The Hut Group

This article is not financial advice, and the only reason I am writing it is so I can re-read my reasoning. I am posting it online so if I am wrong, others can correct my reasoning. Per Lynch:

Know what you own, and know why you own it

Do your own research 😊

Hey friends 👋

Happy Monday! I’m still very much living emotionally in spooktober 🎃

I already know a lot about the Hut Group because 9(!) of my friends work there, but this time I’ve read every single annual report they’ve put out since 2015 (about ~1100 pages) and have studied, in detail, every part of their business.

I’ve condensed this down to an email you can read to understand the business and where it’s going.

Let’s get into it.

🤔 What is The Hut Group?

“You know MyProtein? We run their store.” - THG Employee when I asked

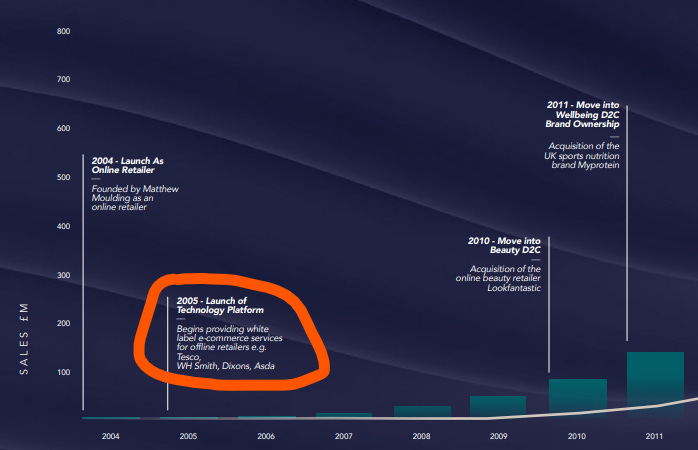

The Hut Group is Shopify but for large brands. Want to sell your products online, but don’t want to create a web development team with a bunch of brand experts and designers? The Hut Group will do that for you (provided you have the cash).

The Hut Group describes itself as:

A proprietary, end-to-end, global technology platform specialising in taking brands direct to consumers

Okay, so it’s a tech company aimed at businesses. Cool! In their annual report they dig deeper:

THG’s purpose is to reinvent how brands digitally connect to consumers globally and to be best in class at building, growing and accelerating brands in order to deliver long-term sustainable growth for its shareholders. This is achieved through THG Ingenuity, our Beauty and Nutrition brands and our own e-commerce websites, whilst ensuring we use our position to promote responsible and sustainable retailing.

I don’t really like these descriptions. A lot of tech companies have lofty ambitions. Build a better internet. Make mooney work for everyone. Banking without borders. The Hut Group’s is just “we take your brand direct to consumers to deliver long-term sustainable growth for its shareholders”. I am not digging the fact that their mission statement states, primarily, they are here to generate a profit for the shareholders. As we’ll see later, this description of themselves has changed over time.

Although I must give them props for:

promote responsible and sustainable retailing.

Now this is a mission I can get behind.

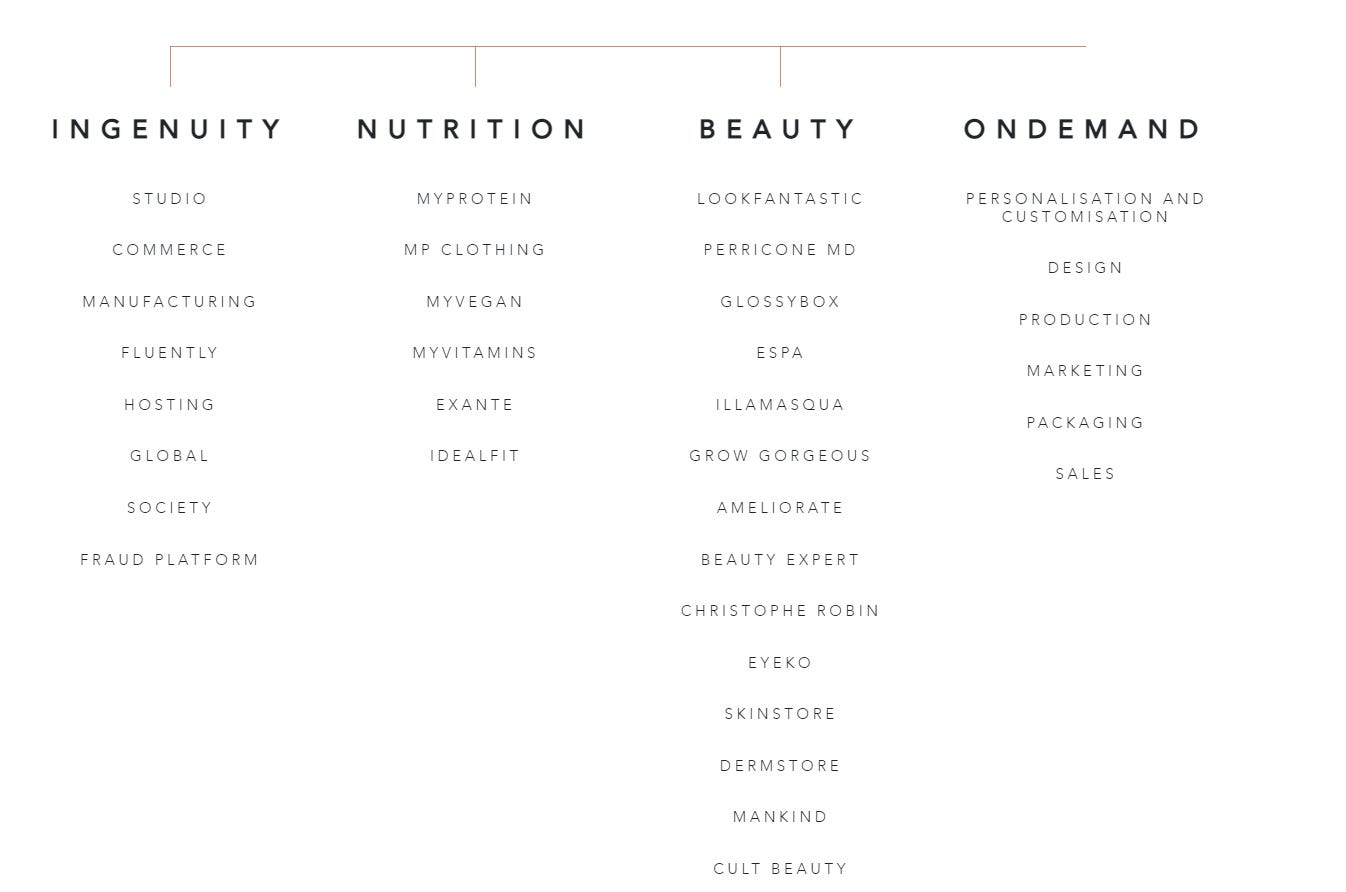

Truth be told, they make themselves out to be a tech company but upon studying them I am not quite sure. They are technology first, but they do so much from:

- Branding

- Search Engine Optimisation

- Customer Retention Optimisation

- Logistics (creating packaging and shipping it)

