A guide to altcoins

There are many Alternate (Alt) coins on the market, but what makes them so different? Why would people invest in them instead of Bitcoin? This article seeks to explain Altcoins.

Note: This article is not a primer on Bitcoin and presumes you have fundamental knowledge of cryptocurrencies. If not, please read this article.

Ripple

Ripple is one of the largest cryptocurrencies on the market. Ripple’s website explains its philoposphy, as seen below

Ripple seeks to expand on what Bitcoin started. More than just a digital currency, Ripple is the world’s first open transaction network. It serves as a decentralized, shared record of accounts and transactions of any kind. By creating this global ledger, Ripple does for money what the Internet did for all other forms of information.

Ripple is designed to allow any person with a certain currency to access another currency, as in transform one currency into another; although it does much more than this as will be explained shortly.

Rippled is not mined in the same way that Bitcoin. Bitcoin is mined using the proof-of-work algorithm whereas Ripple operates its network using consensus. In fact, Ripple cannot be mined at all. When Ripple was created 100,000,000,000 XRP (the currency Ripple uses) was created and a small amount is destroyed every time a transaction occurs on the network. An incentive program to give out XRP is currently being discussed.

To understand how the Ripple network works, we first need to understand how a typical Hawala network works.

Let’s say Bob wants to send cash to Alice. The process goes as follows:

- Bob goes to his local Hawala representative and gives them some cash and a password, which Bob and Alice share.

- The representative phones Alice’s local representative and tells them to release funds to someone who can provide the password (note, they don’t directly know who Alice is)

- Alice walks into her local representatives office, states the password, and receives the cash. Commisions are often taken from both representatives.

Although it may appear that the money has been moved to Alice and Bob, no money has been moved. Bob’s representative owes Alice’s representative money. They can either settle the debt by, for example, meeting up once a month to settle all debts or they can hope that a reverse transaction will happen so money will move in the opposite direction, cancelling out the debt.

Trust is essential and required in the Hawala network. Bob has to trust that his representative will hand over the cash, Alice will have to trust that her representative will give her the cash and the representatives need to trust each other to repay the debts.

But instead of physical people, we now have online representatives. Websites, servers, computers. Ripple works the same way as the Hawala system but uses something called Ripple Gateways instead of representatives.

But, Ripple doesn’t just work for cash. It works for anything. Gold, Cash, Bottles of Water. As long as both gateways are set up and have the necessary supplies to deal with it, it is entirely possible for anything to be transferred through the Ripple network. If 2 gateways agree on a conversion of goods, so one gateway accepts cash and the other dispenses gold, it is possible to convert commodities or currency. Ripple can also morph anything into anything, as long as the gateways are set up for it.

What if the 2 gateways don’t trust eachother?

Ripple uses an algorithm to find the shortest trust path between the two gateways. Bob’s representative may not trust Alice’s representative, but Bob and Alice’s representatives both trust Eve, so they use Eve as a third agent.

What is the network can’t find any paths of trust between two gateways?

This is where the Ripple currency (XRP) comes in. All gateways provide a price of XRP for anything they deal with, for example £1 could be 200 XRP and 1 oz of gold could be 300,000 XRP. As the old saying goes:

“Everything has a price” — Unknown

XRP settles immediately, so when it’s put through the network it’s final and trustless, which is why it’s often seen as a last resort for a trust system such as Ripple. Transfer of XPR over the Ripple network has smaller transaction fees than transfers of anything else over the network.

Ripple also cannot suffer a 51% attack, which Bitcoin is susceptible to. If one computer or network of computers (miners) controls 51% of the nodes on the Bitcoin network they can make Bitcoins out of nothing, or do anything they want with the network.

Litecoin

Litecoin uses a different hashing algorithm to Bitcoin in order to allow anyone (not just people who can afford expensive ASICS) to mine Litecoin. As a result, 1 Litecoin is usually worth less than Bitcoin.

While Bitcoin has an upper limit of 21 billion Bitcoins, Litecoin has an upper limit of 84 billion Litecoins. Litecoin transactions have always been traditionally faster than Bitcoin transactions too. Bitcoin has a mean block time (how long it takes to mine a block) of 10 minutes, whereas Litecoin has a mean block time of 2.5 minutes.

