Wise - Money without Borders

This article is not financial advice, and the only reason I am writing it is so I can re-read my reasoning. I am posting it online so if I am wrong, others can correct my reasoning. Per Lynch:

Know what you own, and know why you own it

Do your own research 😊

💳 Wise - The World’s Bank

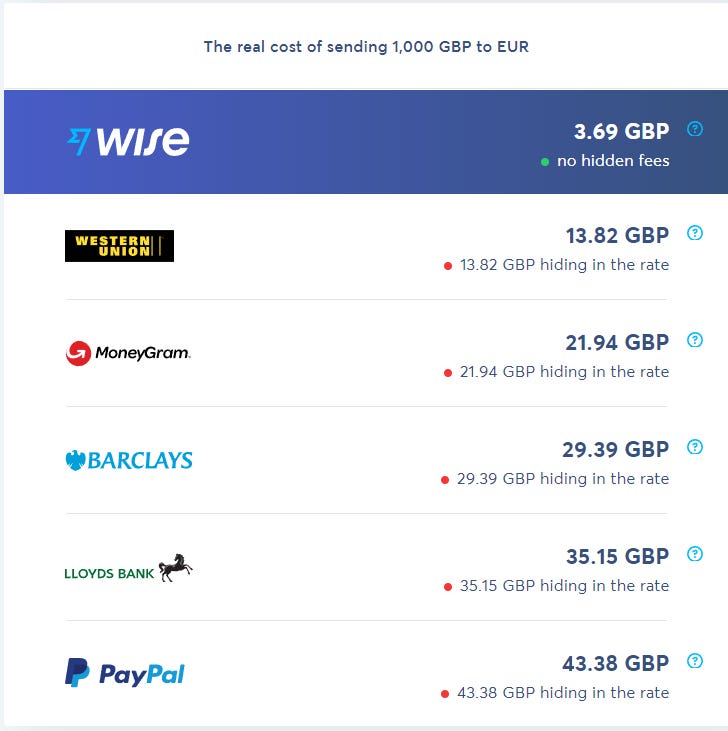

Wise is the worlds first worldwide bank account. On average you can send money to any bank account in the world (America’s Chase → UK’s Natwest) 8x cheaper. You can spend money abroad cheaper too, without any hidden fees. You can receive payments like a local can and hold 54 different currencies in your account. Their mission statement says it well:

Money without borders.

Wise started out as Transferwise in 2011 as a digital remittance service. The cofounders were immigrants and regularly sent money home, but were appalled by the outrageous fees they had to pay.

They’re both from Estonia. Taavet, who was the first employee at Skype, lived in London but got paid in euros. Kristo worked for Deloitte, also lived in London, and got paid in pounds. But he had a mortgage in euros back in Estonia.

So like any good techie they decided “Wait, I can build a better product myself” and so they did.

Wise is the cheapest way to send money anywhere in the world. And on top of that, they are upfront. What Wise means by “hidden fees” are fees that hide within something that isn’t a fee.

Whenever someone sends me USD on PayPal the exchange rate is significantly worse than what it should be. Even if I ask PayPal to pay the USD into my USD account they still want to charge an exchange rate. This is because this exchange rate is made up of 2 parts:

- The actual exchange rate.

- PayPal’s hidden fee.

This isn’t Wise’s only feature, let’s talk about why I think Wise is well-positioned to experience hyper growth and dominate the industry 🔮

Since writing this there has been a fantastic UX case study of Wise done, read below.

💰 Wise’s Financials

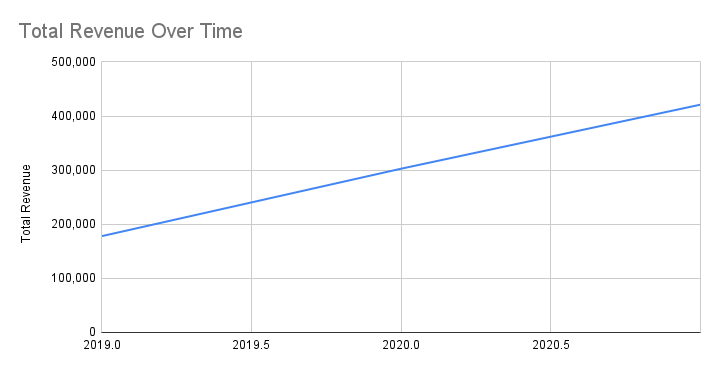

2020 Financials

Total Revenue: £4.21 billion (Increasing 87.41% Year on Year)

Cost of Revenue: £1.6 billion (Inc 54% Year on Year)

Total Consumer Customers: 10 Million (Inc ~2 million / year)

Payment Volume: $74 billion (Inc 41% Year on Year)

Business Customers: ~300,000 (Inc 54% Year on Year)The first thing to note is that Wise makes a profit. They are, effectively, a tech startup unicorn that makes profit. This is incredibly rare to see.

I normally invest in companies with “profit switches”. If they want to make a profit, they could flick a switch and become profitable overnight. The reason they don’t is that they want to expand. It is a lot easier to expand when you don’t charge people for your products than when you do.

As an example, in the game Plague Inc the easiest way to win is to spread a virus throughout the world with no symptoms, and then to mutate and add something which kills people (Pro tip: Start in Greenland or Madagascar. They will be the first ones to close their borders, and they will not open again 😅)

In the same way, startups expand by not charging and taking investors capital and then at the right moment, they flick a switch and make a profit.

In this case, Wise isn’t charging customers much and even when they do, those fees are cheaper than the competitors. It is amazing to see they are making a profit!

Wise grows 50% year on year with all the important metrics. This makes it a hypergrowth business. Hypergrowth provides proof that the company has a great product that is solving a need for customers, and has the operational know-how to create and sell it.

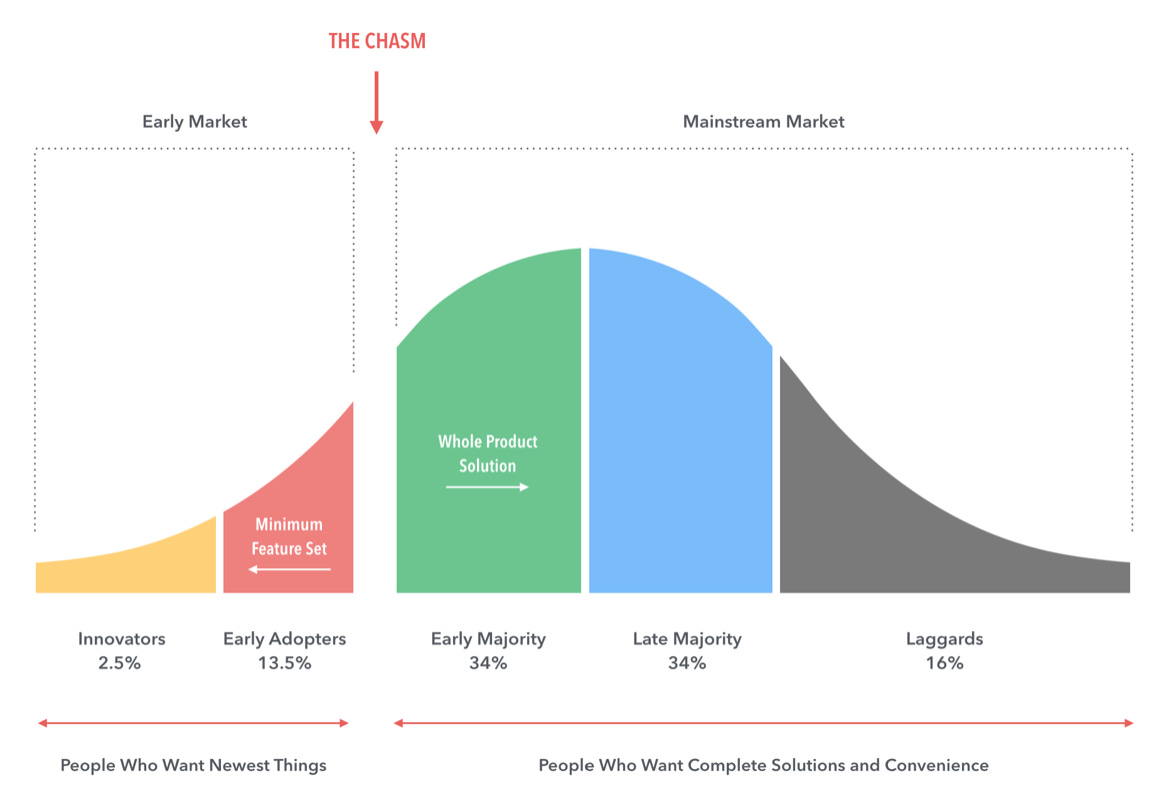

This chart explains a startups lifecycle. The first 2.5% of customers are innovators. The kind of people who hang around on forums, Reddit and more itching to find a new product to solve their issues.

The next 13.5% are early adopters. They do not actively seek new things but are very excited to try them out once they hear about them.

The chasm is where startups die. To jump the chasm the startup needs to transition from “go” (this is cool technology!) to “Grow” (This is a sustainable business). Many startups are very cool, their tech-heavy focus and potentially bad leadership prevent them from crossing this chasm. When you cross the chasm, you go from a small-time startup to a product used by many people.

Hypergrowth implies that they are crossing the chasm. They are solving a problem that many people have that no one else is solving well, and they are doing it effectively. Even better is the revenue, which shows they are already a sustainable business (grow).