- Warehouses to store stuff for customers

- Website hosting

- Fulfilment Centres

- Translation Services

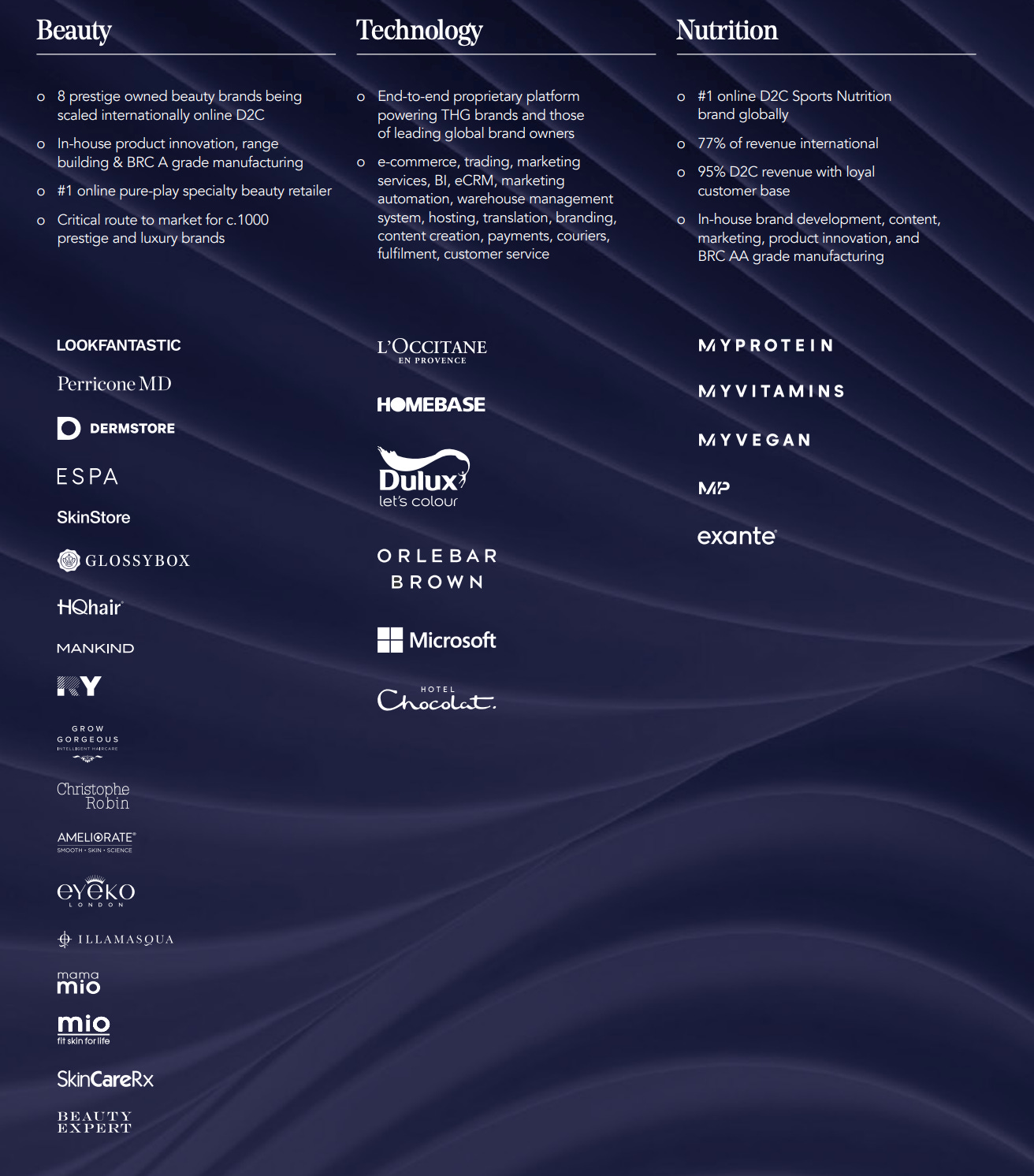

And much, much more. Now, that doesn’t even scratch the surface because The Hut Group (THG) owns a bunch of brands like:

- MyProtein

- LookFantastic

- Mankind

and more. They started out as a Shopify competitor but have become something of a super conglomerate controlling businesses.

Let’s break down into their financials

🤑 Financials

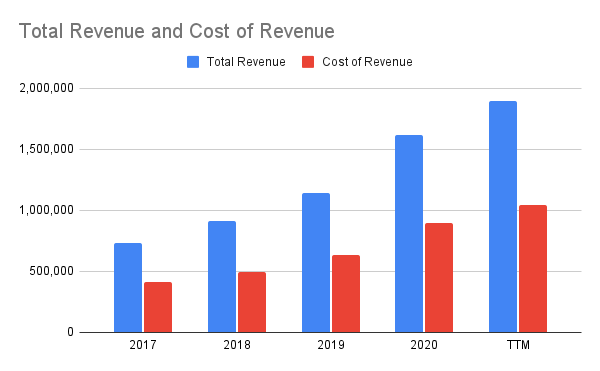

Total Revenue: 1,896,763 (26% YoY growth)

Cost of Revenue: 1,044,097 (26% YoY Growth)

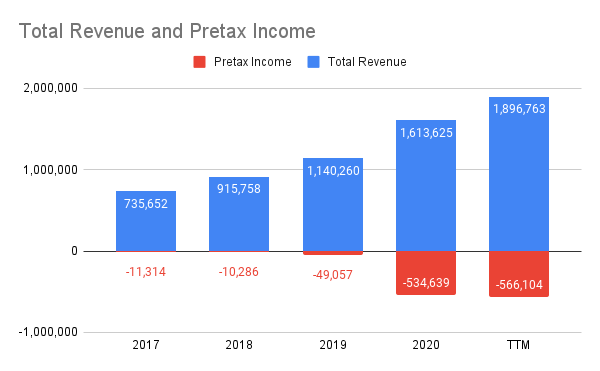

Pretax Income: -556,104 (345% decreasing YoY Growth)

Total Customers: 13 Million (54% YoY)

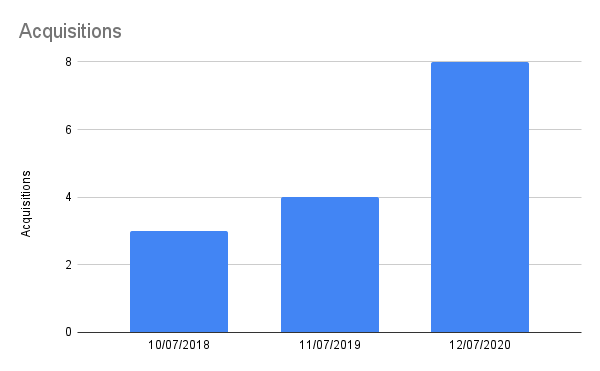

Acquisitions / Year: 8 (67% YoY)

The first thing to note is that revenue is going up at the same rate as the cost of revenue, however, the cost of revenue is lagging behind revenue. This isn’t concerning until revenue decreases or the rate of the cost of the revenue goes up.

The 2nd thing you may see is the pretax income.

Pretax earnings is a company's income after all operating expenses, including interest and depreciation, have been deducted from total sales or revenues, but before income taxes have been subtracted.

Using this metric you can say that the Hut Group does not make a profit, and they are not making a profit at an astounding rate (345% year on year growth 😲). However, depending on what they spend their money on in operating expenses they may be making profit and deciding to just invest it back into themselves.

Normally with good startups, they’ll have a “switch” they can toggle to make profits overnight. I presume with THG they can either stop investing it back into themselves or raise the prices of their products.

This percentage decrease happened in 2020 when The Hut Group’s operating expenses doubled. This happened because:

- The Corona Virus Pandemic (THG are primarily a retailer).