Scrypt is similar to Bitcoins SHA-256 hashing algorithm but instead of rewarding raw asynchronous power (hence why Bitcoins are mined with ASICS) it rewards more memory. ASICS have been created for Litecoin now, defeating the purpose of Scrypt. However, this is only a recent advancement.

Below is an image comparing Litecoin and Bitcoin, image from CoinDesk.

Image from CoinDesk Dogecoin

Dogecoin started off as a meme but eventually progressed into a fully fledged cryptocurrency based on the Bitcoin system. Dogecoin is named after the internet meme Doge.

Dogecoins mean block time is 1 minute, a lot less time than its competitors. Dogecoin also has no upper limit on the number of dogecoins that can be minded.

Whereas the reward for Bitcoin started at 50 btc and halves every couple hundred thousand blocks, Dogecoins reward started off as being random. After each sucessful mine the winner will be rewarded between 0 and a halving maximum for the first 600,000 blocks, as seen below.

- Block 1–100,000: 0–1,000,000 dogecoins

- Block 100,001–200,000: 0–500,000 dogecoins

- Block 200,001–300,000: 0–250,000 dogecoins

- Block 300,001–400,000: 0–125,000 dogecoins

- Block 400,001–500,000: 0–62,500 dogecoins

- Block 500,001–600,000: 0–31,250 dogecoins

- Block 600,001+: 10,000 dogecoins

Etherum

Etherum is perhaps the most promising altcoin on the market right now.

To understand Etherum, we need to understand the internet. Today, all our personal data is on the internet and is controlled by companies such as Google, Facebook, Apple, and Twitter. All our personal data is stored on a server controlled by a company.

This has upsides, mainly that the uptime of the websites is very high so we will have 24/7 access to our personal data and that a team of specialists can work around the clock to make our data secure.

However, there are downsides too. A hacker or hacking group can gain unwanted access to your personal data without you knowing by hacking this third party. Brian Behlendorf, creator of the Apache Web Server, has been quoted as saying that this centralised design is the:

“Original sin of the internet”

Many believe the internet should be open source, decentralised. A new movement has sprung up to try and shift the internet into a more decentralised state. Etherum is one of the newest technologies to join this movement.

Etherum has the goal of using the blockchain, Bitcoins crowning technology, to get rid of third parties on the internet.

Etherum’s goal is to become the worlds computer which would decentralise and democratise the traditional client-server model of the internet. Servers are replaced by thousands of computer nodes across the internet. There are many apps which require a server to be used, Evernote, Dropbox, One Note, Slack. Etherum is designed to return the control of the user’s data back to the user and to give the creative rights of the users personal data back to the user.

Think of Etherum like a decentralised Heroku.

What is Ether?

Ether is the currency of Etherum. Running programs and software on the Etherum network is costly, Ether is a unique piece of code that is used to pay for the resources of the network.

But instead of being a sole currency like Bitcoin, Ether is designed to be the fuel of the Etherum network. In order for a user to change, delete, or add notes to a notebook on the Etherum network the user will need to pay Ether to the network to get the changes to happen. The transaction fee is called ‘gas’ and that’s how hard it is to perform the given task. Every action costs an amount of gas that is based on the computational power that is required and also how long it will take to run. For example, a transaction costs 500 gas.

There is no upper limit on how much Ether can exist, however, Etherum is planning to move to a proof-of-stake consensus algorithm which may change some things. To reiterate, Etherum seeks to replace companies such as Facebook and Google.

The proof-of-work algorithm that Etherum uses is very similar to Bitcoin. It is called ethash and is designed to be more memory intensive to make it harder to mine using ASICS.