For the record, I have never seen a hypergrowth startup make a profit before 🤯

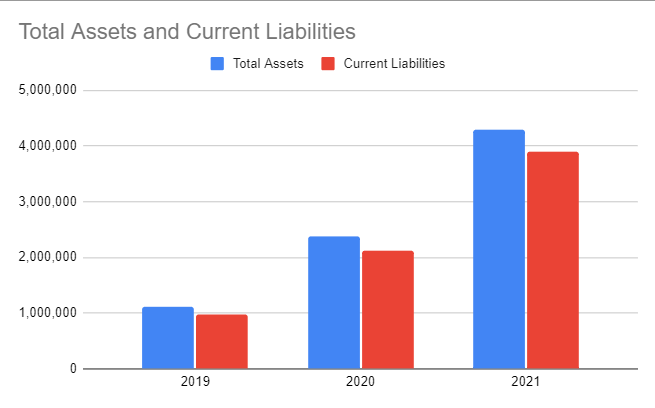

Looking at their balance sheet:

Total Assets: £4.3 billion (81% Inc Year on Year)

Total Current Liabilities: £4 billion (84% Inc Year on Year)

Wise is growing exponentially fast, but so are their liabilities. However, their liabilities remain below their assets meaning they can pay it back at any moment if they need to. Reading the balance sheet it appears to me that Wise is aware of how much they have made vs their debt, as they continue to hold debt below their total assets.

On top of that, Wise has £4.17 billion in cash. Generally, looking at total assets alone may be pointless as most of the companies worth could be in long-term assets or intangible assets (stuff that can’t be converted to cash easily). Since Wise has more in cash than their debts, they are well suited to paying it off anytime they want to and are likely using this debt to create a better business. Sadly, I cannot peer into the company to determine what they are spending this money on.

I am okay with most startups having more debt than their assets anyway, provided they have a switch that enables them to make a profit so I am not too concerned about their liabilities.

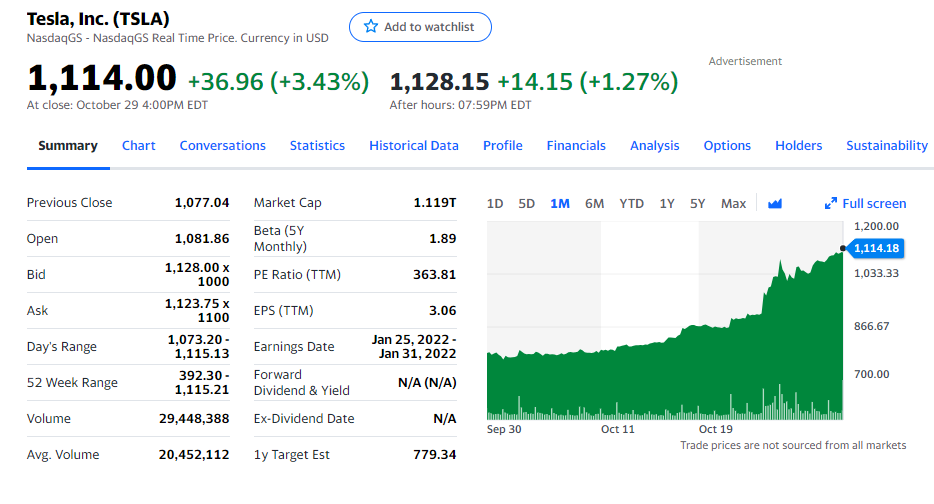

While we’re looking at raw numbers, a lot of people have decided that Wise’s Price-to-Earnings ratio is too high and thus it’s overvalued. I would like to remind these people that unicorn hypergrowth tech startups are often over-valued when it comes to P/E Ratios. For example, Tesla was sitting at ~300 - ~400 P/E ratio and rallied 50% this month alone.

P/E ratio is a good measure to determine if something is “over-valued”, but it’s not the only indicator you should go by. Companies stock prices can (and will) still grow far beyond what their P/E ratio says. A company could have a P/E Ratio of 1 (perfect) but sells magic beans. The company is overvalued, but the P/E Ratio says it is not. It’s the same if the P/E Ratio is high. It’s a good indicator, but you need to do your research to find out if it’s true or not.

🏧 Products

Let’s explore some of Wise’s products in-depth and talk about what makes them unique.

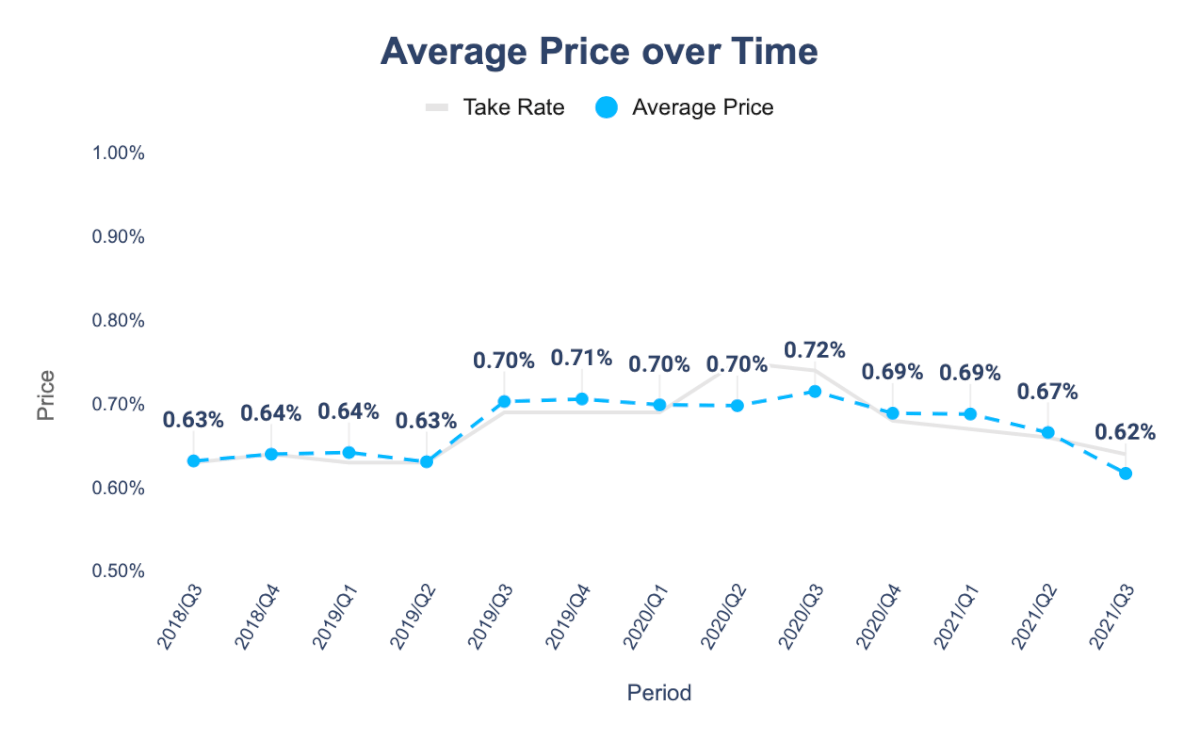

Wise Transfer

Wise Transfer is their first product, and what they are most known for. It’s the digital remittance service that lets you move money around the world. Wise says you can send money to more than 80 countries, covering 85 of the worlds bank accounts. The average fee for sending money somewhere is 0.62%. Wise reports every quarter on this number and updates us on where they decreased fees if they increased and more.

It’s nice that Wise shares this, as it shows they are actively tracking their fees. You can’t reduce what you don’t track!

Let’s take a quick look at how they reduced fees in Q3.

- i/ managing our foreign exchange risk better

- ii/ decreasing our partner fees

- iii/ more customers using Wise, which helps us scale cost

Wise states on their blog post:

This is also a reason why we offer you lower fees when you fund your transaction from money you already hold in Wise accounts - as we can access funds straight away, our FX cost is lower and we are passing the savings back to you.

When you send money from a Wise account, it’s more stable for Wise and lets them lower the foreign exchange cost. This means Wise will want to incentivize customers to use their accounts, as it reduces the fees for everyone.