- They spent a lot on preparation for their IPO (£400 million, the prize money for Squid Game couldn’t even cover this at $38 million).

If we take away the pandemic their year on year decrease in pretax income goes to 130%. They have one more outlier, but this was caused by lower than expected revenue and higher expense costs so I will not excuse it.

If you look at the graph the pretax income for THG they were very near to profit from 2017 - 2019, but then the pandemic hit and they’ve strayed far from this path. With their IPO behind them and the pandemic quietening down, I am hoping to see the pretax profit go back up to near profit levels. This is a metric to watch.

The Hut Group is rapidly acquiring new businesses with over 8 last year. There are a few reasons why a business would acquire others:

- Diversification of their assets - THG should be working on their core product offering in my opinion, not diversifying.

- Greater Market Share - This is possible. They want to become the largest retailer in Health & Beauty.

- Cost Reductions - Unlikely, I can’t see any acquisitions which would help reduce their costs.

This tech startup wants to dominate health & beauty by building out stores or spending millions/year on acquisitions, but their primary product is their tech stack THG Ingenuity. Also, don’t forget their SEO products, brand creation products, or fulfilment products for influencers.

I am quite confused as to what THG actually is or what they are, and I get the feeling that they don’t really know either. Peter Lynch famously called this Diworsification. A company is over-expanding into multiple markets and businesses that they do not fully understand and which do not align with the company’s core competencies. I’d rather see a company absolutely smash it at one thing, and then use that as leverage for other things than to diworsify.

The Hut Group originally started as a tech startup, and they still see themselves as it. But they have so many “this is what we do” that they’re over-diworsified. It’s hard to dominate the shop-building market like Shopify when you’re also trying to dominate the health & beauty markets, and also SEO as well as brand creation and marketing.

Fun fact: Most successful companies have a short mission statement that clearly defines them:

Tesla: Accelerate the world's transition to sustainable energy

Coca Cola: To refresh the world, inspire moments of optimism and happiness

Wise: Money without Borders

Monzo: Making money work for everyone

Google: Organise the world's information

The Hut Group: Reinvent how brands digitally connect to consumers globally and to be best in class at building, growing and accelerating brands in order to deliver long-term sustainable growth for its shareholders. This is achieved through THG Ingenuity, our Beauty and Nutrition brands and our own e-commerce websites, whilst ensuring we use our position to promote responsible and sustainable retailing.Spot the odd one out. I personally find that a short mission statement with lofty goals inspires the employees and public. It’s easy for an employee to say “is what I am working on achieving our mission statement?” Back in 2015, The Hut Group had a snazzy tagline for their identity:

Attention to Retail

Somewhere along the way, this becomes the behemoth multi-sentence paragraph they use to describe themselves. I find it hard to imagine employees actively align with this new mission and can repeat it on-command to anyone that asks what the Hut Group does. In fact, I have spoken to THG employees and asked them what THG does. Their replies were:

“You know MyProtein? We do that.”

“We do website stuff like Wordpress”

“Beauty products like makeup and lipstick”

A strong mission statement aligns the employees to work on the same thing, enabling them to move faster and build better. From talking to employees they have no idea what THG actually does.

I’ll give them the benefit of the doubt. They can still be a good company without a strong mission statement. For now, we’ll balance this out with their balance sheet.

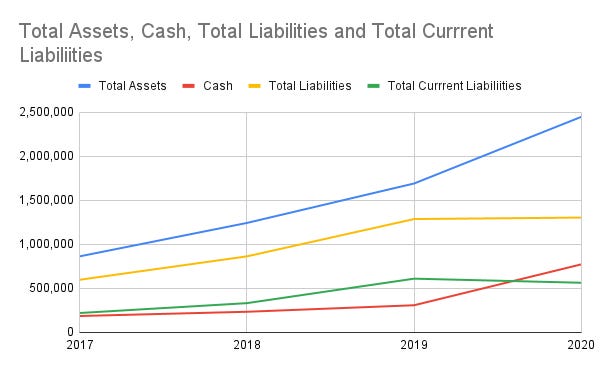

Total Assets: 2,448,852 (41% YoY)

Cash: 773,581 (69% YoY)

Total Liabilities: 1,304,326 (31% YoY)

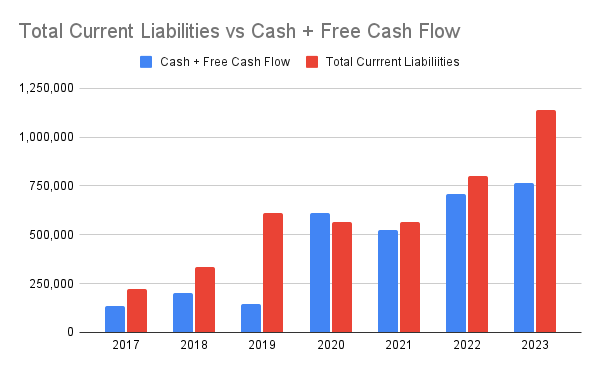

Total Current Liabilities: 564,257 (42% YoY)This is a healthy balance sheet. Their liabilities remain well below their assets, and especially important they have more cash than current liabilities. Current liabilities means “debts that need to be paid back in 12 months” so having cash to pay for these is a great sign.

This wasn’t always the case, before the pandemic, they had less cash than current liabilities.

Their liabilities appear to also be stagnating as their total assets and cash rises. If their current liabilities stay or go down and their cash increases again, potentially they will have more cash than total liabilities. At that point, it becomes excess cash There are a couple of things a company can do with excess cash:

- Buyback shares.

- Create a dividend.

- Invest more in research & development.

However, I think The Hut Group will use this cash to buy another business instead of rewarding investors looking at their history.

Speaking of cash, let’s go with the flow and see what their cash flow looks like 🌊

Operating Cash Flow: -20,900

Free Cash Flow: -248,782 Operating Cash Flow (OCF) is a measure of the amount of cash generated by a company’s normal business operations. Good OCF shows that the company can maintain and grow its operations, otherwise it will need external financing.

Do note that this year is the only year where THG has negative operating cash flow. It’s likely they’ll just use their cash balance for this.

Free Cash Flow is how much money the company generates after accounting for cash outflows to support the operations and maintain its capital assets. They have a lot of cash on balance, but they appear to be losing more & more cash each year,

Looking at this growth we can see extrapolate when they start to run into problems with their current debts.

The Hut Group previously had this problem where they had less cash than their total current liabilities, but their free cash flow wasn’t as bad so they could easily pay them off. By 2023, if everything grows at the current rate, they will have bad free cash flow and significantly more current liabilities. However, I am expecting this to happen.

Most young growth companies have negative cash flows because to grow they’ve got to put money back into the business. I expect them to have negative cash flow so they can build their assembly plants which generate a profit 5 years down the line. I expect them to have disproportionately large cash flows in the future.

They have a negative cash flow now, so as the company matures I expect to see nirvana, massive cash flows in the future. The reason I brought this up was that if you have bad cash flow and large liabilities, there may be problems down the line. But, if the company expects a spurt of hypergrowth it may not

They have a lot of goodwill. Goodwill pops up only when a company has brought another company. This is because when you buy a company with a book value of $4 billion for $10 billion, the accountant now has a $6 billion problem to explain away. So they put it on the balance sheet as “goodwill” and move on with their lives. Want to know why?

It’s because balance sheets have this nasty problem where you have to make everything balance.

Goodwill is a plug variable, it makes the total assets sound good and it inflates them. We should generally avoid this, but we can see that this doesn’t affect THG’s total assets much.