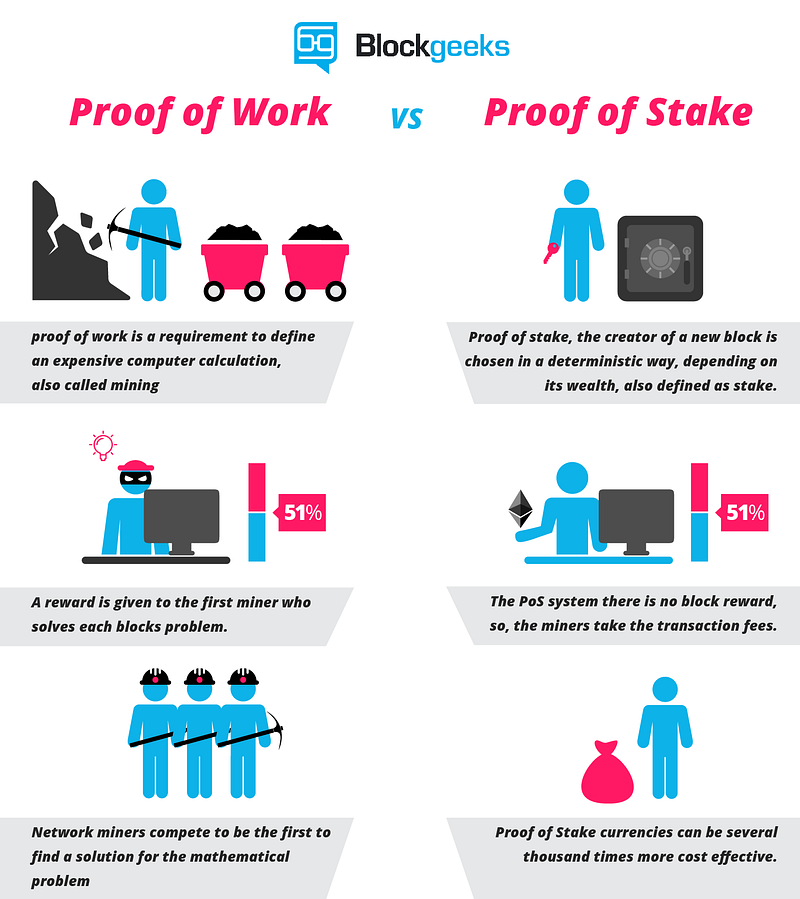

The developers of Etherum are looking to shift from proof-of-work to proof-of-stake where the network is secured by the owners of tokens. Proof-of-stake uses several times fewer resources meaning that the electrical cost of mining Ether will be decreased. The argument goes that users have to spend a lot of fiat money to mine cryptocurrencies putting pressure onto the cryptocurrency, by switching to a proof-of-stake algorithm the pressure alleviates.

This infographic from Blockgeeks details the differences. Blockgeeks also has a good article on proof-of-stake.

Infographic from Blockgeeks Decentralised Apps

The Etherum white paper splits Decentralised Apps (DAPPs) into three categories:

- Those which manage money

- App where money is involved

- Other (includes voting and governance systems)

A Decentralised autonomous organisations (DAO) is one of the ambitious ideas to come about from Etherum. The goal of a DAO is to form a leaderless company, create rules at the beginning of how members can vote and how to release company funds and then just let it run.

Most businesses have rules set at the foundation, such as its purpose (donate 20% of profits per month to a charity) or an idea.

As shown in the Lean Startup, the change triangle. A company will have a set vision for what they wish to achieve which is extremely hard to change as it is the foundation of the company. The only difference is that within a DAO it is set digitally.

Image from Lean Startup The DAO is a way to cryptographically guarantee democracy within a company, where stakeholders can vote on adding new rules, changing the roles or kicking out a member. This is why smart contracts are being applied to government voting systems . One of the issues of a DAO is that once a rule has been set at the foundation level it is incredibly hard to change as 51% of the stakeholders will need to vote to change the rule, meaning that if the rule has a bug in it, it could potentially destroy the DAO.

