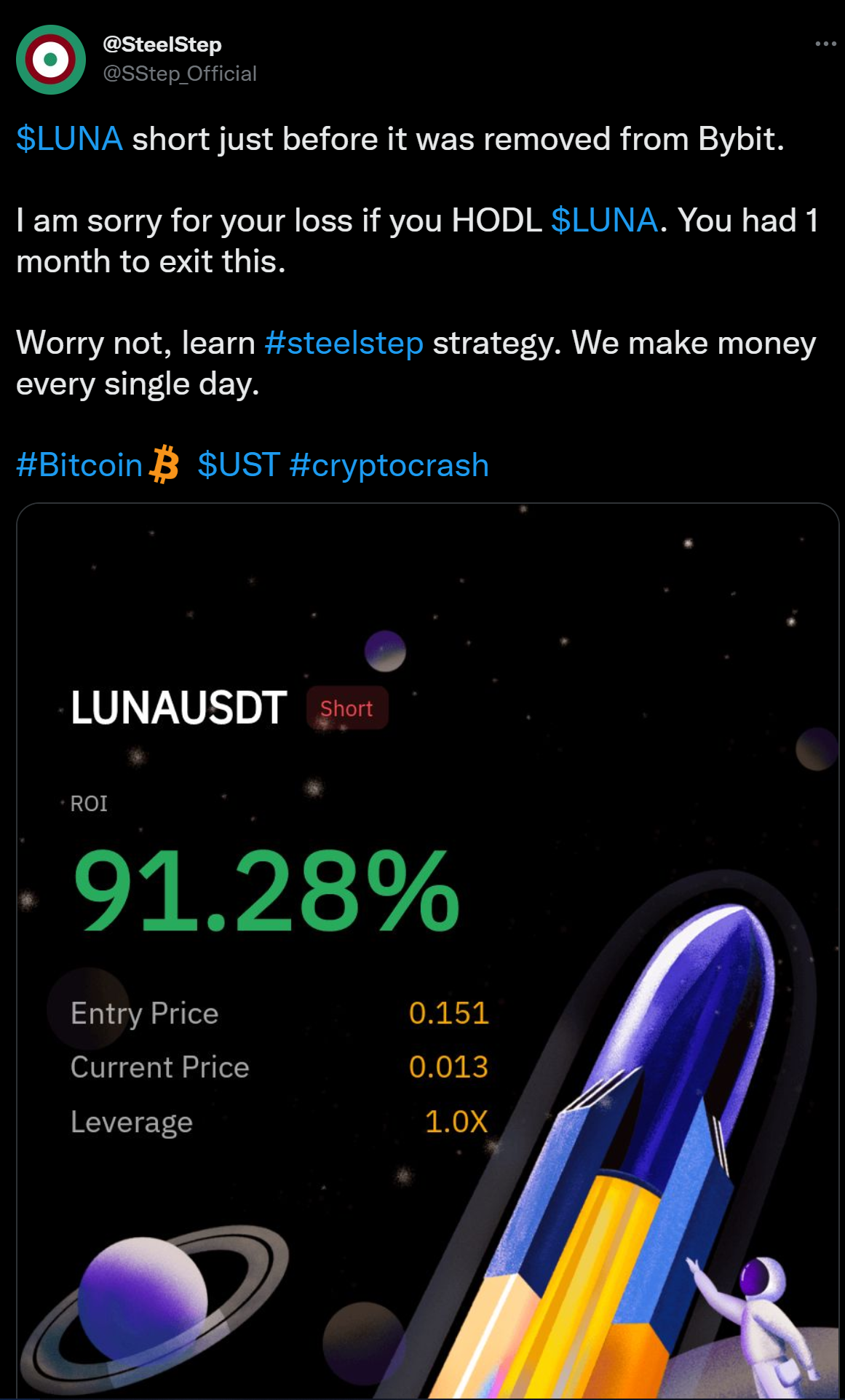

GCR enters the bet against Luna, and bets a further $20 million using derivatives. GCR tells their Discord, and the news spreads through Twitter. Hundreds of people short Luna.

Some double their money on the way down:

Others made 100x in only 1 night:

And others who have been shorting since the top made ridiculous returns on investment (I don’t even know what this number is):

GCR eventually tweets out again, he covered a $20 million short position with $0.72, a ridiculous sum for a ridiculous upside.

Conclusion

Luna failed. In every way imaginable. Organisationally, financially, and more. What are their next steps?

Well, they want to relaunch Luna 2.0. The same but with collateralization on their stablecoin. They plan to airdrop some Luna coins to people who were burnt in this, but as always the VCs at the top get the profits.

Many people were burnt by this, extremely so.

But, on the bright side Justin Sun, creator of the Tron blockchain, has promised to recreate Terra-Luna, but this time with even more on the line (30% interest vs Luna’s 20%). It will be a full algorithmic stablecoin with no collateralization. What could go wrong?

And like always, some crypto people flock to it as the next greatest thing.

And the cycle continues. They say in the stock market money flows from the fools to the wise, but it appears in crypto this cycle is much, much faster and more vicious.