Overall I’d say their finances are okay. They have some problems but nothing too bad for a startup. They appear to be a little confused on who they are and their rate of acquisitions is slightly concerning but other than that, it’s all good :)

Let’s move on to the more physical side of things, their products. What do they actually do?

👗 Products and Services

I’m going to keep this short as they do a lot.

Let’s talk about their physical products first.

🚢 Let’s get physical (products)

Physical products are hard because you have to balance supply and demand, you need to create a supply to match demand (but not too many supplies as the demand may dwindle).

Nike founder Phil Knight said it best:

Supply and demand is always the root problem in business. It’s been true since Phoenician traders raced to bring Rome the coveted purple dye that colored the clothing of royals and rich people; there was never enough purple to go around. It’s hard enough to invent and manufacture and market a product, but then the logistics, the mechanics, the hydraulics of getting it to the people who want it, when they want it — this is how companies die, how ulcers are born.c

Anytime a company creates a physical product they have a whole bunch of problems to fight. Some companies offload some of this work to other businesses, THG does everything themselves apart from delivering it to the customer themselves.

Physical products require a much higher margin than a service due to all of this. It means that you are micro-optimising the margin to increase profit, or increase sales and use economies of scale to make more profit.

Remember those logistics problems that plague the world? Evergrande? Increasing wood prices? Lorry driver shortages?

All of these directly affect THG’s bottom line. There are thousands of variables that come to play here. Slow shipping, a bug in manufacturing, lorry drivers going on strike and much more. One little hitch and affects THG’s profits. This is the sad truth for all product-based businesses.

I personally do not like investing in physical businesses because of this. It’s much harder to grow. Phil Knight talked about how his shoes went from nothing to everyone wanting one overnight. The factories couldn’t keep up and he had massive supply issues.

I prefer the software side of things. If 1 billion people wanted to use the software overnight, they’d be scaling issues but nothing that couldn’t be fixed within a few days or weeks. Product supply issues, on the other hand, take months or years to fix.

THG is aiming to solve this by automating more of its logistics. This solves one half of the equation, but physical products will always be worse than software for supply & demand issues.