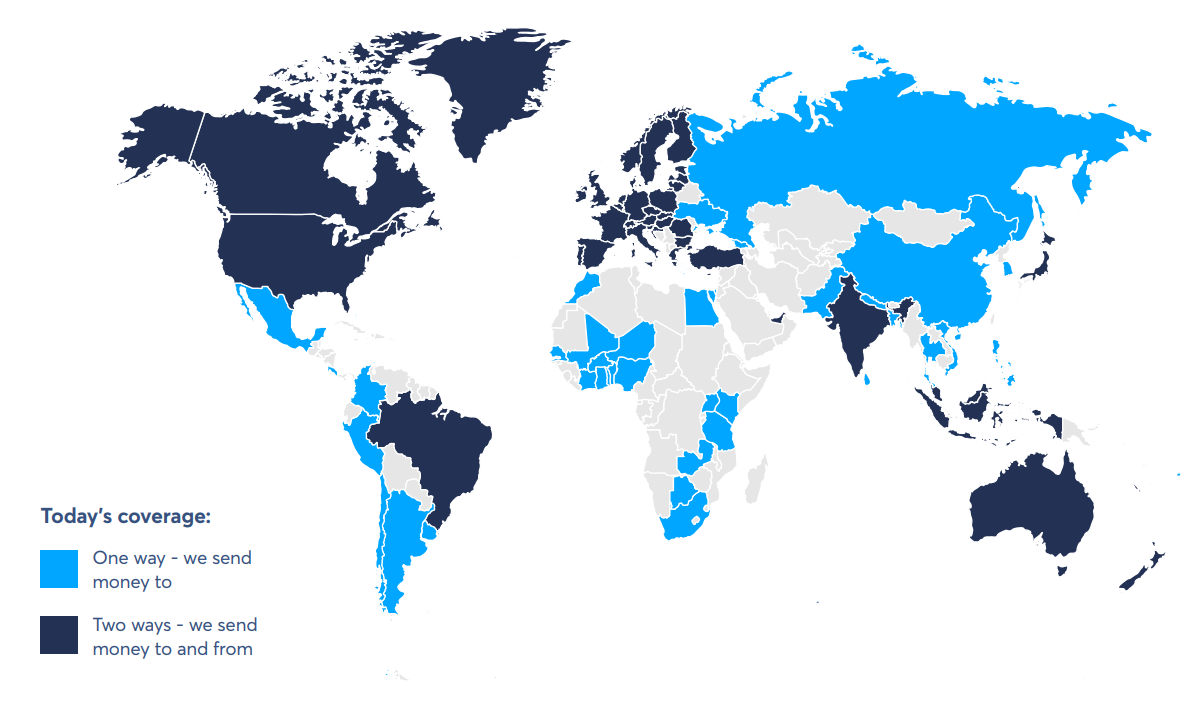

I’ll discuss their third point later, as it deserves its own section. Let’s compare how many countries Wise can send money to compared to competitors.

Having more countries is nice, but due to how life works some countries will be sent money more than others. Pareto’s Principle states that 20% of countries will receive 80% of payments.

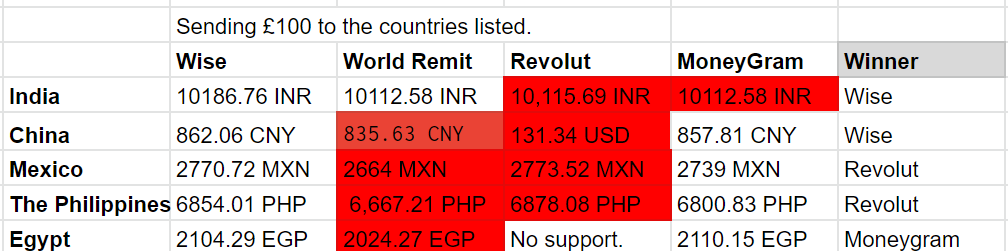

According to the Migration Data Portal the largest digital remittance markets (sending from the US) are:

- India ($83 billion)

- China ($60 billion)

- Mexico ($43 billion)

- The Phillippines ($35 billion)

- Egypt ($30 billion)

Since these markets serve the vast majority of digital remittances, we will compare how the fees look for them.

As you can see, Wise wins out for 2 of them. The red means the fees were not transparent, I had a very hard time calculating them and I could not be 100% sure I was correct. Notice how Revolut is US Dollars to a Chinese account — they knew it was Chinese but I couldn’t change it to CNY😬

Notice where Wise loses out.

Mexico

Wise: 2770 MXN

Revolut: 2773 MXN

In GBP this is £0.11

The Phillippines

Wise: 6854 PHP

Revolut: 6878 PHP

In GBP this is £0.35

Egypt

Wise: 2104 EGP

Moneygram: 2110 EGP

In GBP this is £0.28

Wise is very close to the best transfers for those countries, losing out by a couple of pennies. Many of these services take a day or more to transfer money. But, Wise has instantaneous transactions in all of these countries.

Revolut has 6 million more customers than Wise, so perhaps they have a larger economy of scale and can make cheaper transactions currently. But, Wise is all about money transfers. Revolut is trying to be a “super app”, a one-size-fits-all. They currently do not have the same speed as Wise, and the transfers are close. I am willing to bet in ~2 - 3 years Wise will be ahead of the curve on fees.

Revolut also has these fees “hidden” into the price:

- An international payment outside of SEPA (£0.30 – £5.00 depending on the size of transfer)

- Currency exchange between 0.5% – 1% depending on the size of the transfer

- Transfers conducted on weekends and UK bank holidays incur a 1% charge

- Payments over £1,000 per month will incur a “0.5% fair usage fee”

It’s hard to see these fees, and I didn’t include these in the calculation of the fees (meaning, depending on the day/amount Revolut will be more expensive).

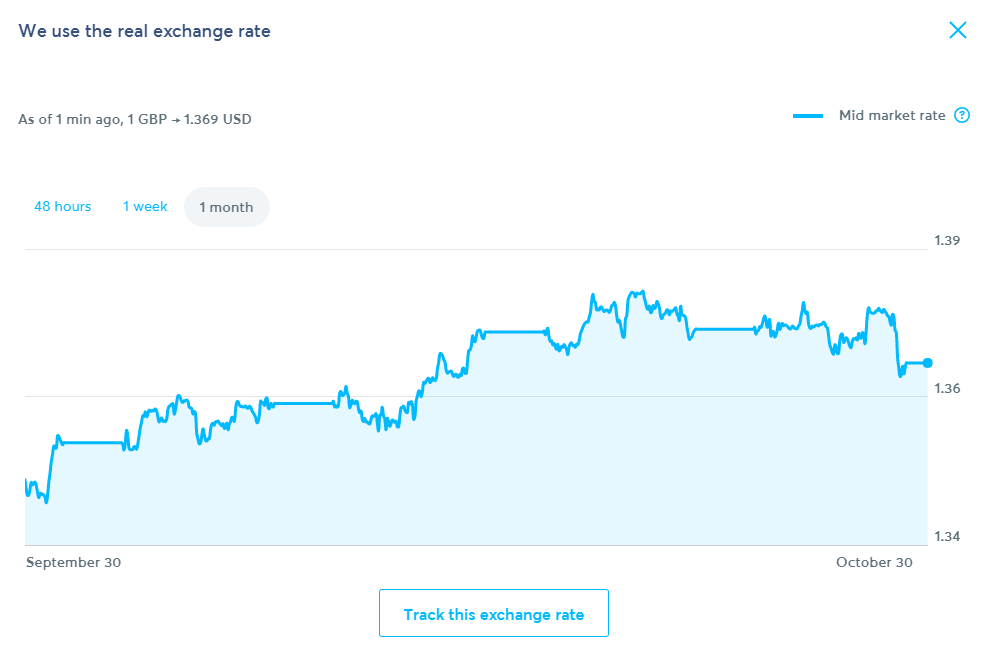

Over the weekend when the markets are closed Wise locks in a rate for you which they actually lose money on. Revolut, on the other hand, applies a 1% markup to all currencies.

However, Revolut does offer 10 free international payments a month (I am not sure if this includes all fees or not. They are not transparent). I cannot imagine they are making money from this, and they are having to fund it from another business venture. If people used Revolut for international payments as much as Wise (I can’t find statistics for Revolut, Wise is £54 billion a year) they’d likely have to change some things. Revolut’s fees are variable and it’s very possible to hide a hidden fee in them. Wise uses the market rate and can lock it in for you, and they even show you the graph and are honest about the rate.

What I would like to see is Wise compose this table themselves (showing their rates vs competitors. If they can work out how the competitor’s fee systems work 😅😂) and show they are monitoring / actively working on reducing fees in the 5 largest remittance countries. Cloudflare did something similar with benchmarking their edge network performance and then later created a blog post showing how they beat the countries they were not the fastest in.

I’ll leave this section with a great quote:

On 8 April 2017, an internal memo from British bank Santander claimed the bank would lose 84% of its revenue from its money transfer business if its charges were the same as Wise.

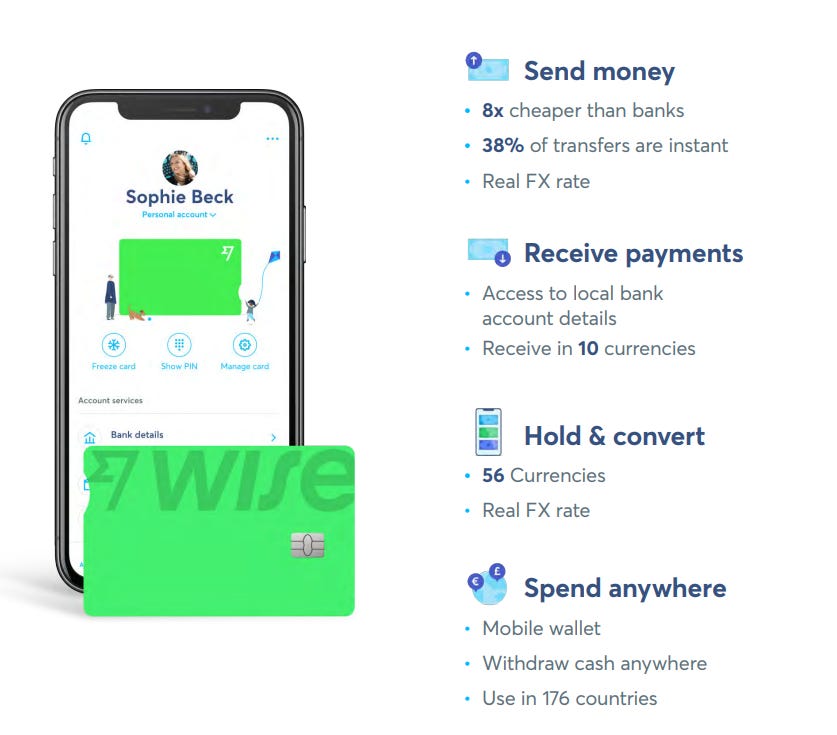

💳 Wise Accounts and Cards

It’s all well-and-good with Wise having the best rates, but it sucks that you couldn’t use them as a frequent traveller. Flying to Germany? Use your old-fashioned bank’s card and get charged a fortune. The advice was to take physical cash out before you go. Some countries are entirely cashless!