Smart Contracts

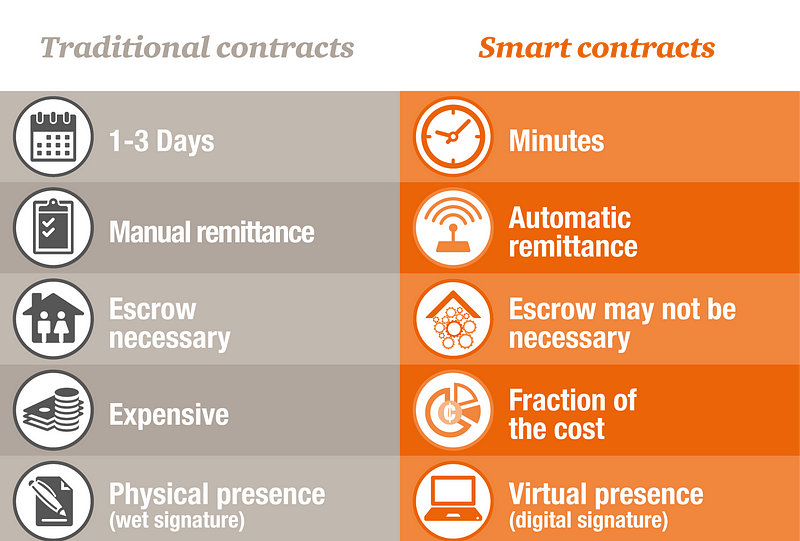

In 1994, Cryptographer and legal scholar Nick Szabo realised the decentralised ledger could be used for smart contracts, also known as self-executing contracts. Contracts could be converted to computer code, stored and replicated on the system and supervsed by the blockchain.

A smart contract lets you exchange property, money, shares, or anything of value in a transparent and conflict-free way while avoiding the use of a middleman.

In order to get a contract (be it for property or shares) you would have to pay a third party to analyse you and provide the contract back to you. With a smart contract, you pay whatever node you need to and the contract comes back to you, without the use of a third party.

Smart contracts not only define the rules and penalties of a contract but can also automatically enforce them, something a normal contract cannot do.

Image from Attores.com NEO (Antshares)

Called the “Etherum of China”, NEO is one of the newest cryptocurrencies on the market. NEO is of course, named after the famous charecter from the Matrix.

The first unusual thing about NEO is that it “uses fiat currencies as its internal currency”. Yes, fiat currencies such as Sterling, Yen, Dollars etc. This is because Neo doesn’t strive to be a cryptocurrency, in fact, they don’t really have a cryptocurrency. They aim to be the link between the old financial system and the new, much more exciting system of Smart Contracts.

The coin currently displayed on the index is the NEO coin, but it’s not the thing that makes the blockchain work. NEO Coin acts like shares in the company that runs the NEO platform. Many of the NEO coins were sold in an Initial Coin Offering (ICO) and the NEO company holds 50% of the remaining coins or even more.

“The remaining 50% of the NEO shares held by the NEO team, will be in the NEO net after the use of NEO smart contract locked for 1 year. 1-year lock-up period, this part of the NEO will be used to maintain the long-term development of Neo.”

The company behind NEO even calls the NEO coins shares.

Much like Etherum they use ‘gas’ to run the whole platform, but unlike Etherum you need fiat money to buy gas to execute the smart contracts. Some believe this is because in order to be a bridge between old and new financial systems NEO has to discredit crytpcurrencies as a non-stable source of value and go with the supposed much mroe stable currency of fiat currency.

A smart contrat is again a contract. Reading any contract it’s just a bunch of conditional statements. “If the tenant doesn’t pay rent every 4 weeks, the tenant will be fined £40”. A smart contract just autoamtically ensures the contract carries out. With a normal contract, anyone may forget the conditional or find a way to game the system but it’s harder to game a smart contract because it’s cryptographically carried out.

NEO aims to combind 2 conflicting ideaologies from the cyptocurrency world. On-chain transactions, which is how most cryptocurrencies work. All transactions are recorded on the blockchain and off-chain transactions much liek the Lightning network, where transactions are performed off-chain and the results are bundled into the blockchain.

The NEO white paper describes this:

“Ripple, BitShares, NXT, etc all are blockchains of decentralized functionality but without layered design.The blockchain itself acts as the ledger and transaction matcher. In such a blockchain, pending orders, withdraw orders, matching and other operations are recorded on the blockchain.”

“Although NEO support the exchange of assets on the chain, the blockchain itself does not provide order book and order matching functionality…through a mechanism called ‘superconducting.’

Under the superconducting transaction, the two parties do not need to host the property to an intermediary (traditional exchange). Users only need send to the exchange an order signed with their private keys. After the exchange matches the buyer and seller orders and broadcast transactions is the transaction complete. From beginning to end, property does not leave the user’s control, putting an end to the traditional moral hazard. Exchange under the superconducting trading mechanism only plays the role of information matching.”

Thank you for taking the time to read this article.