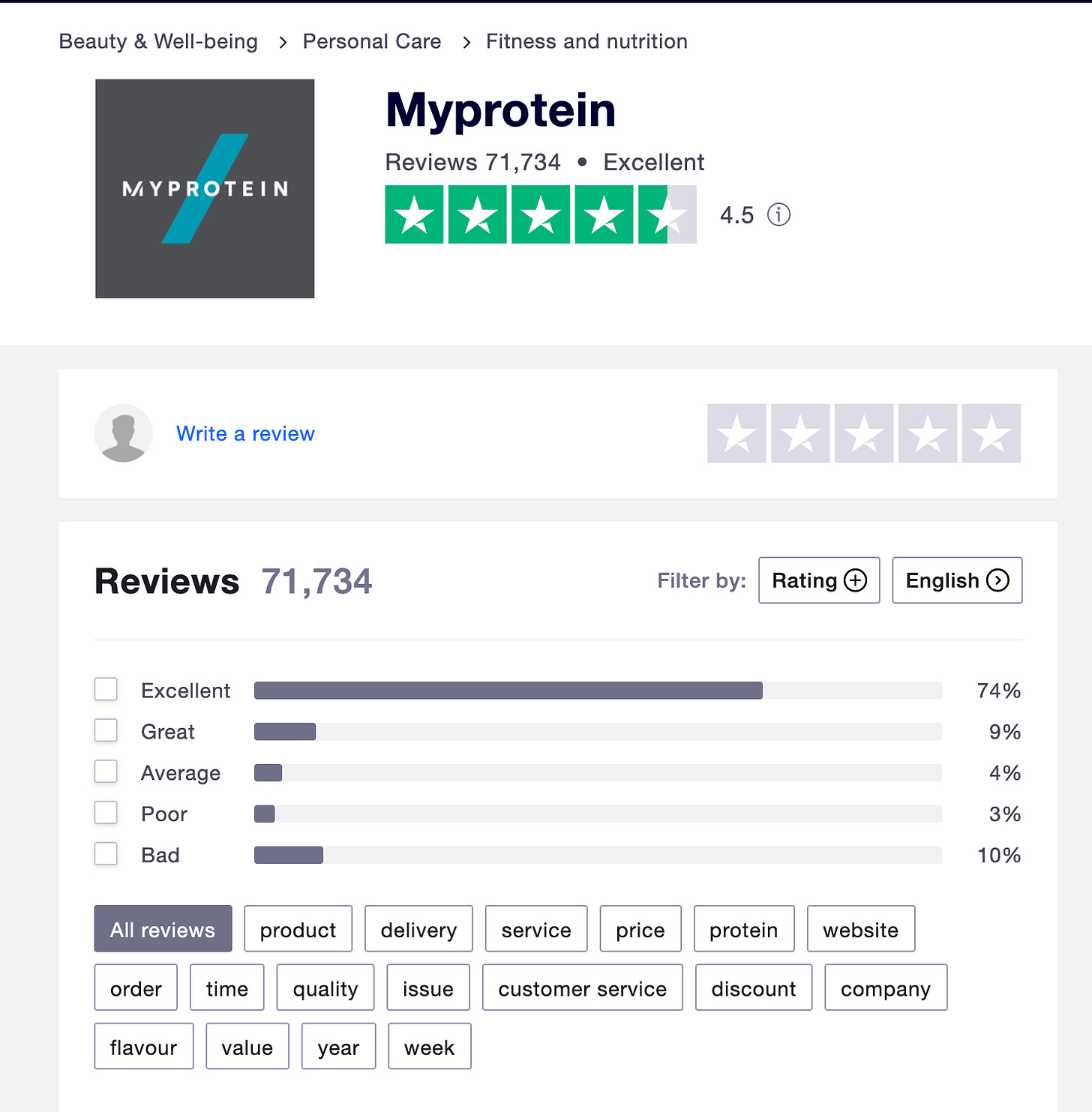

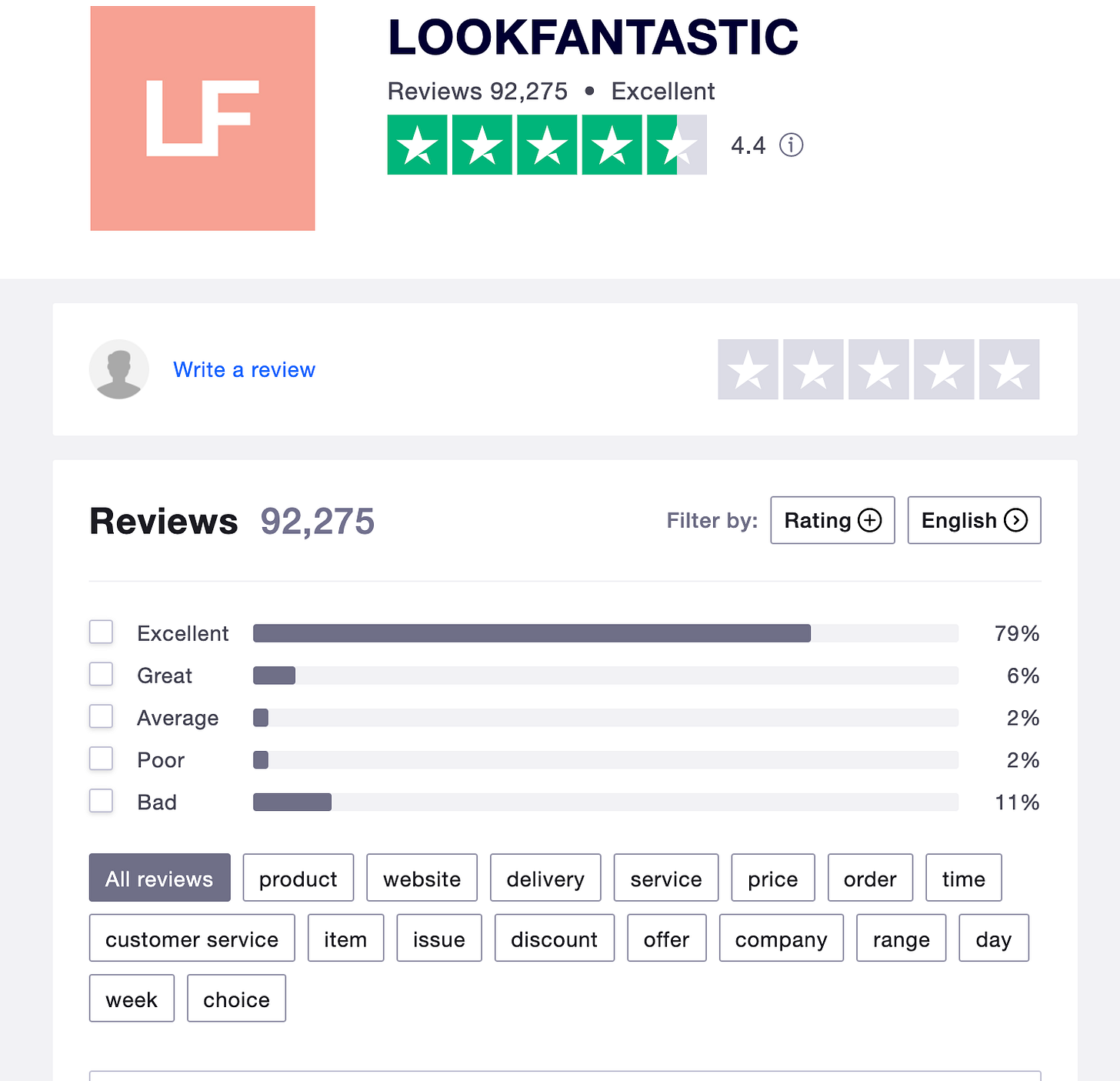

💯 Are their products good?

I have. personal experience with:

- MyProtein

- LookFantastic

MyProtein is quite good, it’s expensive and the delivery was slow but the actual products were good.

LookFantastic is great too.

Overall I say their products are cool and fulfil a need, we don’t really need to go into them too much. I will say not to read that MyProtein is releasing a great new product and think it’ll make the stock price go up. It won’t. MyProtein is a small part of THG’s portfolio, the same for every other company they own.

Monitoring their brands TrustPilot scores to make sure the product quality isn’t getting bad is a metric we should watch. Also, any social media news of customers excited by new products. Nothing says growth like customers raving about products!

Since I am a giant nerd and not at all a product specialist, let’s look at the software side of it.

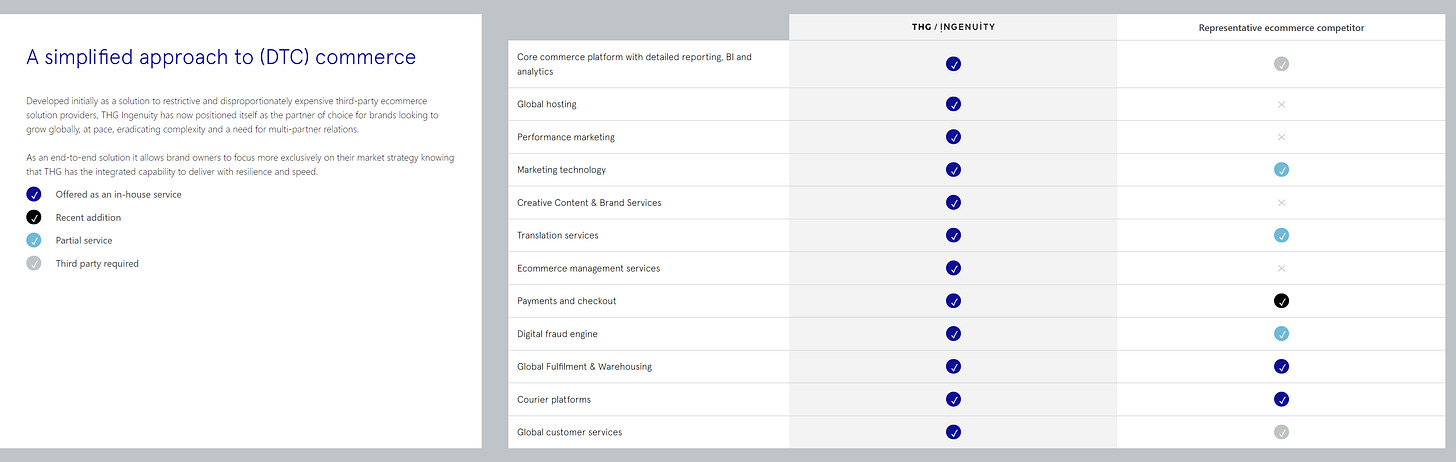

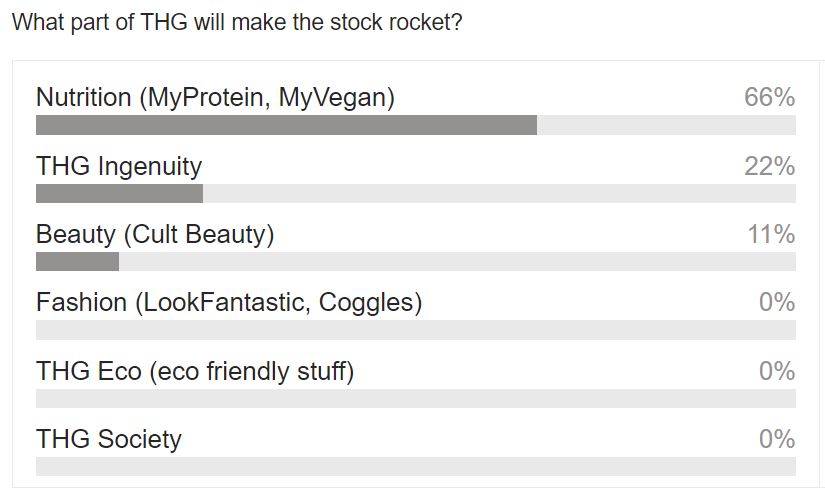

🤖 THG Ingenuity

This is the tech-startup side of THG. The Shopify competitor!

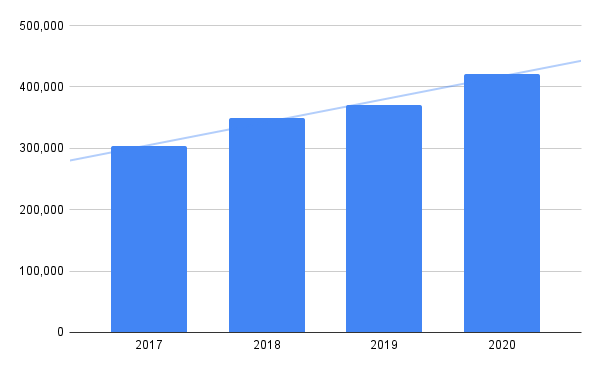

Total Revenue: £19 million (160% YoY)

Total Websites: 89 (400% increase from 2019)

Revenue Contribution to company: 2%Firstly, this is the tech-startup section. They have extremely good margins. THG Ingenuinity currently powers 89 websites (in 2019 it powered around 20 websites) and it generates £19 million in profit a year.