Wise solved this by…. introducing a card! You pay with your card and you get Wise’s amazing transactions rate! Now Wise has become the ultimate debit card for travellers. No more surprise fees. And better yet? If you want to convert £500 into the € Euro equivalent, you can. This means you can transfer money and hold it in your account, in a different currency. Traditional banks can’t do this, you’d have to take cash out. This potentially saves you on per-transaction fluctuations of currency.

Even better, you get paid like a local. Want to get paid in USD? Go into your USA section and gett your American card details. What about euros? Just go to your Euros account. If you frequently travel and work odd jobs, you can get paid like a local would without fighting with a bank to get an account.

Someone on the internet wants to send you USD but doesn’t want to pay for the foreign exchange? Get it sent to your USD account and spend it as USD with your card (or your card details online!)

My personal favourite thing about the card is the ability to spend in 176 countries. Firstly, I try to imagine the absolute worst possible scenarios that could happen to me and try to hedge against them. Picture this.

I’m in an aeroplane flying over Asia and it crashes. I make it out alive, but alas! I need money to get home, to do anything, Thankfully my Wise card supports this country so I can spend in it. That’s why I use Wise as my emergency card because in the absolute worst case I know it is likely that Wise will support that country and I can spend my way back to the comforts of my bed 🛏

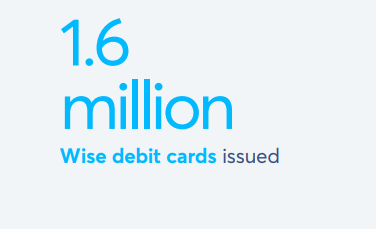

This little story becomes even more possible when Wise partnered with both Visa and Mastercard to bring their card to more countries.

A little fun fact is that debit card issuers earn themselves an interchange fee. When you use your card at the local chippy, a small per cent of that transaction actually goes to your bank. Financial Companies charge this fee in return for accepting the credit risk and handling charges inherent in credit card transactions.

Wise has seen its take-rate increase in recent years thanks to the launch of the Wise Account.

A take rate is the fee charged by a marketplace on a transaction performed by a third-party seller or service provider.

It’s just a fancy word for “the fee we charge”. Wise saw their take rate increase from 0.73% to 0.77% in 2020. This means that the Wise account is actually increasing the bottom-line, their revenue. This is a metric to watch.

However, the bigger picture is a monumental shift in how Wise operates, and where they plan to go next. By creating Wise Accounts, Wise created the worlds first worldwide bank account. Usable in 90% of all countries in the world with the market rate for foreign exchange. Most banks start out in a single country and try to expand their banking abroad.

But, Wise has taken the Plauge Inc™ approach. They have built payment processing in multiple countries which enables people to transfer money to other people. And then they built a bank on top of their already existing service. This reminds me of Cloudflare, which built a distributed network of servers around the globe to provide DNS resolution and a content delivery network. They made it entirely programmable, and then they built a business on top of their already existing network.

It’s a lot harder to copy and paste a bank to another country, but when Wise is already operating there and deals with transactions already it’s significantly easier.

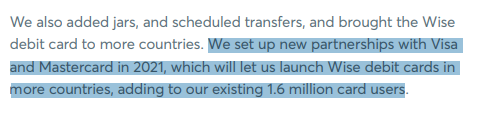

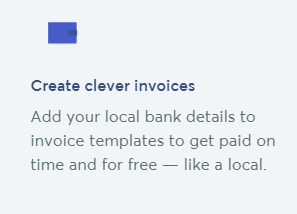

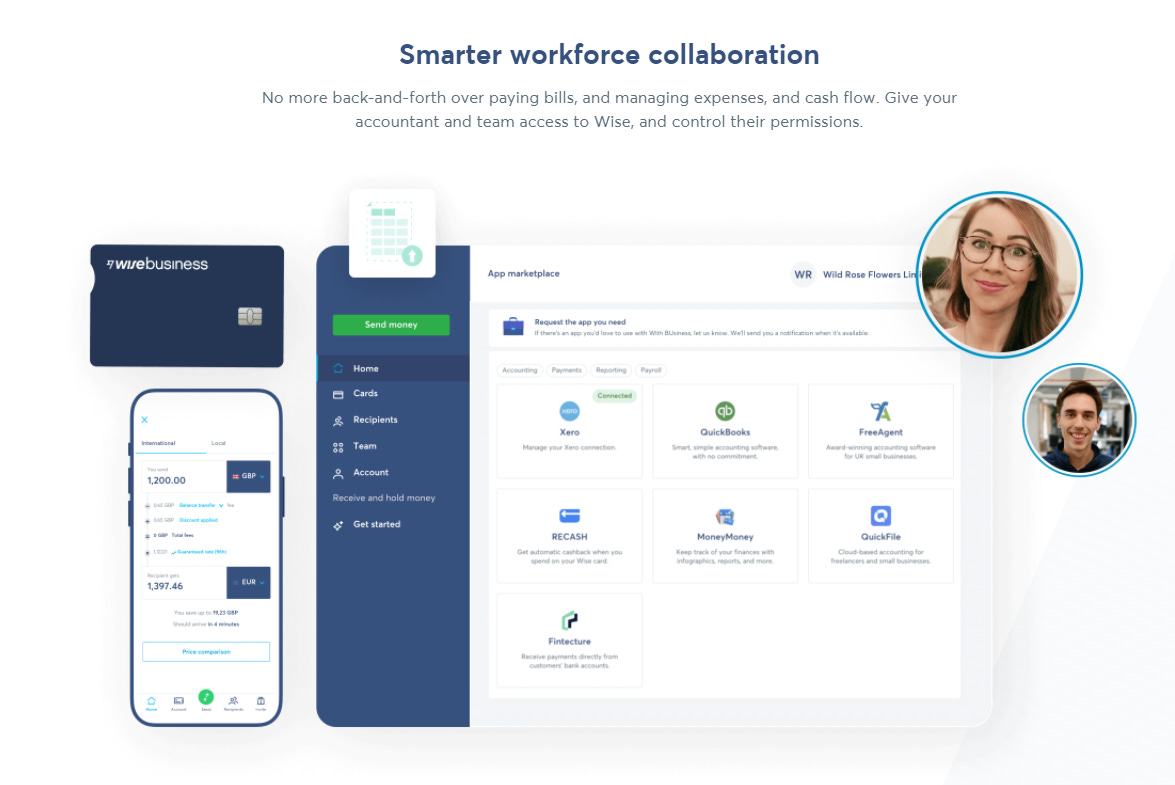

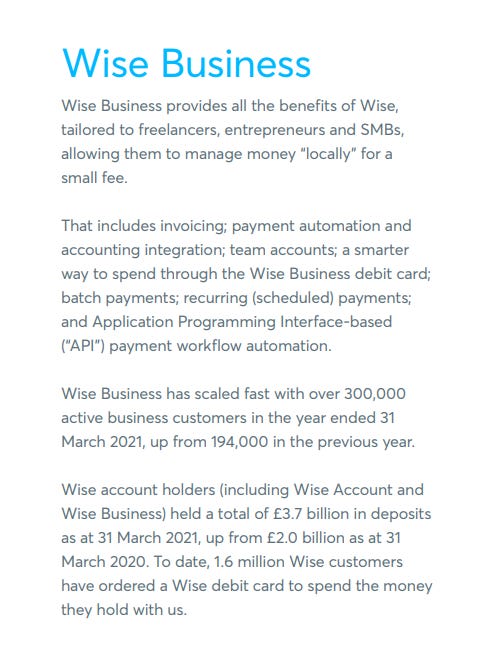

🕴 Wise Business

Now, imagine Wise but for…. ✨ business ✨ Wise Business has a bunch of benefits, so let’s go through them.

Remember earlier how I said if you’re a freelancer doing odd jobs around the world, the Wise account is perfect? Well, with a Wise business account you can create invoices using your local account. Working in France? Use your Euro account on Wise to create an invoice just like a local and get paid!

They also have a bunch of team-based things which let you manage expenses, cash flow and paying bills.

Let’s talk for a little bit about Wise Business. At first glance, it’s diworsiification. Why would a digital remittance company get into the business of business banking? A Wise Account — sure. Makes it easier to send your family money and spend it when you visit your family. But business? Let’s dig a little deeper.

Somewhere along the way Wise’s mission stopped being entirely about cheap transfers, and moved towards their new mission statement:

Money without borders

Actually, I can tell you when. 21st of February 2021 was when they rebranded from Transferwise, whose mission was to create cheaper, faster ways to send money abroad.

Wise goes into this some more on their blog:

You’ve told us for years the problem is bigger than money transfers. Any time money moves into another currency, it’s still a maze of hidden exchange rate markups, high fees, delays, and small print.

Wise realised there was a market opportunity and went for it. This isn’t diworsification, this is Wise pivoting to serve a similar, but different market.

Wise says it better than I do:

For generations, banks have been defined by borders. Traditional bank accounts trap our money in one country, making international lives more difficult and expensive than they need to be. We shouldn’t have to accept this status quo.