The important statistic is that this is only 2% of the total contribution to the company. This means that as the revenue for Ingenuinity grows, it may boost the companies revenues dramatically.

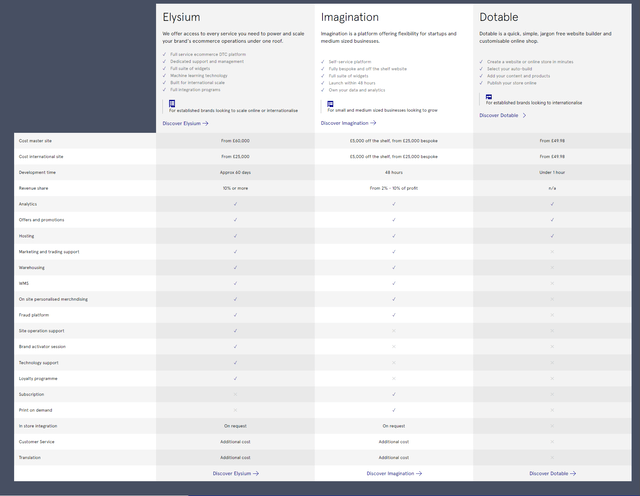

THG outline the differences between their competitors in the image above, mainly

- Business Intelligence, Analytics and more - Some competitors may not have this, but most do.

- Global Hosting - I don’t believe this is true, there is no way a single competitor does not offer global hosting.

- Performance Marketing - I can believe this since this word sounds like they just made it up. (Just Googled it, it means advertising that you only pay for when there are measurable results)

- Creative Content and Brand Services - They do a lot of branding stuff for you, seems neat if you don’t want to hire a brand agency or do it in-house.

- eCommerce Management Services - They don’t explain what this is and Google doesn’t help, so by definition, their competitors do not have this 🤷🏻♀️

- Payments and Checkout - THG have their own payments platform, normally retailers use Stripe. Shopify has its own too.

- Digital Fraud Engine - This is cool, helps detect fraud which can improve your profit.

- Global Customer Services - again, I refuse to believe they are the only people in the entire industry with customer servers in more than 1 country.

Let’s dig down into some of these. At least the stuff I know. I have no idea what “eCommerce management services” means but I’ll bet that their CEO doesn’t either (Matthew Moulding if you can call me and explain this to me, I’ll exclusively buy my protein from MyProtein).

Digital Fraud Engine

According to the Association of Certified Fraud Examiners eCommerce companies lose on average 5% of revenue per year to fraud. If your business makes £1 million a year, that’s £50k / year lost to fraud. Not to mention you have to actively chase it up and ensure the fraud does not affect your business.

If people launder money using your business, commit large amounts of fraud or otherwise, you may be investigated by the police which incurs more costs. Fraud is something companies want to avoid at all costs.

THG’s Fraud Engine uses machine learning which means the more accurate data it has about fraud, the better. Luckily this engine is used by:

- 70+ retail brands.

- Serving clients in 170+ countries.

- Monitoring billions of dollars in eCommerce transactions every year.

It’s cool to see this built into the platform, and certainly a giant ➕ for any companies looking to switch to THG.

Payments and Checkout

Payments are a large issue with eCommerce sites. How do you get paid? Typically some sites used Stripe, but they didn’t like paying their own fees so built their own payments system.

That’s what THG has done here. It enables every customer to automatically support a wide range of payments without having to work through it. Trust me, the documentation on some of these systems is quite bad and a pain to implement.

THG lets customers pay with:

- Visa

- Mastercard

- AMEX

- PayPal

- Klarna

- Alipay

- Apple Pay

- Google Pay

This includes localisation. Tailoring the language, currency, payment providers, shipping options, and tax requirements 😅 imagine implementing this all on your own!

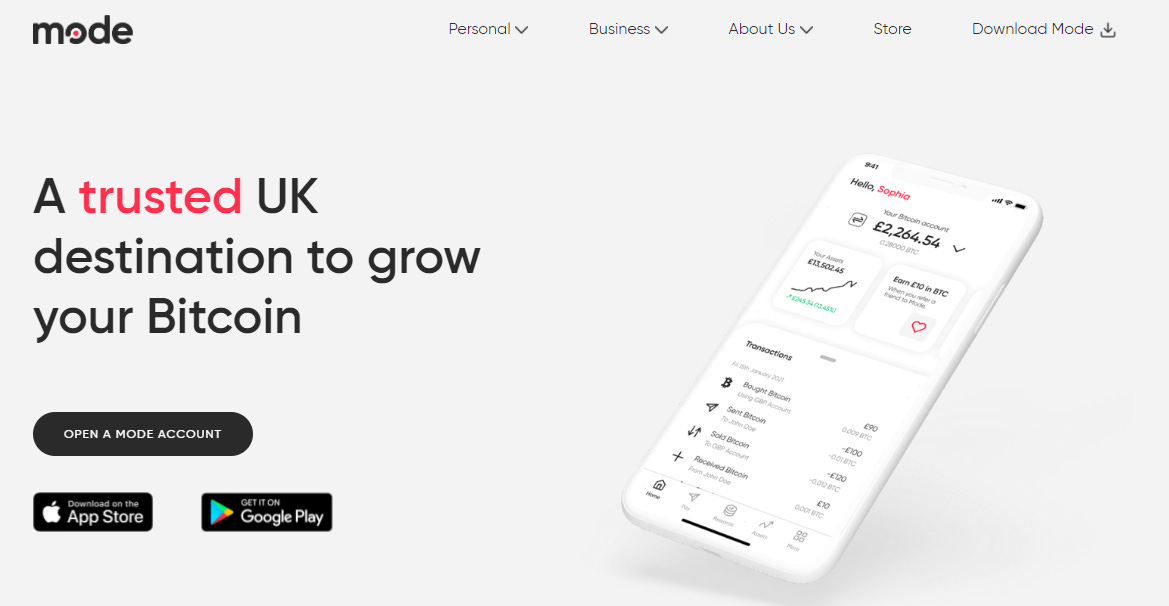

THG has recently partnered with Mode (£mode) to provide cryptocurrency payments. You can hold a Bitcoin balance with them, and when you spend using Mode you get Bitcoin cashback (10% cashback the first time, 5% for repeat purchases). This is great to hear, now when you open up a shop on THG you get all of these possible payments and cryptocurrencies included. Not to mention the 10% generous cashback from Mode.

What’s especially great about this is seeing how forward-thinking THG are by integrating cryptocurrency payments into every site that uses THG.

💰 THG Ingenuinity Pricing

THG Ingenuinity starts at £50 with their dotable plan.

Despite it being so cheap, you still need to contact THG and work with them to create a dotable site on ingenuity. Whereas on Shopify, you do not.

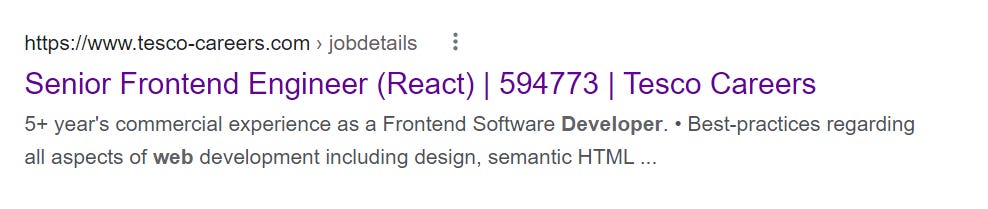

Earlier we saw THG claim that this powers 89 websites. If the entry point is £50, why haven’t more companies joined up? The Hut Group proudly displays that one of their first customers was Tesco, but looking at Tesco’s recent jobs (and their employees LinkedIns) it appears Tesco no longer uses THG.

Looking at Tesco some more, the name of their production server is exposed through Curl.

Which exposes you as using Azure. Upon some Google searching, I came across this which clearly states they likely do not use THG anymore but have homebrewed it across Azure and AWS.

It’s always important to note when one of the largest and earliest customers moves away from a service, especially if THG once celebrated that Tesco used them!

A very quick look at those other sites show that none of them still use THG Ingenuinity. I checked because THG celebrated how much their ingenuity platform grew year on year, but I wanted to see whether those customers actually stayed.

There’s a large difference between “We get 100 new customers a year who leave after a month” and “We get 100 new customers a year who stay with us for 5+ years”.

🍜 Other Ingenuinity Things

THG also has multiple options ranging from marketing to sales. Their marketing platform is similar to Salesforce, it provides a customer relationship manager who aims to give the customer the best experience possible. Marketing provides 3 possible solutions: CRM, THG Society (influencer marketing), and THG Flow (project management solution).

For physical products, they have a warehouse management system, THG Orbity (dedicated customer service team in 30+ languages), THG Delivered (keeps customers up to date on the location of their packages). THG even provides hosting for websites.

THG Ingenuinity is designed to be a “want to run an eCommerce store? We’ll do everything for you” kind of service.

Operations

Operations here means fulfilment of shipping and packaging and production. Firstly, they’ll help you design your packaging including specialist packaging like lipsticks. Secondly, due to their scale, they can provide cheaper shipping as they have warehouses on 3 continents. Europe, Asia, and North America.

Finally, they have an on-demand service. This is a production facility that allows influencers to launch a product line based on demand. No longer will people have to create 10,000 items that sit in an unused warehouse, the demand is perfectly met by supply.

Given the fact that influencers are releasing more product lines, I think this is a metric to watch, as it could certainly raise their revenues.

💾 THG Digital

I’m going to quickly run through their digital services to give you an overview.

THG Studios is a digital brand builder for established brands. It focuses on creating content for these brands, from photography, videos to artwork and packaging design.

THG Fluently is a translation service to help companies reach customers in new markets. It offers translations in over 160 languages. The service tries to tailor the content to the local market and culture also.

THG Precision is a performance marketing service. This includes Search Engine Optimisation (SEO, making you appear higher in Google), Customer Retention Optimisation (keeping customers for longer) and a digital marketing strategy.

THG Media is the advertising solution and focuses on offline and online adverts.

From an investor’s perspective, THG Ingenuinity is really the “one-size-fits-all” solution to eCommerce needs.

📊 THG Data

Data is the key player for most companies. We have too much data and we want to turn it into actionable insights we can use to improve our business. THG Data aims to do this.

THG Data will build reports for the company in Tableau or the client can integrate it in SAP. What this means is that the company can give you this data however you want. THG can also help you with your data strategy.

🎫 THG Ingenuinity Conclusion

I think this could represent their major growth in the next few years. They’ve built a tech platform, dogfood it to their own retailers and are opening it up to others. Being a small percentage of the total revenue, it has plenty of room to grow.

If they opened it up to the public some more (do not force the public to call you to pay for this service) I reckon it will rocket 🚀 to be one of their largest assets. And the best part? Technology has far better margins than its physical products.

I’ve read a lot of posts about how ingenuity will lead their stock price higher, but the truth is currently it is only 2% and this entire side of the business is far too locked down for a normal, small-level shop creator to use. Generally, when considering using a product, even at a large company — you’ll want to use it before deciding. Having to call someone up to give you access sucks.

A metric to watch for is if / when this opens up to more and more people. Perhaps THG doesn’t want to service smaller vendors (less than 100 sales or so / month) but I am sure there are plenty of vendors with ~1000 or more sales that would love this.

Not to mention the other big players using THG Ingenuity. Microsoft’s gaming department has recently decided to start using it to sell merch for new games. It has deals with Warner Bros, Pokémon, Nestlé, Walgreens, Disney and Honda. In short: a bunch of large companies use them.

🌳 THG Eco

This is something I’ve got to give props to, even if it doesn’t affect the share price 👏

THG (eco) is THG’s programme to meet its sustainability targets. The idea is that they develop solutions that allow businesses who use THG to create a big, collective change to the planet for the better.

Recycle:Me is designed to tackle hard-to-recycle beauty products with cmplex packaging, such as lipsticks. Customers in the UK can send THG their plastic beauty packaging, free of charge, to THG to be recycled.

THG more:trees enables brands and individuals to plant trees all over the world to reduce CO2 Emissions. This reminds me of Strike’s automatic “send 5% of this transaction to save the trees” feature.

There isn’t much to this that’ll affect the stock price, so I’ll stop talking about this now. It is cool to see, however.

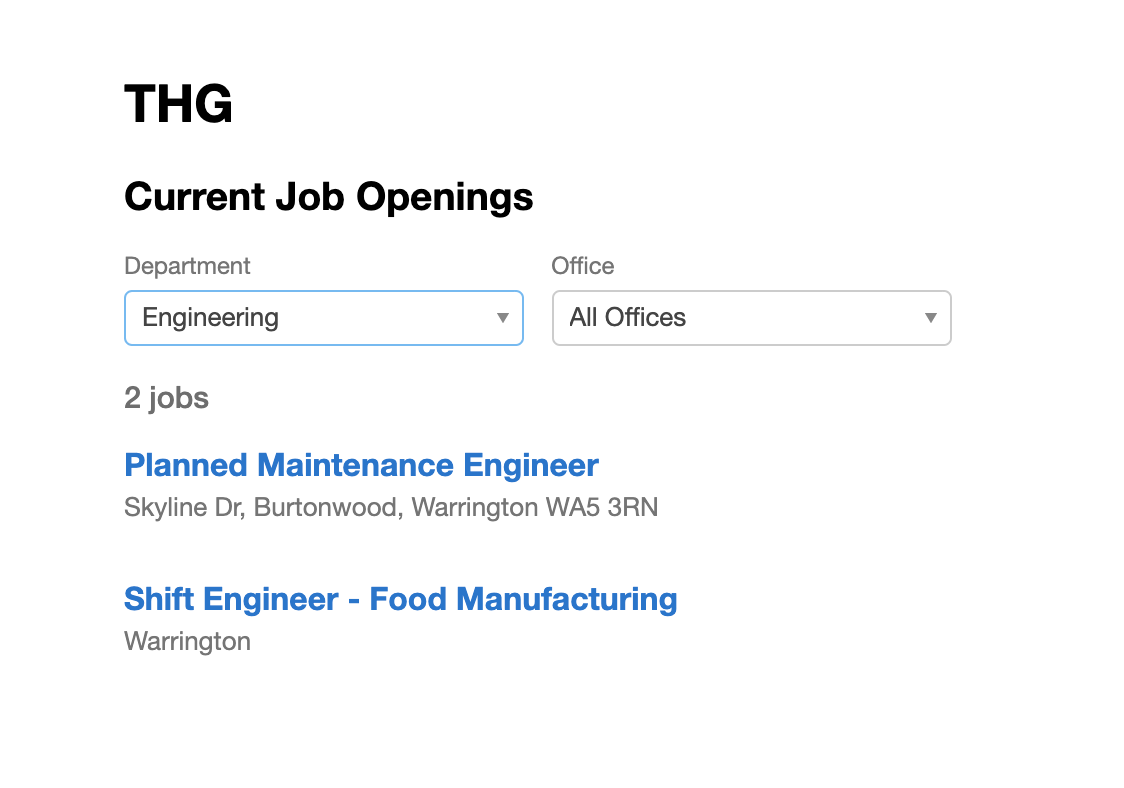

🕴 Jobs and Careers

Ok, so I have a lot of friends at THG. Let me give you the inside scope. Firstly, they’re engineers. Secondly, they told me that the vast majority of engineers at THG are university graduates. One of my friends has worked there for 2 years and is already a tech-lead (for reference, my tech-lead has 20 years of experience).