Today, we don’t. We’ll fix it with Wise — the world’s most international account. It makes your money borderless — with instant, super-cheap money transfers, a debit card to spend in any currency, account details to get paid in 30+ countries, balances to hold your money safely in 50+ different currencies, multi-currency direct debits, and other revolutionary features.

Wise is no longer only in the foreign exchange transfers business. It’s the world’s first bank without borders.

Now, let’s go back to Wise Business.

As we’ll see later, the more money Wise has the better they become via scale. Wise’s business customer base increased by 106,000 in 2021 who collectively hold £3.7 billion in deposits, up from £2 billion.

Generally, businesses will have far more money than retail customers. I’ll be watching to see how much the business customers grow year on year. Creating a hypergrowth product that is used by both retail & business customers is fascinating, as they are often both completely different markets.

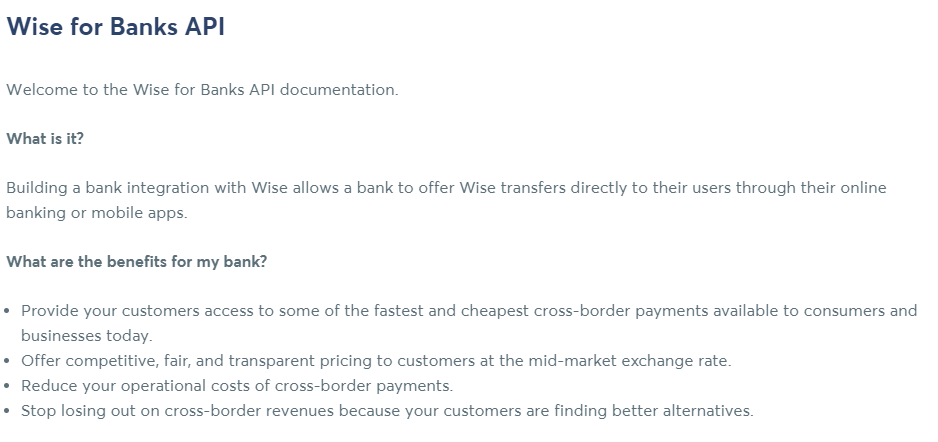

Wise Platform

So many banks have international payments, but working on reducing the fees is a full-time job (for a large team). What if we could just…. use an API and get all the benefits of cheap & fast international payments without putting in much work? That’s what Wise Platform is.

Let’s say you’re a bank looking to offer international payments. You’d have to:

- Create a team dedicated to this problem.

- Learn and build technologies to support international payments.

- Continually work to reduce fees on these payments. Transferwise was an entire company dedicated solely to this problem.

In total you’re looking at months, years of development time and millions spent to achieve this. Or, you could use Wise Platform.

Some of the banks which currently use Wise Platform are:

- Monzo and Wise in the United Kingdom

- N26 and Wise in Germany and Europe

- EQ and Wise in Canada

- Novo and Wise in the USA

Wise will even work with the bank to make the flow perfect for you. In total there are:

- 14 banks in 10 countries that use Wise Platform (Monzo, Stanford Federal Credit Union)

- 7 Enterprise customers (Xero, Emburse, Google Pay)

- 11 Distribution partners (Thought Machine, Tememos)

This feature has 2 major advantages for Wise:

- Less competition. Fewer banks will want to create international payments software if it’s already available to them as an easy-to-use API. This reduces the competition for Wise.

- More data. More data means Wise can reduce fees, as we’ll discuss later.

This feature also allows Wise to rapidly gain new customers. If a bank has 25 million customers, suddenly 25 million extra people will use Wise to make transfers. Wise does not include these numbers in their annual report. Technically, Wise should have around ~50 million customers if you include all of the customers from other banks which use the Wise Platform. Wise itself only has ~10 million.

This is a metric to watch. The more banks that use Wise Platform, the more customers from those banks use Wise. Wise does not report this number, so we have to monitor Wise Platform numbers instead. In fact, there are almost no numbers on the Wise Platform itself other than how many business enterprises use it. I’m willing to bet this is the Dark Horse for Wise. It could potentially be driving more business to Wise than the Wise app.

This is a feature that no one else currently offers, and it is something I plan to monitor very closely.

Wise Assets

Currently, banks are offering little to no interest. I am personally getting 0.5% interest from my bank. There are some alternatives I have considered:

- Put my money into cryptocurrencies like Stablecoins and wait to get a debit card that lets me spend that.

- Put all my money into the stock market, exclusively use my credit card for the month and then pull my money out of stocks to pay off my credit card (it takes effort, and I may not be able to sell my stocks in time to pay my credit card).

Wise Assets lets you do something similar to (2).

- Hold money in assets like stocks (currently iShares World Equity Index Fund only)

- Spend from your card and Wise will automatically sell that portion of the fund to give you the money.

The stock market should return ~7% year-on-year, and Wise charges these fees:

The service fee is 0.40% annually. The fund fee is 0.15% annually. Both fees are taken automatically.

This is significantly higher than normal index funds, which normally sit around ~0.2% flat. However, I think that having the ability to spend directly from stocks is worth the higher fee.

Wise is planning to add more assets. The way they phrase it as “more assets are coming soon”, and the assets are “Cash, Stocks” implies there will be assets that are not cash or stocks. To purely speculate:

- Gold (when I think of an alternative to cash, I think of gold).

- Cryptocurrencies (pure speculation but they are all the rage).

Wise Assets were released after the 2021 annual report, so I am not sure how they affect the bottom line. However, there are 2 things I know:

- Customers have flocked to Wise to hold their balance in stocks (one look at Reddit r/ukpersonalfinance will tell you this).

- Wise charges customers 0.4% annually for holding their balances.

- Customers who are familiar with the stock market will know not to take money out of their accounts (or pay for things), as it hurts compounding:

The first rule of compounding: Never interrupt it unnecessarily.

🌐 Network Effects and Hooks, or why Wise will keep on winning

The best hypergrowth companies all make use of the network effect. Metcalfe’s Law states:

The value of a network is proportional to the square of the number of its users

These companies don’t degrade with scale, they improve with scale. And even better, the more people that use it the more people want to use it.

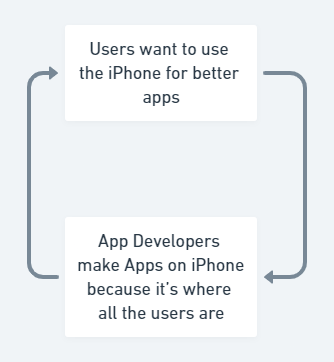

An example of this is the iPhone. Users want to use the iPhone because it has the best apps on it. Developers want to develop on the iPhone because it’s where all the users are. It’s a vicious cycle that compounds the network effect.

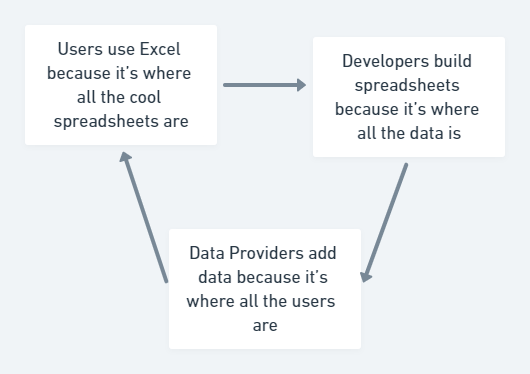

Some hypergrowth companies are doubly hooked. Think of Excel. Users use Excel because it’s where all the cool apps (spreadsheets) are. Developers build spreadsheets because it’s where all the data is. The data providers create their data in spreadsheet format because it’s where all the users are.

The best hypergrowth companies understand this and build more products or services which creates more vicious cycles. You know when you run your hand around in a circle in the water it makes a whirlpool? When 2 hands do it, it goes faster. 3 hands and it goes faster. Hypergrowth companies are the companies introducing new hands to the water.

This brings us back to Wise. What are they doing to get more hands in these whirlpools?

"How can @wise be 10x cheaper than banks, deliver 40% of transfers under 20 sec and *still be profitable* ?"

— Kristo Käärmann (@kaarmann) October 28, 2021

👆🏼 I get this a lot.

A big part of the answer is the code that runs our treasury ...

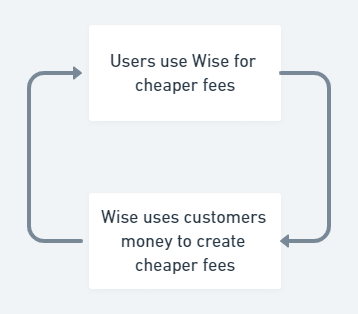

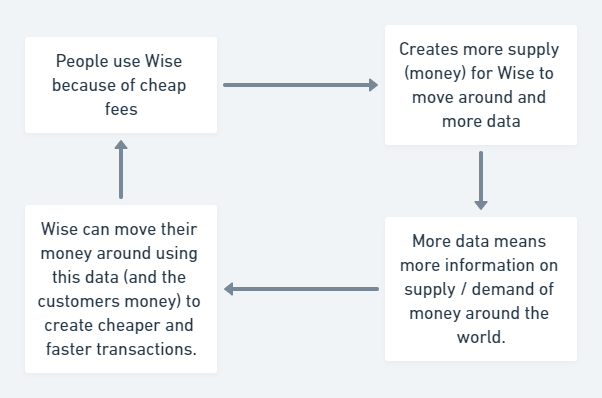

The main use of Wise is the cheap fees and instant transfers. Customers flock to Wise so they don’t have to pay expensive fees to other banks. And because they use Wise because of the cheaper fees, Wise now has more money sitting in accounts. And because they have more money:

It's a sophisticated piece of kit. It predicts where $$ needs to be, in what currency, how to get it there the cheapest, accumulating 300M new data points every month to crunch.