Secondly, if they are a tech startup why are they not hiring engineers?

There are 2 reasons why a tech company is not hiring:

- They cannot afford more engineers.

- Some big organisational restructure is going on and they don’t want to throw new people into the fray.

There is always room to grow more engineers, always more things people can be doing to optimise everything.

Looking at the companies hiring is a very nice metric to monitor. Every company will say they are growing, but we can directly see this live on their hiring page. If a tech company is only hiring for 2 tech roles, then clearly it isn’t growing as fast as it would like.

Wise, a much smaller startup, is hiring for 63 engineering roles. There is a drought of engineers currently, they are in need almost everywhere. It’s next to impossible for a company to run out of engineering needs (see Google or Apple, who still hire at a rapid pace) which leads me to believe they simply don’t have the budget for more engineers.

I see this as a red flag, they proclaim they are a tech company but they do not hire for tech 😅 Perhaps their next annual report will show that they had less cash, less money this year to get more engineers. After all, the hiring page is a live update of how fast the company is growing.

🪓 Acquisitions

Okay, we’ve got to talk about the elephant in the room. Eight acquisitions in 2020 alone. That’s a lot. That’s almost 1 new company a month being acquired. I mentioned earlier that this could be diworsification, let’s look far deeper into the rabbit hole to find out what they’re buying.

🎋 Environmental Acquisitions

THG completed 2 Environmental, Social, and Governance (ESG) related acquisitions in 2020 with other businesses in advanced talks.

These include the UK leading in-house expertise for plastic recycling technologies, and a reforestation supply chain that we saw earlier.

I’m going, to be honest, anything environmental/good for the planet is a complete write-off in my books. So long as it doesn’t bankrupt the company if they want to take time to do good for the environment, go ahead. Your opinion may vary :)

🐙 Others

The Hut Group acquired Perricone MD for $60 million and Dermstore.com for £59.5 million, two leading beauty companies in the US. <do they incur debt?>

THG said this about Perricone:

The addition of Perricone MD to the portfolio in September 2020 enhanced our prestige own brand offering, with the transition to the Ingenuity platform completed within a matter of weeks. We are very pleased with the progress of the acquisition as the brand pivots to a D2C, digital first model. Transforming brands in our own portfolio is testament to our ability and expertise to support third-party brands with the same strategy

Which is a good sign. Migrating a company to their own platform in a few weeks shows how good it is, and it’s even better they are dogfooding their platform.

For nutrition, they also acquired Claremont and Berrmany for £60 million.

All of these companies are in line with what THG does already, thus cannot be diworsification. However, I am not sure how much debt these companies individually held (this info is not available for retail investors like you and I 😢) but THG’s debt did not significantly go up in 2020 indicating it can’t have been much.

I’m going, to be honest, I thought their acquisitions would be much worse — but they’re not. They make perfect sense and if THG has the budget, why not?

🤓 Insiders

There are many reasons why an insider might sell their shares. They want to pay for their children’s college, they want a new house, perhaps they want to go on holiday. But, there is only 1 reason why an insider buys shares. They think the share price is going to go up.

And who understands the company better than the executives buying shares? No one.

On the 7th of October, a non-executive directory brought £106k of shares. In fact, insiders haven’t recently sold shares. They’ve brought more over the last 3 months. THG is primarily owned by shareholders, not institutions. This means:

- Their employees believe the company is undervalued and the share price will go up.

- Their employees are incentivised to work harder, as the work they put in affects the share price which could make them richer.

Over the past year, the total shares outstanding have grown by 25.7% diluting some of these shares, but shareholders are still holding on. This is an incredibly bullish metric.

🐻 Bear Case

The Hut Group stays confused, their employees do not have a clearly defined mission to work towards, and their technology dies down.

This means THG can only grow by:

- Buying new businesses.

- Growing their current businesses.

And this growth won’t be as fast as if they worked on their tech some more. At some point, they may go from “tech startup which buys companies to use their platform” to “retailer with many brands who builds a tech platform to support them”. One of these has a very high upside (tech first) as SaaS is almost infinitely scalable with large margins.

The other, a retailer, is physically constrained by the products, logistics, and how customers “feel” about the products and won’t be able to grow as fast.

The fact is, you need to be a technology business or your replacement will be. THG started out great with their technology. If they do not leverage this fully there wi

🐂 Bull Case

The Hut Group opens up their ingenuity service so more people can use it. Right now they are targeting mega-brands (Pokemon, Microsoft etc). If they started targeting smaller brands (anything over 10k revenue/month) they’ll be able to get a much larger audience. They should avoid smaller shops as it’s much harder to provide a customised service to them.

I would also like to see them be specific about who they are and what they want. They are unique, likely the only ones in the world doing what they’re doing. But, answering “what are they doing?” is the question everyone is asking.

I think if they can just nail some of these things down, they have significant growth in the future. Theoretically, they are already worth a lot as they own so many brands and technologies. They also make a lot of money and regularly reinvest it into themselves.

👋 Conclusion

I think it’s really hard to effectively value this company, they do so much. You’d have to put them against multiple companies to get a rough fair value. In fact, I can’t name a single competitor that does everything that THG does.

I am personally not going to invest in them because:

- They seem confused about who they are.

- Their employees seem confused.

- It’s outside my circle of competence.

Dunning-Kruger is an effect where people think they are smarter than they are. This is a bull market and in a bull market, everyone is a genius. You pick a random stock and chances are it’ll do great. The key is to pick a stock that’ll survive a downturn.

My circle of competence is fintech, infrastructure companies, and cyber security. It is not at all eCommerce, it is outside my comfort zone and that is not a risk I am personally willing to take.

🕵️♀️ Metrics to watch

Before you go, you’ll want to pay attention to these metrics:

- How many influencers use THG, and how many followers do they have?

- Pretax Profit going up (although not required as they are a startup and continually investing in themselves).

- THG Ingenuity to begin opening up to more people. When you no longer have to reach out to them to set it up, that’s when it could explode.

- Their engineering hiring to start back up again and to hire rapidly.

- Monitoring their brands TrustPilot scores to make sure the product quality isn’t getting worse.

- Insiders do not sell their shares and even buy more.

Write down why you are investing. When the stock goes down 95% re-read them and see if they still apply. If they do and they are on track with all the metrics you are watching, then great!

These metrics above will allow me to keep an eye on how THG is doing and will help me reconsider my position in the future.