— Kristo Käärmann (@kaarmann) October 28, 2021

It's smart, it can be much smarter!

Come build the next version 🇬🇧🇺🇦🇺🇸🇪🇪🇭🇺🇸🇬https://t.co/Z1BK8v8v98

They now have more money to send around the world to their data centres, meaning that it results in cheaper fees for everyone.

This is Wise’s vicious cycle. Wise doesn’t get more expensive with the more people that use it, it gets cheaper with scale. This is a beautiful Economies of Scale mixed with a Network Effect which makes Wise create a whirlpool of constantly lower fees, more customers and more profit.

Get this. This isn’t even the start of their hook! Wise doesn’t just have money in the right places at the right time.

It:

- Predicts where money needs to be and at what time. For example, the UK gets paid around the ~26th - 28th of each month. This means Wise needs more Great British Pound £ in the UK at this time to handle that demand.

- Determines what currencies need to be there. For example, Iceland has 2 currencies. The Króna and the Euro. Some places even take United States Dollars. This means an employee could be paid in Euros and change it to Króna, meaning Wise needs to know what currencies they should hold in that country as a reserve.

- The cheapest route to get it there. Wise dogfoods their own platform by determining the cheapest way to move their money around the world, to create lower fees for all of their customers. I wouldn’t be surprised that in times of high demand they also calculate the fastest way to move money there to meet demand.

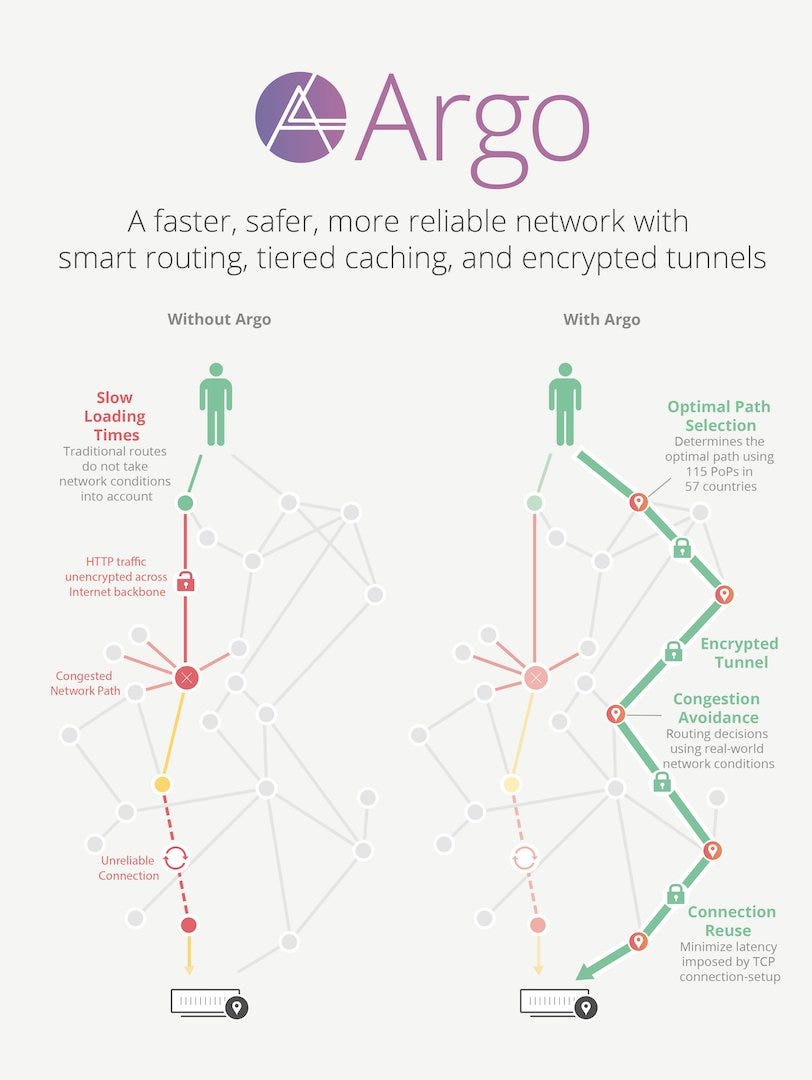

Wise has created the Cloudflare Argo of money transfers. Argo is a technology that determines the fastest and cheapest routes from one computer on the internet to another. Argo can do this because Cloudflare handles over 10 trillion global requests a month. They use machine learning and big data to calculate the best routes.

The more people that use Wise, the more data Wise has on how currency flows in the world and the more supply (money) they have to move around. The more data they have on this, the more they can move their money around to effectively meet demand. Moving their money around through this network creates cheaper & faster transactions.

As you can see, the more people that use Wise the more Wise can create cheaper and faster transactions.

There are 2 ways to expand from this:

- Create more hands in the whirlpool (make new features that aid to this cycle)

- Get bigger hands (expand the things already causing this cycle)

One of the problems with moving money around is that when a lot of customers want their money, you have to meet the demand for it. Ideally, what we’d like to do is ensure customers do not want to use their money or to somehow take a larger portion of that money and make it Wise’s money. In Q3 2021 Wise achieved this with a great new product called Assets.

Assets does 2 things well:

- Incentivizes customers to keep their money in Wise.

- Turns a small percentage of that money into money for Wise.

- Enables the customer to get a much larger % gain on their money than traditional banking with interest.

This new feature builds on customer acquisition (no one else is doing this) and enables Wise to own some of the money people put in. This in turn makes the cycle stronger, meaning Wise is better for doing it. I bet customers who use assets are less likely to spend or use that money, so Wise can move it around more than regular money.

On top of this, Wise also has millions and millions of customers from their Wise Platform. More customers, more data, cheaper fees. Everything Wise has done in the last ~year has been to get more data and money, which enables them to create cheaper & faster transactions. It is a brilliant plan that is working out effectively for them.

📈 Total Addressable Market (TAM) - How much can Wise grow?

I am not really a fan of price predictions, but we will calculate a total addressable market and then a serviceable addressable market which will allow us to see how much further Wise can grow in this industry.

Some people may use this to create price predictions, I use this to determine how long a company can sustain hypergrowth.

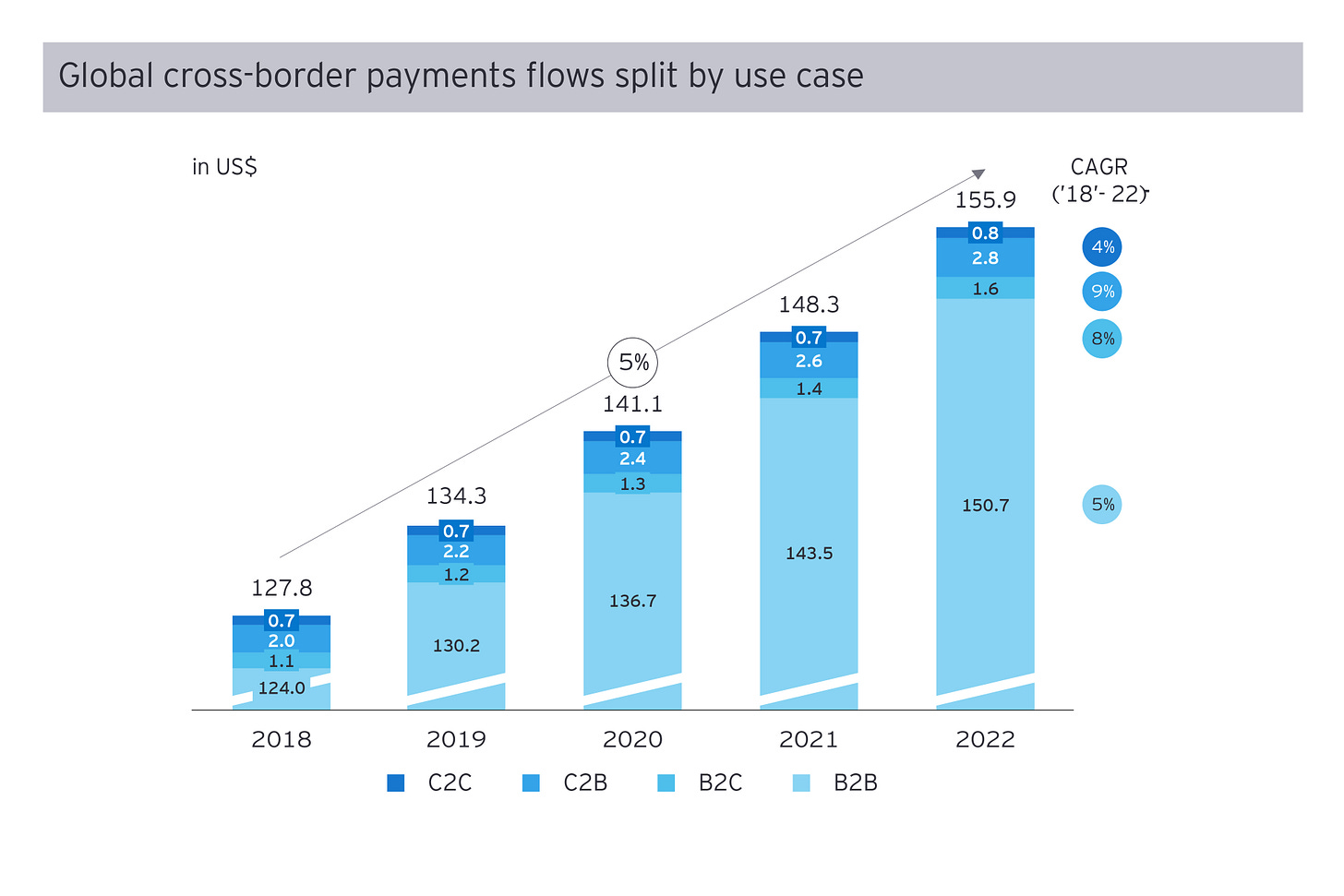

According to a report from EY, the total global cross-border payment flow grows 5% at a compound annual growth rate (CAGR) and is likely to hit $156 trillion by 2022. From that report:

- Business-to-Business (B2B) transactions make up the largest share by far, expected to account for US$150t.

- Consumer-to-Business (C2B) transactions, such as cross-border e-commerce and offline tourism spend, are forecast to reach US$2.8t.

- Business-to-Consumer (B2C) transactions, which include wage salaries or interest payments, are expected to amount to US$1.6t in 2022.

- Consumer-to-Consumer (C2C), or remittance payments, contribute the least – expected to reach US$0.8t in 2022.

Wise has built products to address some of these:

- Business-to-business (B2B) - Wise for Businesses and Wise Platform.

- Consumer-to-Business (C2B) - Wise Account (the debit card) you can pay businesses with it.

- Business-to-Consumer (B2C) - Wise Account (the debit card) you can get paid into it.

- Consumer-to-Consumer (C2C) - Wise’s first product, their international payments product.

EY also states:

These low-value transactions from, to, and between emerging markets offer the highest disruption potential driven by consumer behavior, increased trade with emerging markets, and higher financial inclusion.

Luckily for us, Wise started out as enabling low-cost fast transactions between emerging markets. EY also provides us with information about how cross-border payments will grow. Africa, Latin America, and Asia are the lion’s share of international payments.

Global cross-border trade is expected to grow by 5% between 2018 and 2022, with most of this coming from emerging markets where growth is estimated to be 11% between 2018 and 2022.

Some projects in emerging markets like the African Continental Free Trade Area and China’s Belt and Road Initiative are expected to stimulate this growth even more.

These are the important facts you should take away:

- Global cross-border payments are increasing year on year.

- Most particularly in emerging markets, which Wise has been serving since day 1.

- There are 4 different markets within the total addressable market. Wise has created new products to increase their serviceable addressable market to all items mentioned in EY’s report.

- The business-to-business market makes up 95% of the total addressable market. Seeing this number means we now have context for why Wise entered into the business market.

- Wise is an $11 billion unicorn in a $150 trillion market.

🥊 Competitors

Let’s look at 2 of the largest competitors, Revolut and World Remit. Going back to our TAM we know the largest market is business-to-business.

World Remit does not have a business account, but Revolut does. Revolut has 500k business customers, and Wise has 300k. Revolut doesn’t regularly post their numbers so I can’t compare them, but Wise for Businesses is growing 50% year on year.

Revolut points out on their business page that international payments are one of the things they do best:

For years, Revolut Business’ stand-out feature has been our competitive exchange rates and commitment to having no hidden fees. Our customers have access to local account details in EUR, GBP, AND USD, and can transfer money in local currencies as well as send and receive funds for free between Revolut accounts around the world.

Revolut also allows businesses to set a fixed foreign exchange rate, something Wise does for all customers.

I assume there is no 10 free international transfers on Revolut for Business, and with their confusing fee structure, I bet Wise is generally cheaper than Revolut. I am not too concerned about Revolut. They are trying to be a super-app. Jack of all trades, master of none. For international payments, I expect the companies which do them (Wise, World Remit) to win out in a few years.

Let’s look at PayPal. Actually, let’s not. PayPal won’t let me withdraw into USD and forces me to convert it. The fees are so incredibly large I cringe every time PayPal forces me to do this. I laugh at the idea that they could be considered a serious competitor.

None of these competitors has a Wise Platform equivalent. Wise is pervasive and can be easily installed into another bank. They don’t report these numbers, but if a bank uses Wise Platform and has a business bank account I imagine you could use Wise with your business account. This means that Wise is adopting thousands of business customers, inadvertently, to use their platform.

The more customers that use Wise, the better. This is Wise’s killer feature, they are mass-adopting users, data and more by simply integrating with other banks. No one else is doing this. Wise for Businesses itself may only have ~300k customers, but they may serve all the business customers in the banks they are integrated into.

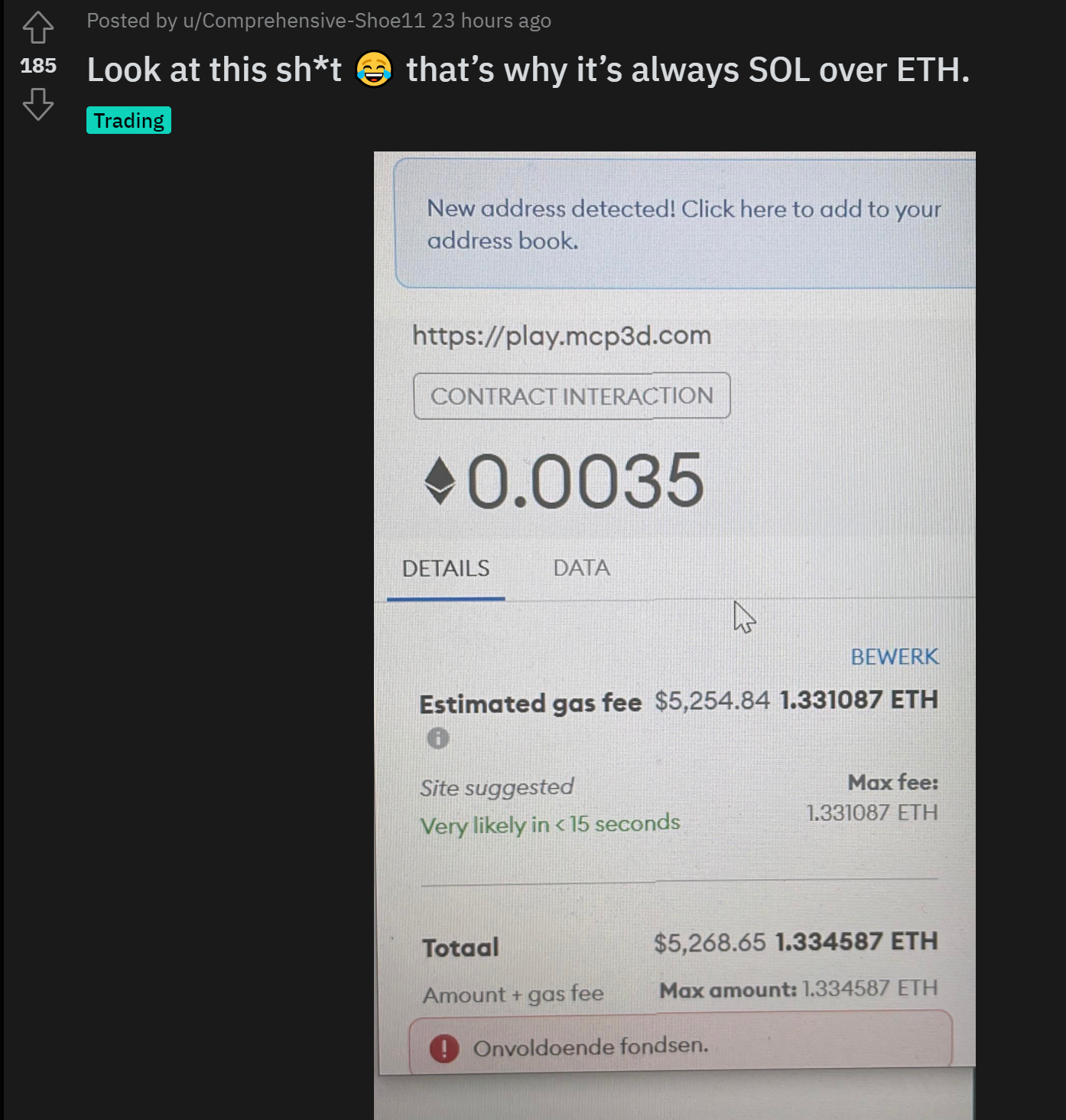

Let’s talk about cryptocurrencies. I just went to try and send my friend some money and Ethereum wanted me to pay a fee of $43. $43 to send $10, by the way.

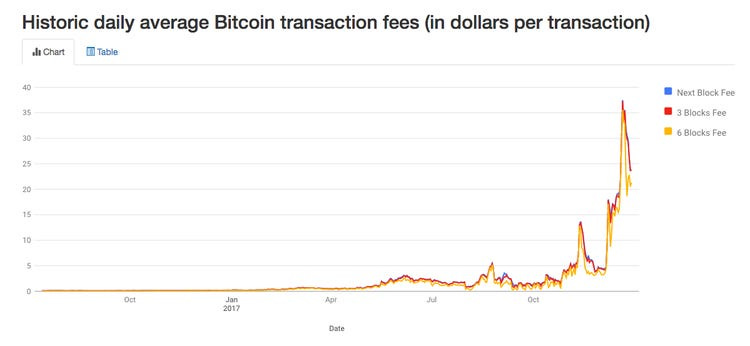

Okay, what about Bitcoin?

Bitcoin fees are going up, too. Currently, it costs $3 for me to send someone Bitcoin. Let’s look at how this process works:

- I sign up to an exchange, providing KYC (drivers license and proof it’s me)

- I buy Bitcoin (this incurs a fee from the exchange, usually around 1%).

- My recipient signs up for an exchange.

- I send them Bitcoin (this incurs a fee, usually around $3).

- They withdraw into their local currency (it’s unlikely the exchange supports their local currency, so they withdraw into USD. This also incurs a fee).

- They withdraw to their bank and pay a fee to convert USD into their local currency.

Don’t forget, cryptocurrencies are banned in China, Mexico (potentially), Egypt, and soon-to-be India. I have picked these countries because they are the 5 largest digital remittance countries from earlier:

- India ($83 billion)

- China ($60 billion)

- Mexico ($43 billion)

- The Phillippines ($35 billion)

- Egypt ($30 billion)

We have a $150 billion dollar market that can’t be served by cryptocurrencies. I believe cryptocurrencies are cool and will play a large part in the future, but I am also realistic and know that it’s not going to replace a bank for at least 10 to 15 years.

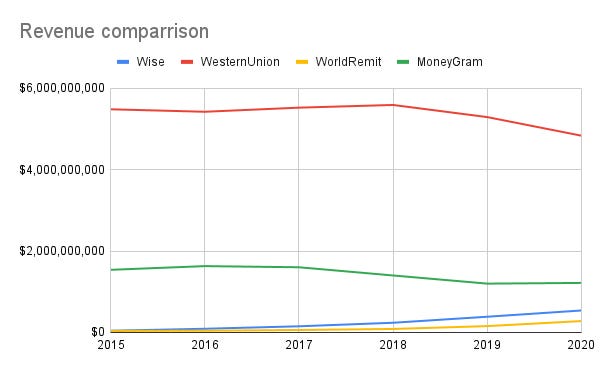

Wise is leading the fintechs in terms of revenue, but lagging behind the big players like MoneyGram.

These businesses are tankers and can’t innovate as much as Wise can, which is a technology-first company. Wise is already eating their lunch, unless the big players can create lower fees they’re unlikely to win out here. Also, Wise is the only player in the space with a bank account or Wise Platform. This chart is only comparing Wise against the international payments market, Wise is much more than that now.

In conclusion, the only real competitor that’s expanding into the same TAM is Revolut. 95% of this TAM is business-to-business, which only Wise and Revolut do. I do not believe Revolut can keep up with lowering their fees like Wise can, due to Wise’s constant evolution and their scale and the fact that Revolut tries to do everything in finance. I will, however, watch out for Money Remit in case they release a business product.

🐻 Bear Case

I like to imagine the worst things possible and hedge against them. So let’s look at the bear case first.

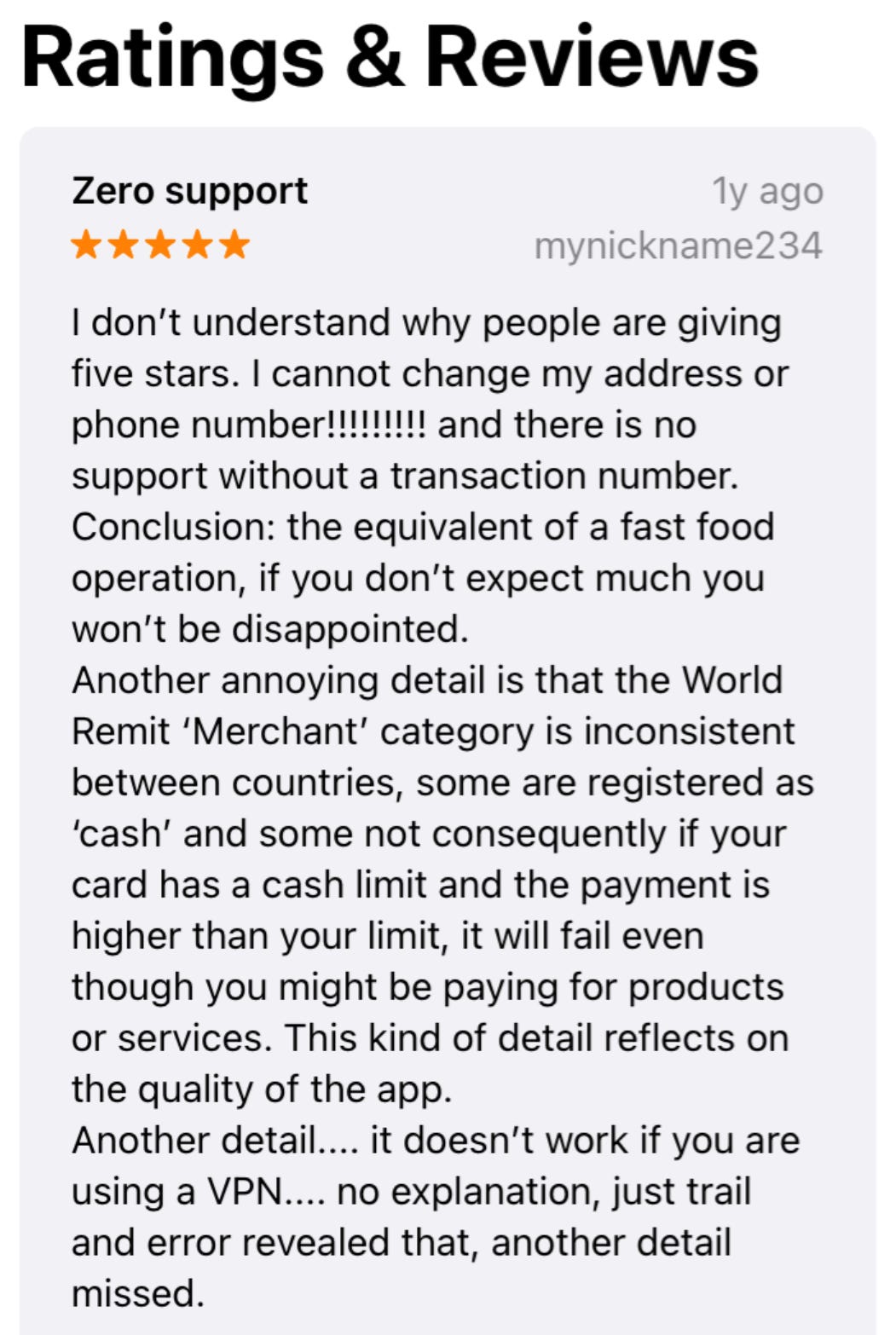

In the worst case possible, World Remit creates a business account (which threatens the $150 trillion market in the total addressable market). World Remit has more reviews on the app store than Wise (65k vs 40k) however there appear to be more negative reviews for World Remit than for Wise and even some reviews which are ironic.

World Remit appears to still be in the venture capital stage and generates significantly less profit than Wise, from a 2020 article of their acquisition of Sendwave:

In the last 12 months, ending 30 June 2020, WorldRemit and Sendwave have sent approximately US $7.5 billion in transfers, generating approximately US$ 280 million in revenue

WorldRemit appears to be acquiring customers by buying other businesses or linear scaling of their app (getting more customers). Wise is acquiring more customers by linear scaling (more customers sign up) but also by Wise Platform which enables them to gain millions of customers in a short amount of time.

For WorldRemit to be of any concern to me, I’d expect to see them move into the business-to-business market and work on reducing fees, as earlier they didn’t have the lowest fee in any of the top 5 remittances markets. They are also looking to IPO at some point.

For Revolut, I’d expect to see them reduce their fees and create clearer, more transparent fees for everyone. If they were to keep their 10 free international payments a month (I do not think they can sustain this) then they could be a problem. But knowing that the largest market is business-to-business I am willing to bet they make more than 10 transactions/month on average.

🐂 Bull Case

I’d like to see Wise expand their customer base, which results in more data and cheaper & faster transactions. More specifically, I am very bullish on their Wise Platform and would love to hear more about the specific numbers involved.

Wise should continue in the business-to-business field and take over that massive market opportunity, and I expect to see their personal account expand to more countries (America doesn’t have assets yet, for example).

Whenever I create one of these, I always like to bring to the surface the important things to watch out for. Every year on the annual report I’ll record these new metrics and see if they match my expectations, If they do I know the company is doing well.

- Take Rate increases - The fee they charge. I am hoping this increases from 0.77% as it increased due to the interchange rate. More increases indicate a direct correlation that more customers are using their Wise card more often.

- Amount of businesses using Wise Platform increases - This is Wise’s dark horse. The more banks use them, the less competition and more profit for Wise. This is one of the most important metrics I want to watch.

- Lower / lowest fees in top 5 digital remittance countries - I expect to see these lower year-on-year which indicates Wise is growing (more customers == more data == cheaper transactions).

- Growth rate maintains > 30% - When this starts to slow down, Wise has expanded to the “laggers” in the market and it becomes harder for them to win. See HP vs Dell for laptops. They are both fighting the same market, neither is losing or winning. So long as Wise is still in hypergrowth mode, I am happy 😊 (Note: with their expansion to B2B I am hopeful it lasts for a few years longer).

- App Store Reviews maintains 5 stars and the amount of reviews grows - Customers are the first to know when a business is going sour. If the app store reviews get worse, I know something is up.

Invest in what you know and use - Peter Lynch

🙏 Thank you

Generally, I don’t perform price predictions, since I believe if you need to use Excel to determine whether or not a business is a good investment you’re missing the story. However, Wise still has a long way to grow in their TAM and appear to be doing everything right.